For most young individuals, opening a bank account seems like the first step into adulthood. Whether you are a student, a salaried person or pensioner, having an account in a reputable bank has become somewhat of a necessity. After all, banks not only keep your money safe but also allow you to earn interest and enjoy a number of other perks, including but not limited to tempting discounts on using your debit card. However, before you visit your nearest bank, you need to know the different types of bank accounts in Pakistan along with their main features.

In order to make things easier for you, here’s a detailed guide on how to open a bank account in Pakistan as well as the most common types of bank accounts everyone must know about.

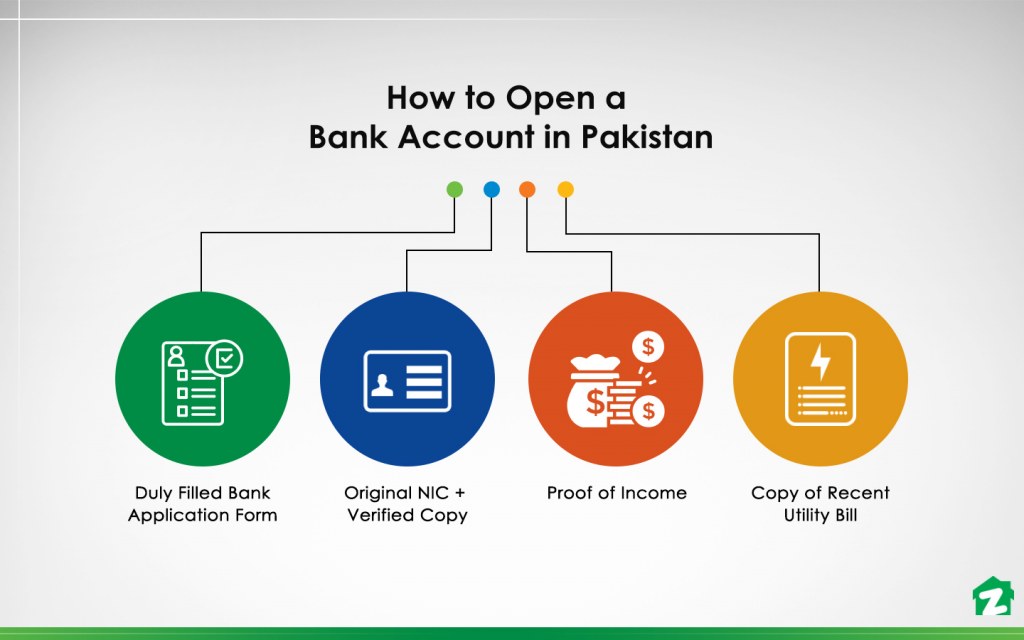

How to Open a Bank Account in Pakistan

These are the basic account opening requirements in Pakistan.

- Original Computerized/Smart National Identity Card (NIC) along with a verified copy.

- Original National Identity Card for Overseas Pakistanis (NICOP) or Pakistan Origin Card (POC) along with a verified copy for dual national citizens.

- Proof of income in the form of salary slips, salary certificate or pension book

- Copy of recent water/gas/electricity bill

- Photocopy of Form-B or Birth Certificate for minors

- The school/college/university ID card and proof of income of the guardian for students

It is important to note that these account opening requirements may vary with each bank and type of account. For instance, if you are opening a joint account with a family member, you will need to submit a verified copy of their NIC and utility bill (in case of a different address) along with your application.

Meanwhile, companies and partnership firms will have to submit additional documents, such as NTN certificate, certificate of incorporation, memorandum of association, a letter of partnership and certified copy of partnership deed among others.

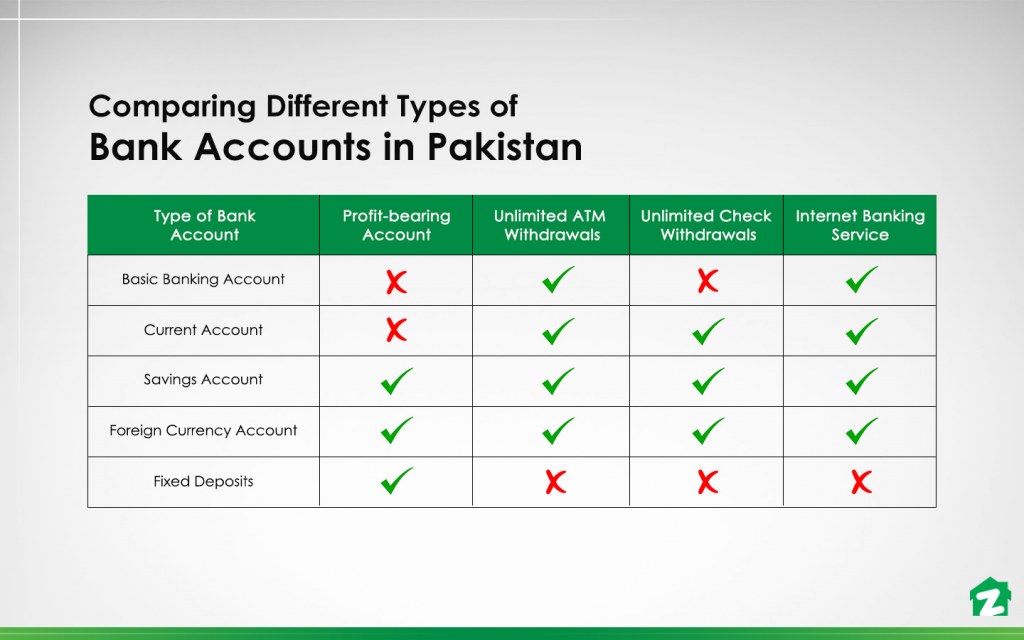

Common Types of Bank Accounts in Pakistan

There are five common types of bank accounts offered by banks in Pakistan.

- Basic Banking Account

- Current Account

- Savings Account

- Foreign Currency Account

- Fixed Deposit Account

Let’s take an in-depth look at the different types of bank accounts and their features.

Basic Banking Account

Almost all major commercial banks in Pakistan offer the Basic Banking Account (BBA) to their clients. As the name suggests, it is a simple bank account that provides basic banking facilities.

BBA is ideal for account holders who don’t need to make frequent transactions.

Salient Features of Basic Banking Account

These are some of the main features of a Basic Banking Account:

- No account maintenance fee

- No interest rate, which means it’s a non-profit bearing account

- Exempt from Zakat deduction

- The account may be closed if the balance remains ‘nil’ for a consecutive period of six months

- Maximum four transactions, i.e. two deposits and two withdrawals via check, are allowed free of charge on a monthly basis. Account-holders will have to pay a small fee for additional transactions

- Unlimited ATM service. While withdrawals from the bank’s ATM are free of charge, ATMs of other banks may charge a transaction fee

- Customers can switch to BBA from any other type of account

Minimum Account Opening Amount: PKR 1000 (may vary with each bank)

Minimum Balance Amount: None

Who Should Open a Basic Banking Account?

Basic Banking Accounts are ideal for students, homemakers and retired individuals.

Current Account

The current account is easily one of the most popular types of bank accounts in Pakistan, widely used by working individuals, businessmen and commercial entities. This account is ideal for making business transactions on a day-to-day basis, which means you can deposit and withdraw your money at any time.

You can open a current account in any private or public sector bank, most of which offer a number of different current accounts to their customers.

Salient Features of a Current Account

These are some of the key features of current account:

- No-interest bearing account

- Exempt from annual Zakat deductions

- Debit card service with unlimited transactions. However, the amount you can withdraw via ATM per day may vary with each bank.

- Free of charge phone banking service

- No restriction on the number of deposits and withdrawals via checks

- Free online and internet banking

- SMS and email alerts for every transaction

Minimum Account Opening Amount: PKR 1000 (may vary with each bank)

Minimum Balance Amount: None (may vary with each bank)

Who Should Open a Current Account?

Current Accounts are usually used by entrepreneurs, salaried individuals, traders and companies.

Almost all At-Work accounts are also current.

Savings Account

As the name suggests, savings accounts are meant for securing your savings. In addition to that, unlike the current account, they also allow you to earn a certain percentage of interest over time. It means the amount you deposit in your savings account will accumulate a modest profit.

Moreover, banks in Pakistan offer a number of different savings accounts for individuals who want to earn income through interest.

Salient Features of a Savings Account

Here are some of the main features of saving accounts:

- Profit-bearing account

- Most banks calculate profit on a monthly average basis.

- Zakat and withholding tax are deducted

- Funds can be accessed at any given time

- Banks periodically credit the profit to the client’s account

- Debit cards can be used to make unlimited transactions

- Free online banking services

- Free of charge phone banking services

Minimum Account Opening Amount: PKR 100 (varies with banks)

Minimum Balance Amount: None (varies with banks)

Who Should Open a Savings Account?

Savings accounts are ideal for people with fixed income and minors who want to start saving money. Since a number of banks provide this service to individuals under the age of 18, opening a savings account is one of the best money management tips for kids who want to grow up to be money-savvy adults.

Foreign Currency Account

This type of bank account is usually maintained by overseas Pakistanis, dual national citizens, charitable institutions and commercial entities. It only allows customers to deposit money in foreign currency. Most banks in Pakistan offer both savings and current foreign currency accounts where customers can deposit money in US Dollar, Euro, Japanese Yen and British Pound.

Salient Features of a Foreign Currency Account

Here are some of the most important features of a foreign currency account.

- Only deposits amount in a foreign currency

- Can transfer funds abroad

- Depositors can earn interest if they choose a savings account

- Zakat and other taxes to be deducted from foreign currency savings accounts.

- Availability of Traveler’s checks and other remittance services

- Its credit card can be utilized in and outside Pakistan.

- Transfer amount from one account to another

- Non‐residents don’t have to pay withholding tax and Zakat, depending on the bank.

Minimum Account Opening Amount: USD 250 or equivalent (may vary with banks)

Minimum Balance Amount: USD 1000 or equivalent (may vary with banks)

Who Should Open a Foreign Currency Account?

Foreign currency accounts are mostly used by foreign and dual national citizens, companies, firms and charitable foundations.

Fixed Deposits

Fixed deposit accounts, also known as Term Deposit Accounts, allows customers to deposit a large amount into their accounts and earn a profit on them. Compared to the savings account, the rate of return is higher on the amount invested in fixed deposit. However, account holders cannot withdraw their funds from a fixed deposit for a certain period of time.

Usually, fixed deposit accounts hold funds for a time frame ranging from one month to 10 years.

Salient Features of a Fixed Deposit Account

Here are some of the main features of fixed deposit accounts that you should know:

- Higher rate of return

- Fixed interest rate

- Zakat may be deducted

- Customer can deposit the amount only once

- Earned profit can be collected on a monthly or quarterly basis, depending on the bank.

- The term for a fixed deposit account can be renewed

- Cannot withdraw money either by check or ATM card before the term is up.

- Internet banking facility is not available

Minimum Account Opening Amount: PKR 25,000 (depends on the bank)

Minimum Balance Amount: PKR 25,000 (depends on the bank)

Who Should Open a Fixed Deposit Account?

Fixed deposit accounts are ideal for retired individuals who want to earn interest on their retirement funds.

Please note that the minimum account opening requirements, minimum balance requirements as well as interest rates are subject to change.

Furthermore, you can check out our detailed explanation about the deduction of Zakat at source and why some bank accounts are exempted from it.

To learn more about banking in Pakistan, stay tuned to Zameen Blog – the best lifestyle and real estate blog in the country. You can also subscribe to our newsletter to receive the latest updates about the property sector in the country. Moreover, if you have any queries or suggestions, feel free to get in touch with us at blog@zameen.com.