February 18, 2025

Islamabad: The Federal Board of Revenue (FBR) has revised the territorial jurisdictions for the collection …

February 15, 2025

Islamabad: The federal government is considering easing the tax burden on salaried individuals in the …

February 14, 2025

Karachi: The Patron-in-Chief of the Association of Builders and Developers of Pakistan (ABAD), Mohsin Sheikhani, …

February 12, 2025

Islamabad: The Federal Board of Revenue (FBR) has announced plans to closely monitor bank transactions …

February 12, 2025

Islamabad: The National Assembly Standing Committee on Finance and Revenue has approved amendments easing restrictions …

February 12, 2025

Islamabad: The Federal Board of Revenue’s (FBR) proposed restrictions on property transactions exceeding PKR10 million …

February 10, 2025

Islamabad: The federal government is likely to abolish the Federal Excise Duty (FED) imposed on …

February 10, 2025

Islamabad: The Pakistan Tax Bar Association (PTBA) has urged the Federal Board of Revenue (FBR) …

February 7, 2025

Islamabad: The government has finalized a set of proposals aimed at reviving Pakistan’s real estate …

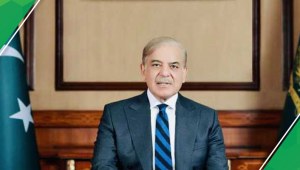

February 6, 2025

Islamabad: Prime Minister Shehbaz Sharif is set to review a major package for the housing …

February 3, 2025

Islamabad: The Task Force for the development of the housing sector has recommended abolishing Section …

January 31, 2025

Islamabad: The federal government is considering allowing property purchases of up to PKR 10 million …

January 29, 2025

Islamabad: The real estate sector has urged the government to amend The Tax Laws (Amendment) …

January 28, 2025

Islamabad: The government is reportedly considering a significant reduction in tax rates for high-value property …

January 28, 2025

Lahore: The Punjab Excise and Taxation Department has introduced a landmark reform in the property …

January 26, 2025

Lahore: The Punjab Excise Department has introduced a new initiative aimed at tackling property tax …

January 24, 2025

Lahore: In a significant move, the Punjab government has extended its property tax collection system …

January 23, 2025

Islamabad: The National Assembly Standing Committee on Finance and Revenue has expressed its support for …

January 21, 2025

Karachi: In a groundbreaking move to promote transparency and improve tax compliance, the Sindh province …