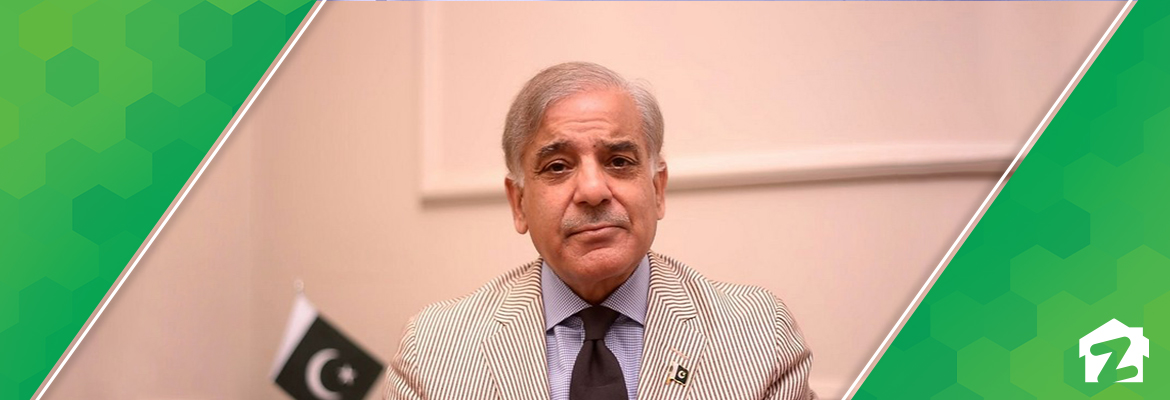

Islamabad: Prime Minister (PM) Shehbaz Sharif on Friday (June 24) imposed a 10% ‘Super Tax’ on large-scale manufacturing (LSM) industries, news sources reported. The tax is imposed to improve national reserves and generate revenue.

Read: Miftah assures realtors of tax relief, special provisions under FBR

Reportedly, the new tax has been imposed on steel, sugar, oil and gas, fertilizers, LNG terminals, textiles, banking, automobiles, cigarettes, beverages, and chemicals. The premier said that the tax has been imposed to sustain the dwindling national cash reserves. He said that the tax will be imposed in addition to the existing tax structure and will generate additional revenue that will help create more opportunities for public-benefit projects and services. The premier was of the view that direct taxes on large-scale industries would reduce the tax burden on ordinary people. Furthermore, while explaining the newly imposed tax, Finance Minister Miftah Ismail stated that the 4% super tax will apply to all industries. However, an additional 6% will be applied to the chosen 13 sectors, for a total of 10%.

Just to clarify: the super tax of 4% will be applicable to all sectors. But for the specified 13 sectors, another 6% will be added for a total of 10%. So their tax rates will go from 29% to 39%. This is a one-time tax needed to curtail the previous four record budget deficits.

— Miftah Ismail (@MiftahIsmail) June 24, 2022

Read: Senate committee levies revised advance tax on property for non-filers

As a result, their tax rates will rise from 29% to 39%. This is a one-time tax that was required to close the budget deficits. It is important to mention here that the government has recently presented a budget on June 10 with a tax target of PKR 7.2 trillion.