Islamabad: The federal government on Friday presented a budget with an outlay of PKR 9.5 trillion with PKR 3.8 trillion deficit, according to news sources.

Read: Budget 2022-23: FBR mulls imposing luxury tax on big houses in posh areas

Finance Minister Miftah Ismail presented the budget for the fiscal year (FY) 2022-23 and stated that economic stability is the government’s top priority. He said that the government aims to strengthen the foundations of economic development spurred by sustainable growth.

Amid the government’s negotiations with the International Monetary Fund (IMF), the budget has posed a negligiable change in subsidies (PKR 699 billion in FY-23 against PKR 682 billion in FY-22). There is a reduction of 4.4% in the power sector’s subsidies – which are kept at PKR 570 billion – as compared with last year’s figures. The national average power tariffs are to be raised by over 20% with a cumulative financial impact of over PKR 1.5 trillion.

Moreover, a non-tax revenue target of PKR 759 billion is set for the petroleum development levy (PDL), which shows an increase of 455% from the estimated collection of PKR 135 billion during FY-22. The budget 2022-23 allocates only PKR 500 million each for Naya Pakistan Housing Authority and mark-up subsidy on Naya Pakistan against PKR 30 billion and PKR 3 billion, respectively.

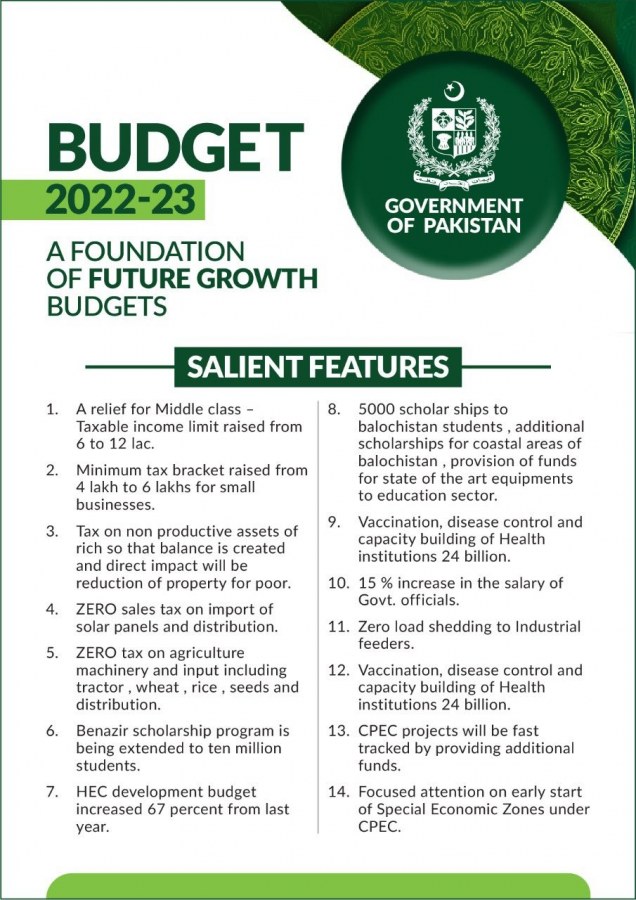

Minister Ismail opined that the government wishes to impose a tax on non-productive assets and wealthy people to boost entrepreneurship and investments as part of its five top tax policy principles.

Read: LDA asks for PKR 202 bn development budget for FY-23

Furthermore, the government has instructed the non-resident Pakistanis (NRPs) to become taxpayers in Pakistan in case they weren’t taxpayers in their country of residence. Also, advanced withholding tax will be collected from those sending remittances to other countries. The 17% general sales tax on the import of solar panels and their local supply is also eliminated.

Minister Ismail said the government’s biggest challenge is to achieve a 5% economic growth rate without incurring an unmanaged current account deficit. The Federal Board of Revenue (FBR)’s collection target for the coming fiscal year is set at PKR 7 trillion with a 20% increase, against PKR 5.829 trillion revenue target for the current year. It was highlighted that the PKR 973 billion will be amassed due to the 17% impact of inflation (projected at 11.5%), and GDP growth of 5% and the remaining PKR 355 billion will be generated through additional tax measures.