Through an ad published in national dailies today, the Government of Punjab has announced that the property tax details can now be accessed through SMS. Calling it a vital service for tax payers, the government gives clear instructions about how to view these details on your cellphone. The service has been introduced to help property tax payers find out whether or not they are being tricked into paying higher taxes.

Though the property tax notice, officially known as PT-10 Challan, is sent annually to individual property tax payers at their postal address, the SMS service will help people tally the figures mentioned in PT-10 Challan and those mentioned in the message sent by the Excise, Taxation and Narcotics Control Department. In case you see any difference, you must report to the concerned office and get your records corrected.

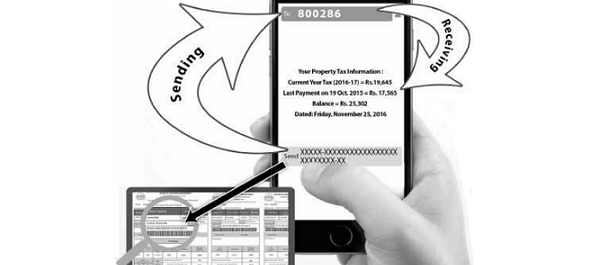

In order to avail the service, you are required to send the Property Identification Number, mentioned on PT-10 Challan to 800286. You will get a reply shortly from the same number giving important details about your current year’s tax as well as the property tax you paid last year. In case you haven’t received your PT-10 Challan this year, you can get the pin code from your last year’s challan, as this code is unique for each tax payer.

You can also visit the official website of the Excise, Taxation and Narcotics Control Department i.e. www.excise.punjab.gov.pk and verify your PT-10 Challan, for which you would be required to enter your pin code. In case you find any contradictions in details mentioned in your online PT-10 Challan or that sent to you through post or SMS, visit the Excise, Taxation and Narcotics Control Department and get the records rectified.

For additional information, you can also call their toll free number: 0800-08786

what is the registry price in Gajumata Green Cap for 4 Marla Plot. thanks in advance

what is the registry price in Gajumata Green Cap ferozepure road lahore for 4Marla plot.

how can i find my PT-10 PIN number online.