In October, 2017, Standard & Poor’s maintained Pakistan’s credit rating at level B, labelling the economic and fiscal condition in the country stable. The news has created waves in the country, as it heralds good economic growth and credit standing for the country in the future. How does the rating impact the real estate sector? Read on for a detailed analysis.

What is Standard & Poor’s?

Standard & Poor’s is the world’s leading index provider when it comes to independent credit ratings. According to S&P, the organisation has offices in 26 countries and is known the world over due to its investable and benchmark indices. It also issues a huge number of credit ratings, and is the market leader when it comes to this. Investors all over the world look up to it for ratings and indices.

How do credit ratings work?

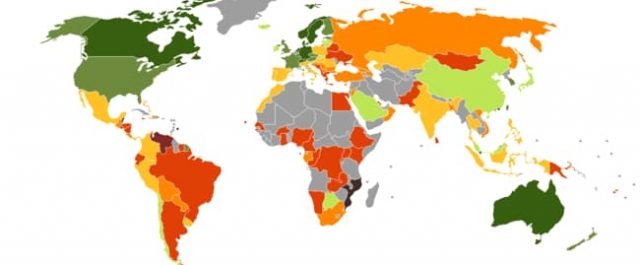

Different credit ratings are used today to show the potential for good returns on investment and the default rates for different countries around the world. The top-ranking credit rating agencies include Standard & Poor’s, Fitch, and Moody’s. The S&P rankings start from AAA, which is the highest possible investment grade. Countries/bonds with an AAA rating are the best possible investment options with zero default rate. According to S&P ratings (which are available online), AAA, AA+, AA and AA- are high-level investment grade bonds. After these come bonds rated A+, A, A-, BBB+, BBB and BBB-, which are lower level investment-grade bonds. The rest are non-investment grade bonds, which include the ratings of BB+, BB and BB- as slightly speculative non-investment grade ratings.

B+, B and B- are non-investment grade bonds of a highly speculative nature. Bonds following lower ratings i.e. CCC+, CCC, CCC-, CC, C and D (in default) are very risky investment options that are to be avoided due to high fluctuation in market factors, dependence on unstable variables, and high default rates. Non-investment grade bonds are also called junk bonds or high-yield bonds because the risk involved gives rise to high yields on offer to invite investment.

Pakistan’s B rating according to Standard & Poor’s

A country with a B credit rating is considered slightly more vulnerable than the higher ratings, but is considered capable of meeting its financial commitments. A B rating, therefore, can be a good sign for developing countries with highly volatile market variables involved (e.g. law and order, fluctuations in economy, foreign debt, etc.).

On October 31, 2016, Standard & Poor’s improved Pakistan’s sovereign credit rating from B- to B, as covered by leading national and international media outlets. It estimated Pakistan’s per capita GDP at $1,500 in 2016 and revised an upward forecast of a 5% annual GDP growth. The forecast was previously 4.7%. S&P also forecasted the government’s gross general debt to fall lower than 60% of the GDP by 2018. This was seen as a great improvement after Pakistan’s longstanding ranking at B- previously.

S&P’s rating for Pakistan in 2017

In 2017, S&P has maintained Pakistan’s credit rating – it still stands at B as highly speculative. This means that though Pakistan’s credit credibility relies heavily on several variables, it is not very likely to default on its debts. According to news reports, S&P’s decision to keep the rating unchanged is also good news for the Finance Ministry, since it is planning to issue international bonds worth over $2 billion to ease off pressure from the country’s external accounts. News analyses state that the decision affirms Pakistan’s economic and fiscal outlook as stable, disregarding political uncertainty in the country at the moment.

Impact on the real estate sector

According to a RatingsDirect report by S&P which indicates key credit factors for the real estate industry, the country risk rating plays a critical role in determining the ratings of individual companies as well, including real estate companies. Country-level risk factors have substantial impact on the creditworthiness of the entire sector, both directly and indirectly. According to the report, a country’s credit ratings can reflect the country’s real estate sector’s situation as well. It should also be kept in mind that the factors that affect a country’s credit rating affect the real estate sector as well, including factors like real estate prices, leasing activity, and rental rates.

According to financial analyst Aasif Iqbal, real estate markets function highly based on speculation, like most other trade markets. As a highly-speculative but stable country with a B credit rating, Pakistan’s property market reflects similar levels of speculation. An improved credit rating (from B- to B) is also great news for the Pakistani property market. It shows that the returns on investment (ROI) will be high since the market is highly speculative. In return, this will lead to greater foreign investment coming into the country.

In the past years, according to news reports, the Government of Pakistan and the Finance Ministry have been trying to pull in investment from foreign nationals and expatriates. In addition to all the steps the government has been taking to regularise the real estate sector (read about the regularisation process here), and the new Companies Act 2016 which will impact the real estate sector positively (read more here), Standard & Poor’s decision to keep the B rating unchanged for Pakistan is a good sign not just for the economy, but for the real estate sector as well.

For suggestions or questions, please do leave a comment below. If you want to have a more detailed discussion, please head over to the Zameen Forum.

The tax landscape in Pakistan is changing rapidly. The government is trying to impose taxes on everything. It has now become difficult to purchase property. The income tax filing has become important to get back the extra taxes paid in a tax year.