Home » Laws & Taxes » Here’s what you should know about Tax Brackets for 2019

Salaries and self-employed individuals along with non-incorporated firms are liable to pay tax on their income every year. The main source of income for the Pakistan government is the money they collect from taxpayers. In 2018, the country welcomed a new political party to power, but the tax rates were in place before the new elected officials assumed office. To take a look at the tax brackets in Pakistan for 2019, a basic understanding of the applicable tax rate is essential.

How Much Salary Income is Eligible for Income Tax?

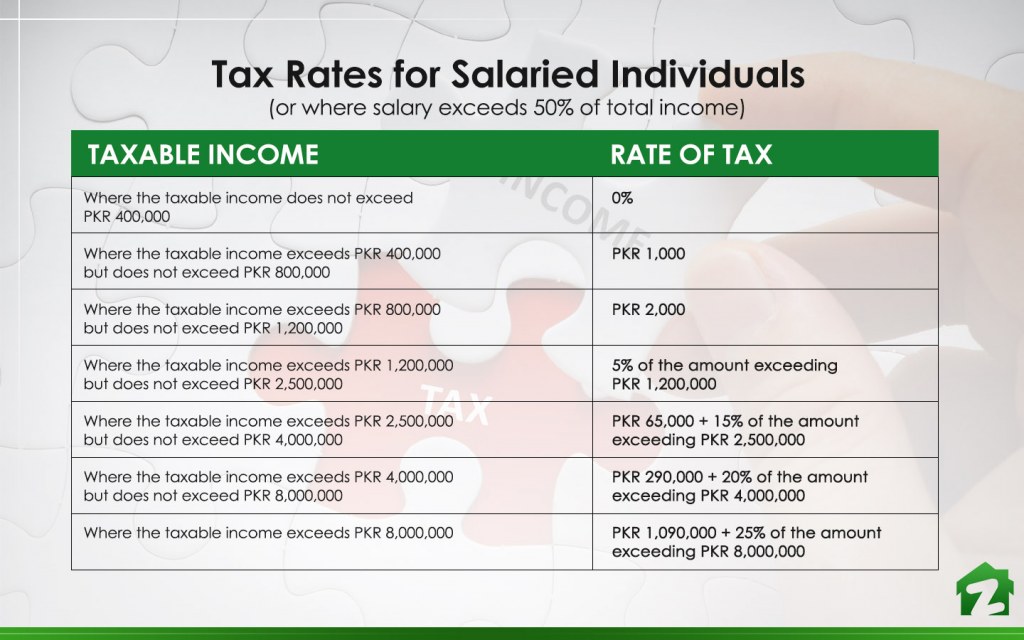

[Data for the table extracted from the official website of FBR]

To address individual tax brackets, we first need to figure out how much money you should be earning in order to be liable for income tax rate in Pakistan. As per the budget 2019, individuals earning less than PKR 400,000 per year, are not subjected to personal income tax rate. In terms of monthly income, this works out to around PKR 33,333 per month. Beyond the PKR 400,000 threshold, different tax brackets apply for each incremental income level. For instance, individuals earning between PKR 400,000 and PKR 800,000 per year have to pay a fixed income tax, i.e. PKR 1,000. Divided over 12 months, this amount works out to around PKR 83 per month.

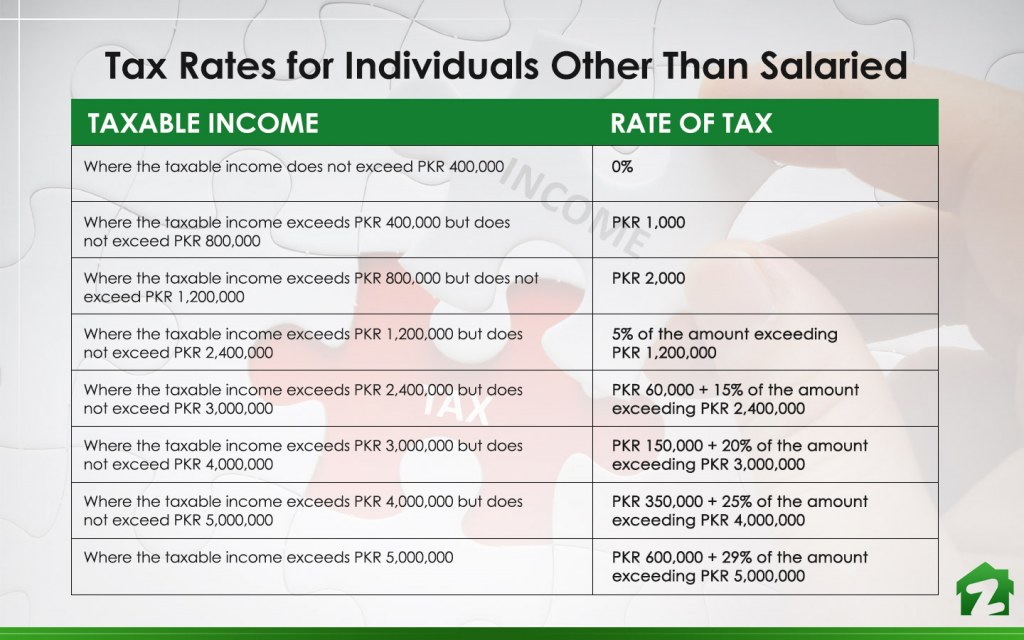

[Data for the table extracted from the official website of FBR]

According to the salary tax slabs 2018-19 in Pakistan, high-income individuals are taxed the most. This reason is why the tax rates for low-income earners are low, though the tax starts at a lower threshold than under the previous government. The highest tax slab, as per the tax brackets in Pakistan for 2019 is for individuals earning PKR 8 million or more. The applicable income tax on their earnings is PKR 1.09 million per year. In addition, they have to pay 25 percent tax on their income exceeding PKR 8 million.

Pakistani authorities will use technology to catch tax evaders in future

For example, if a person makes PKR 9 million a year, they will pay PKR 1,090,000 and an additional PKR 250,000 (i.e. 25 percent of PKR 1 million). In this scenario, the monthly taxable amount is around PKR 111,667.

PTI Amnesty Schemes 2019

The new government announced a tax amnesty scheme to increase its tax collection. The amnesty scheme will cover a number of assets, ranging from undisclosed sales to real estate. For instance, individuals can declare their immovable properties in Pakistan and whiten them by paying 1.5 percent tax. The tax rate applicable on undisclosed sales is 2 percent. This initiative marks the first time that undeclared sales will be under the tax net. The amnesty scheme allows taxpayers to come into the fold before the end of the financial year, i.e. 30th June.

The government will impose a default surcharge if individuals make a late payment. Depending on the date on which the person pays the tax, the surcharge could range from 10 percent to 40 percent. This offer is valid till 30th June next year, which means that individuals can disclose their incomes and assets between 31st March and 30th June 2020, by paying a 40 percent surcharge.

Tax on Corporate Income

When we take a look at the tax brackets in Pakistan for 2019, we observe that the Pakistan corporate tax rate changed slightly last year, with the slabs for public and private companies changing. The government reduced the taxation on public and private companies from 30 percent to 29 percent. In comparison, the tax rate imposed on banking companies and small companies remained the same as per tax year 2017-18. The tax on corporate income depends on the nature of the business. For instance, not for profit organizations are not subject to taxation if they qualify for that status. If they don’t receive approval, they will have to pay tax as per the rates applicable to private companies.

Taxation for Private Limited Companies

Private limited companies have the same basic tax structures as public limited companies, i.e tax on profits at 29% subject to minimum turnover tax of 1.25%. Private limited companies have to file their returns annually.

Taxation for Public Limited Companies

As per the new tax brackets in Pakistan for 2019, public limited companies have to pay tax at a higher rate than private limited companies. Their taxable income is subject to 29 percent tax, while they have to pay 1.25 percent tax on turnover. The taxes charged on profits and dividends are the same as for private limited companies.

Other Business Structures

Sole traders, business individuals, and proprietors who generate a turnover of more than PKR 10 million have to pay 1.25 percent tax. Partnerships also have to pay tax at the same rate and for the same turnover threshold. However, partners are not liable for paying taxes separately.

The federal budget 2019-2020 tax year is just around the corner, and may introduce new tax changes that apply to wage earners and businesses in Pakistan. Till then, the information provided above is relevant with regard to taxation in Pakistan.

It is crucial for local residents to be aware of different types of taxes, especially when they are dealing with real-estate matters. For instance, if you are buying a property, do your research on all sorts of property taxes in Pakistan.

For more information on laws and taxes, stay tuned to Zameen Blog, the number one real estate blog in Pakistan.