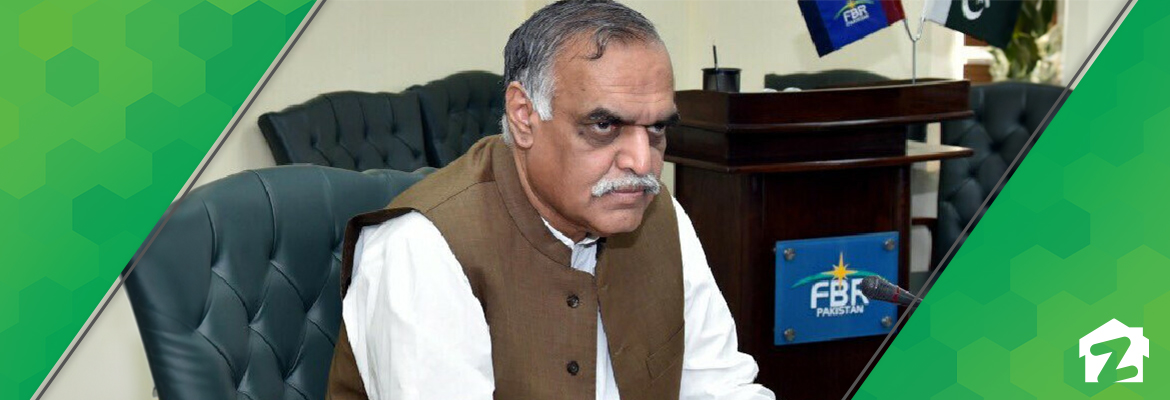

Islamabad: Federal Board of Revenue (FBR) Chairman Malik Amjad Zubair Tiwana announced that currently, there would not be any new tax exemptions, concessions, or special tax treatments available due to the Stand-by Arrangement with the International Monetary Fund (IMF), according to a news article published on August 7.

Read: FBR postpones hike in immovable properties’ valuation till September

Following the instructions from the Minister of Finance and Revenue, the 90th meeting of the National Assembly Standing Committee on Finance and Revenue took place at the FBR Headquarters in Islamabad to address taxation issues related to real estate transactions. The FBR chairman presided over the meeting attended by a group of realtors led by the President of the Federation of Realtors Pakistan (FRP) Sardar Tahir Mehmood.

The FRP president highlighted the challenges being faced by the entire real estate sector due to the currently deteriorating economic situation. He stated that the current taxation of immovable property would need re-evaluation, pointing out that the real estate sector has historically been a significant source of both domestic and foreign investment. However, affected by the economic downturn, the delegation revealed that people have become less interested in investing in this sector. Another concern tabled before the meeting about was about recent taxation measures introduced through the Finance Act, 2022 and Finance Act, 2023.

The delegation suggested scrapping taxes on deemed income from immovable property. They also proposed that the valuation table for properties should remain unchanged for now, or if there are any changes, they should be reasonable and made after consulting stakeholders.

Read: Sindh takes charge of KUTC to launch KCR project

FBR Chairman Tiwana assured the delegates that the concerns would be addressed and that efforts would be made to provide the best possible assistance in resolving challenges related to implementing tax laws.