Islamabad: The Federal Board of Revenue (FBR) is unlikely to extend the Tax Amnesty Scheme for construction sector in order to promote the building industry, according to media reports published on Wednesday.

Read: FBR notices served to realtors regarding legal compliance

During a meeting of the Senate Standing Committee on Finance, it was proposed that the withholding tax on contractors be cut from 7.5 % to 1 % and that a general amnesty be given. The amnesty, along with the PM’s Construction Package and the International Monetary Fund (IMF) granting a three-month extension, would promote construction sector.

In a post-meeting press conference, FBR Chairman Asim Ahmed stated that this was not an option since it would cost PKR 200 million in tax collection.

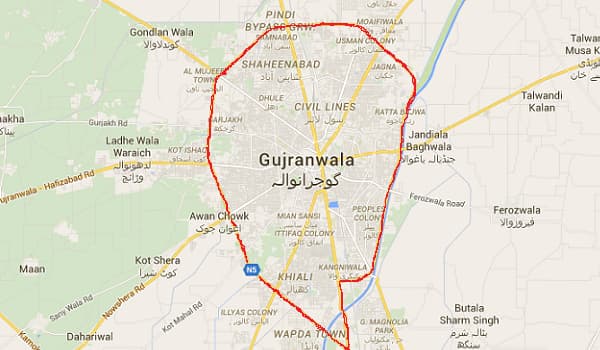

Also, addressed at the meeting was the need to raise the value rates of properties in 23 cities in order to collect taxes on profits of up to PKR 5 million obtained within a four-year period at the time of land disposal. The chairman further noted that the valuation figure announced by the FBR was 70% of the market value.

During the meeting, real estate agents Sardar Tahir and Ahsan Malik informed the government that the gain tax regime has been altered to raise valuation rates beginning in July 2021. Furthermore, they have requested that the terms “habitual customer” and “adventurer” be defined in income tax law.

Read: FBR shares latest statistics on real estate projects registered under amnesty scheme

Separately, the Senate rejected the FBR’s suggestion to levy a 17 percent GST on jewellers. Furthermore, the Senate Panel rejected the FBR’s proposal to levy a tax on household electricity bills above PKR 25,000 per month.