Government of Pakistan has presented the budget for fiscal year 2013-14. The following post discusses the views of Pakistan real estate experts on the budget and how it could impact the real estate sector. While several sectors have already voiced their concerns over the proposed taxes of the budget, agents & real estate experts at Zameen.com are of the opinion that the current budget won’t hamper the growth of Pakistan’s realty sector.

The recently elected government has presented its first budget for 2013-14 which has quickly turned into the subject of heated debates across the country. Different sectors have a different take on this budget; a few believe that the proposed tax will give birth to a new wave of inflation and further burden the salary class while others are particularly interested in the recently proposed property taxes in Punjab. The panel of experts and estate agents at Zameen.com, the largest portal catering to the online property market of Pakistan, however believe that even though taxation is not a bad thing but it could momentarily hamper the growth of realty sector.

The real estate related proposals of Budget of Punjab 2013-14 did not impress Pakistan real estate experts at large because of the heavy taxation. Experts believe the road to success for real estate is already bumpy and the taxes levied by Punjab government can hamper the growth of realty sector in Punjab. According to Ahtesham ul Haq of MM Marketing, “After the property boom of the mid 2000s, 2012 was the year when a lot of genuine transactions were recorded in Pakistan. 2013 too started nicely for the property market where even the general election failed to dent property prices. The budget however could change a lot.”

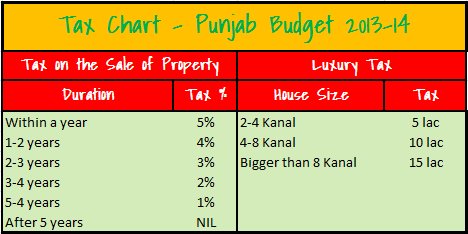

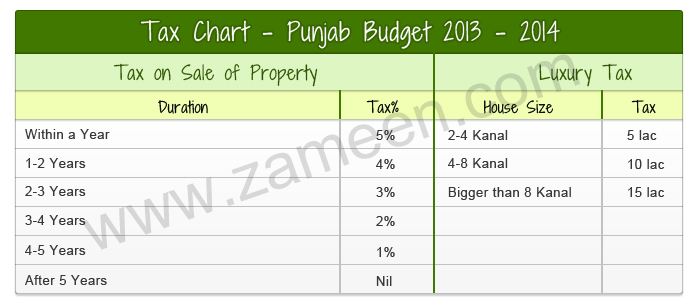

As per the new Punjab budget, 5 percent sales tax is levied on each property transaction made within one year of the purchase along with a considerable amount of tax to be paid on transfer of property. Also more taxes are imposed on cement and building material in this budget. “A cement bag, which previously cost Rs 445, now costs Rs 500,” says Ali of Al-Muzzamil Estate & Builders. He believes, “new taxes, which have already affected the construction industry, would lead to a sudden increase in construction cost.” Eventually, it could slow down the activity in the market, especially in the major cities like Lahore, Karachi and Islamabad where living cost is already high.

However, there are a few positive aspects of the budget as well such as the government has increased the tax net and imposed luxury tax on homes of 2 and over 2 kanals. It will help the government collect more money in the form of taxes from the elite class of all major cities including Lahore, Karachi and Islamabad. Many estate agents listed on Zameen.com are of the opinion that the imposition of new taxes is not a bad thing but what the government should do instead is to make sure it spends those taxes on the welfare of people too.

Taxes levied on 5 marla houses in posh localities of Punjab, to some extent, is also a step in the right direction. Some may argue that it would unnecessarily burden lower income groups but that’s not true. Tax have only been levied on those 5 marla houses which fall within Category A and we all know that Category A mainly comprises of houses in posh localities and whoever affords a 5 marla house in say, DHA Lahore or Bahria Town Lahore, can certainly afford to pay tax as well so overall speaking, this is actually a good step towards trying to include more people in the tax net.

Pakistan real estate sector is an all-season, recession-proof industry which, although has its ups and downs, but it is still regarded as one of the most widely trusted sectors for investment. This billion dollar industry has not yet truly realized its potential but it can still go a long way in being a major source of revenue for the national exchequer. Implementation of newer taxes is not wrong but perhaps it would be a good idea to adopt a more systematic approach and take things one step at a time and make measures to not alarm the investors.

In the light of the current scenario however, it can be said that the market will slow down for a bit before gaining momentum after Ramadan. In the long run however, I believe the new property taxes will not hamper the growth of the local realty market.

Hi, Just i wan to know about tax apply on my property the property is double story house in the papers the total arae is 6.1 marla and actual plot is 5.1 marla the question is examption will apply on this house as a 5 marla or i have to pay the income tax on it because the house is on rent????

I m going to buy 5 marla house in bahria town islamabad do I have to pay tax if yes than how much

what is the actual market trend after the new valuation ? or it will meet the same fate like dollar account in the previous rule of PML