Lahore: The Punjab Excise, Taxation and Narcotics Control Department (ETNCD) Punjab has increased the annual property tax rate on self-run private commercial properties by more than 40%, a news source reported on August 16.

Read: Rental value to become base of property tax, instead of area

In this regard, the ET&N department has issued a notification. The notification which was reportedly issued on July 7, 2021 states ‘Governor of Punjab has withdrawn the remission of property tax for financial year 2021-22, granted in the preceding financial years over and above the liability of property tax of the valuation lists enforced/notified in the financial year 2013-14.’

Read: Excise offices to begin collecting property taxes in Rawalpindi

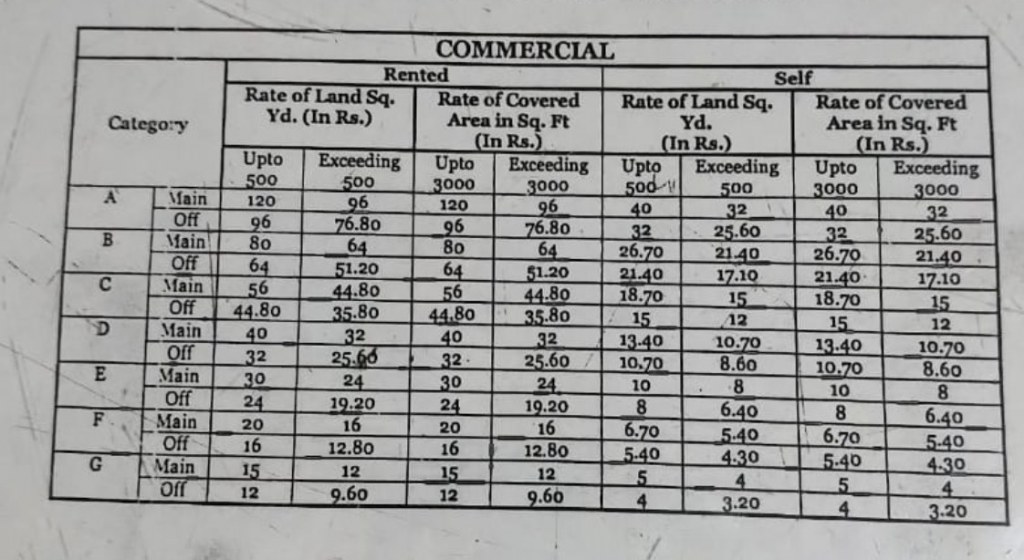

Through this notification, the ETNCD has notified ‘the revise rates of commercial self and rented properties for determining the Gross Annual Rental Value for the assessment of Property Tax with effect from July 1, 2021.’ Here is the screenshot of the chart shared through the same notification:

As per the news report, the government has increased the annual property tax on businessmen who own private commercial property by 40%. Following the tax increase, 2.5 million property owners will bear the tax burden, generating an additional PKR 2 billion in revenue for Punjab.