January 13, 2025

Islamabad: The Federal Board of Revenue (FBR) Chairman Rashid Mahmood has agreed, in principle, to …

January 10, 2025

Islamabad: The Federal Board of Revenue (FBR) has initiated the budget preparation process for the …

January 6, 2025

Islambad: The Federal Board of Revenue (FBR) has raised concerns over significant disparities in tax …

January 3, 2025

Islamabad: The Federal Board of Revenue (FBR) has reported a shortfall of Rs386 billion in …

January 1, 2025

ISLAMABAD: President Asif Ali Zardari on Monday night promulgated the Income Tax (Amendment) Ordinance, 2024, …

December 27, 2024

Islamabad: The Standing Committee on Finance and Revenue on Thursday unanimously approved the Tax Laws …

December 27, 2024

Islamabad: The Islamabad Chamber of Commerce and Industry (ICCI) has called on the Federal Board …

December 27, 2024

Karachi: In a landmark move to encourage foreign investment in Pakistan’s real estate sector, the …

December 26, 2024

Islamabad: The Federal Board of Revenue (FBR) has introduced a new penalty targeting non-banking transactions …

December 19, 2024

Islamabad: The Government of Pakistan has introduced the Revenue Amendment Bill 2024, tightening restrictions on …

December 6, 2024

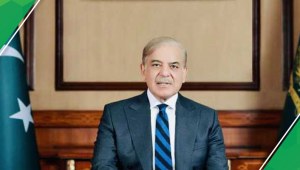

Islamabad: Prime Minister Shehbaz Sharif has set a December 31 deadline for the digitalisation of …

December 4, 2024

Islamabad: Finance Minister Muhammad Aurangzeb on Tuesday underscored the importance of bringing the wholesale and …

December 3, 2024

In a move set to encourage overseas investment in Pakistan’s real estate sector, the Federal …

November 29, 2024

Islamabad: Chief Justice Yahya Afridi has announced the formation of dedicated benches to expedite the …

November 24, 2024

Karachi: Pakistani banks have begun implementing monthly fees on large savings accounts to meet the …

November 19, 2024

Peshawar: A significant relief for property owners in Peshawar is on the horizon as a …

November 18, 2024

Islamabad: In a significant move to simplify tax processes for salaried individuals, the Federal Tax …

November 15, 2024

Islamabad: The Federal Board of Revenue (FBR) has introduced ePayment 2.0, an advanced digital payment …

November 4, 2024

Islamabad: The Federal Board of Revenue (FBR) has introduced short-term and long-term measures to address …