Home » Laws & Taxes » Register Your Business For Sales Tax With FBR’s Tax Asaan Mobile App

Tax Asaan is a mobile app that has been recently developed and launched by the Federal Board of Revenue (FBR) to facilitate taxpayers. There are many features available on the app so that you don’t have to open up your laptop every time you wish to access your IRIS account. Through Tax Asaan, you can easily make online inquiries using your smartphone. Previously, we discussed the complex process of how to file your income tax returns online; in this blog we will be looking at the many features available on the app. Later, we shall take a look at how to register business for sales tax through the FBR’s Tax Asaan App.

Features Available On FBR’s Tax Asaan Mobile App

A smart application developed by FBR, Tax Asaan app is available for both Android and iOS platforms. This app has many important features to help you in managing various aspects of your taxpayer account. Following are the features of the app:

- E-Payments

- Online Verification Services

- Sales Tax Registration Process

E-payments

You can make E-Payments via the Tax Asaan app as it provides the facility of paying taxes online directly through bank accounts using Alternate Delivery Channels by logging into the system or without logging into Tax Asaan application. You can conveniently create Payment Slips for Income Tax and Sales Tax through the app.

Online Verification Services

As a taxpayer, you need updated information regarding any order or notice issued to taxpayer through your IRIS account. Or maybe you want to check your taxpayer status – If you are included in the Active Taxpayer List or not. Apart from this, you can also seek information about Exemption Certificates through Tax Asaan Mobile App.

Online Sales Tax Registration via Tax Asaan Mobile App

A brand new feature has just been added to the app. Now, Tax Asaan app users can easily have online sales tax registration done for their businesses. This can expedite the registration process for taxpayers.

How to Register Business for Sales Tax through Tax Asaan App

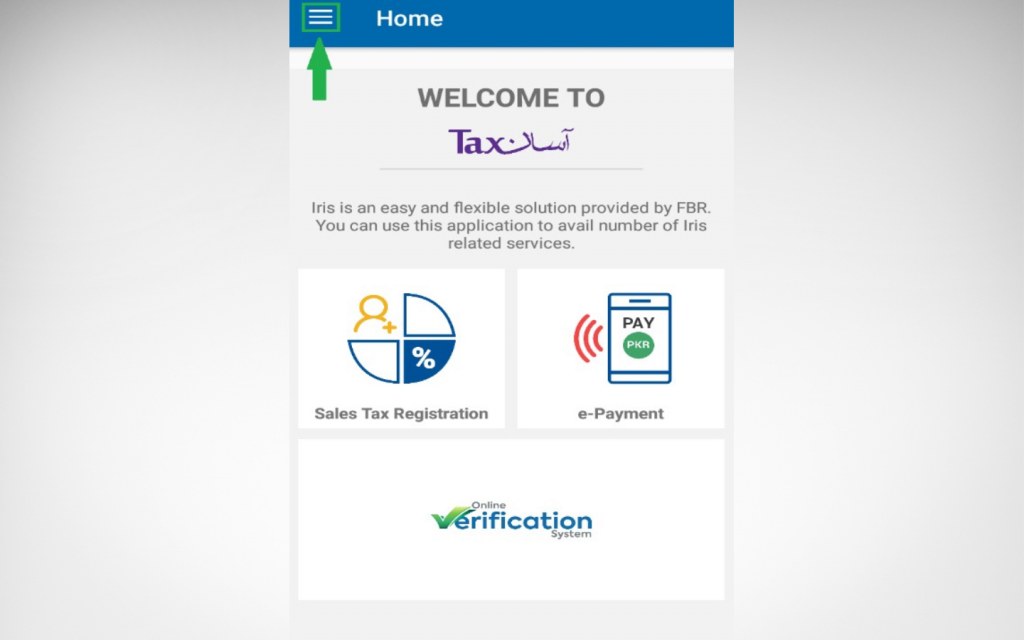

First download the Tax Asaan App via Google Play Store. The home screen for the app will appear as shown below. Click on the menu button and a list of features will appear in the left panel of your mobile screen.

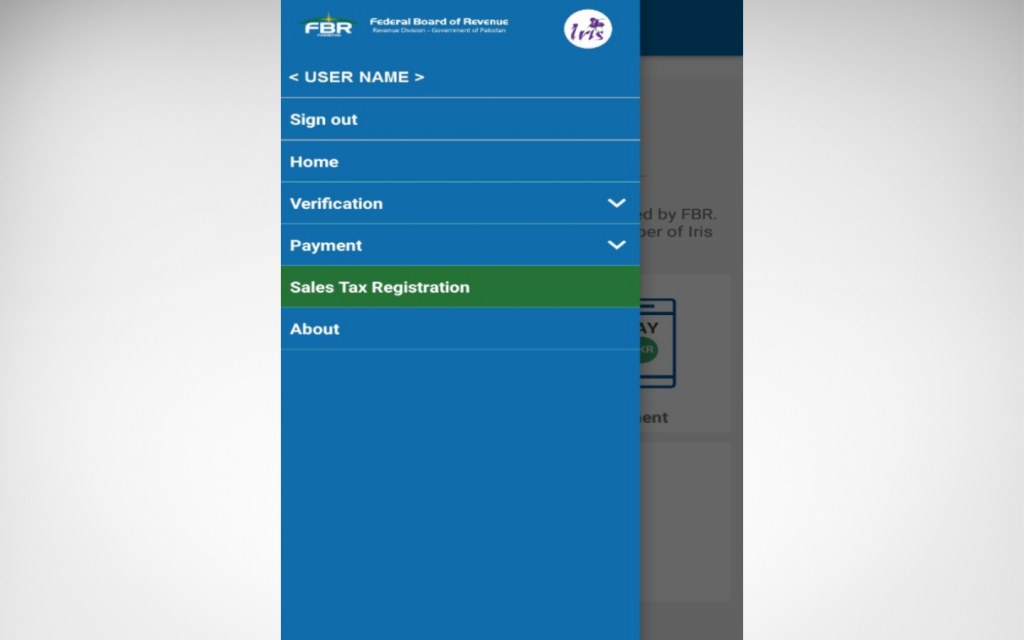

Tap on the Sign In button from the drop down panel and enter your username and password so that you can login to your account. You can either use your individual or credentials of your company’s account to sign in to Tax Asaan App. Once you have signed in your name will appear on top left.

Click on the Sales Tax Registration Menu either from the drop down panel on the left side or through the Sales Tax registration tile on the main dashboard screen.

Online Sales Tax Registration for Manufacturer/other than manufacturer via Tax Asaan App

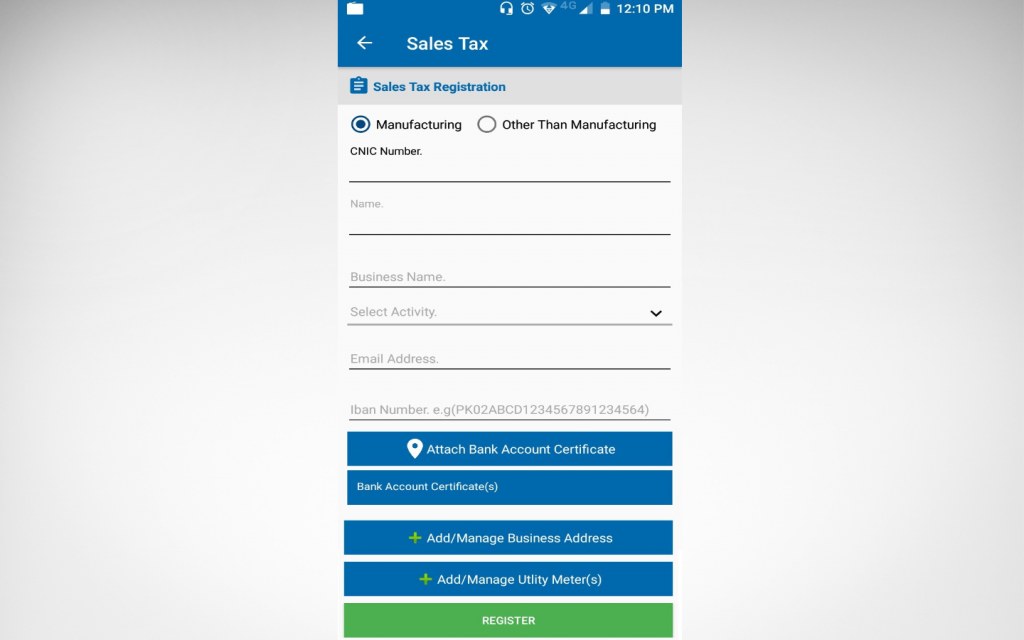

Once you tap on Sales Tax Registration tab, the Tax Asaan application will redirect you to the Sales Tax Registration page. Now, choose the ‘Manufacturing’ option and click on it. If you are not a manufacturer, then choose the ‘Other Than Manufacturing’ option.

Fill in your business details like your CNIC and name of the sole proprietor or partner or any representative of the company.

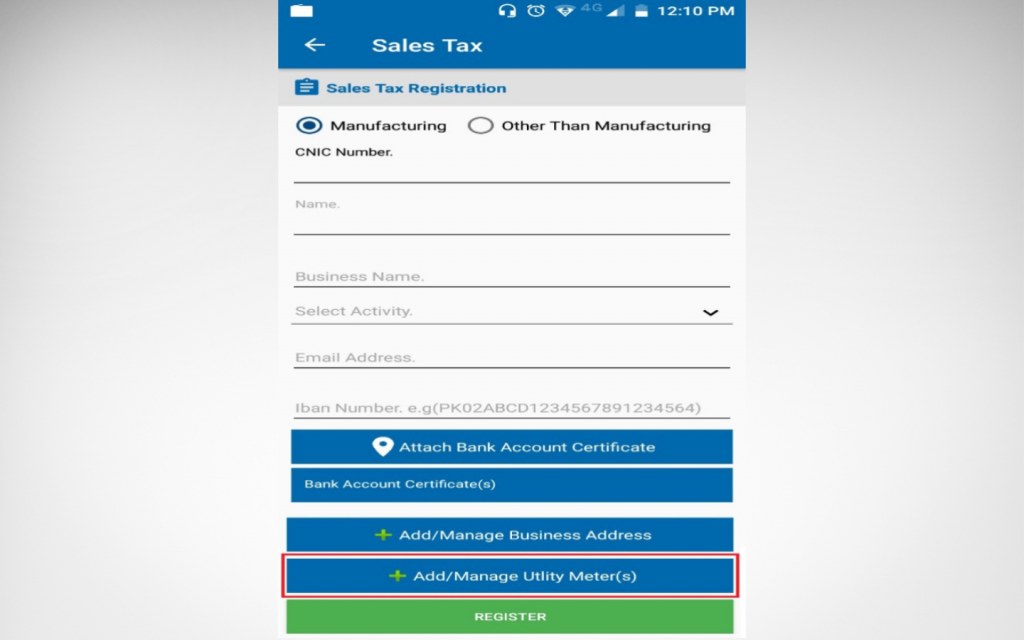

Then enter the name of your business and select ‘Activity’ from the drop down menu. Enter your email address and IBAN and then click on the button where you will have to attach your bank account certificate. Also add your business address.

How to Add Business Address in the App

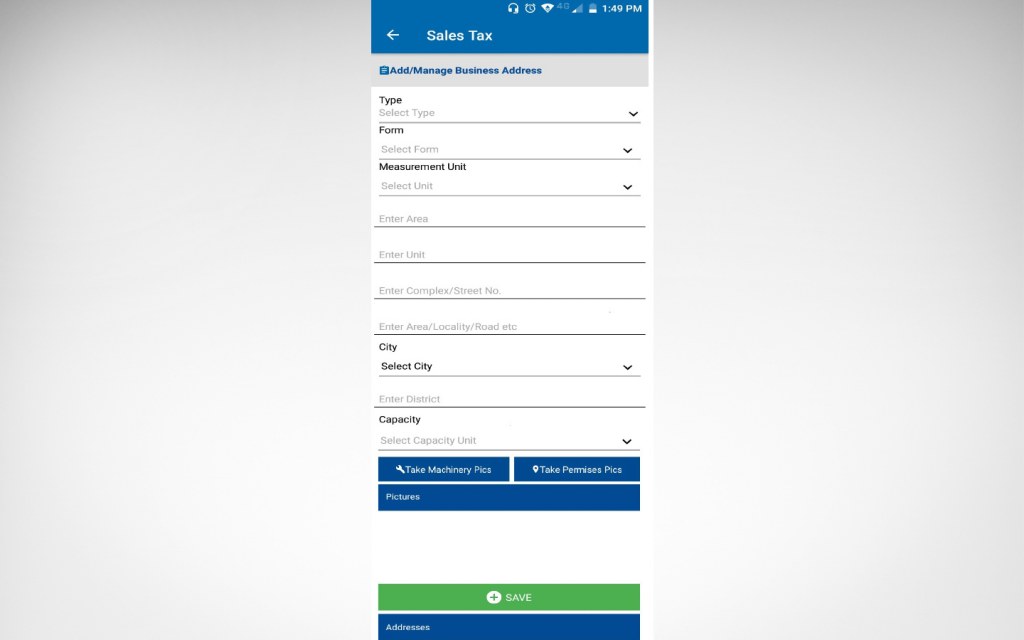

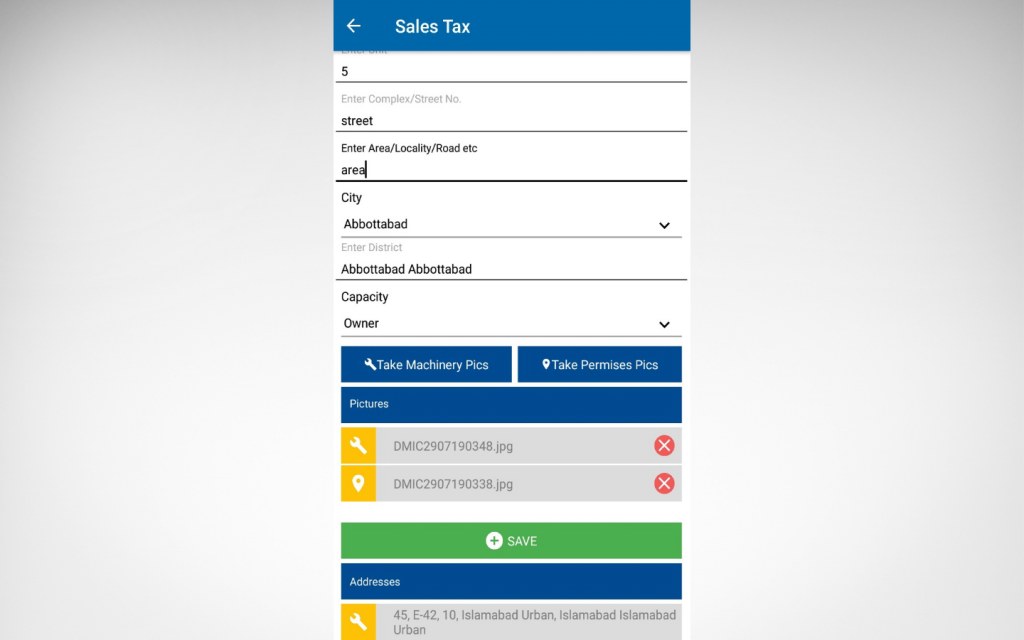

To add business address the app will lead you to another page where you have to fill in address details of your business. Select the type if it is residential or commercial property. Choose ‘Form’ from the drop down menu if it is a flat or a house.

Also, select ‘Measurement Unit’ from the drop down menu. In the ‘Capacity’ tab, choose whether you are an owner or tenant. Select your ‘City’ and then click on ‘Take Premises Pics’ as shown in the picture below. When you press this button it will take GPS tagged photos of the business premises.

Once the pictures are taken, click on the tab Take Machinery Pictures and take pictures of the machinery used in your business. You can take as many pictures as you want both of the premises and of the machinery and you can later delete those pictures which are not needed by pressing the delete button present at the end of each row of the image uploaded.

Click on the ‘Save’ button once you have completed taking pictures to add that business address. If you have more business addresses to add, remember one picture of the premises is mandatory with each business address you save. All the business addresses will be saved under the ‘Addresses’ section.

Click on ‘Manage Utility Meters’ as shown below.

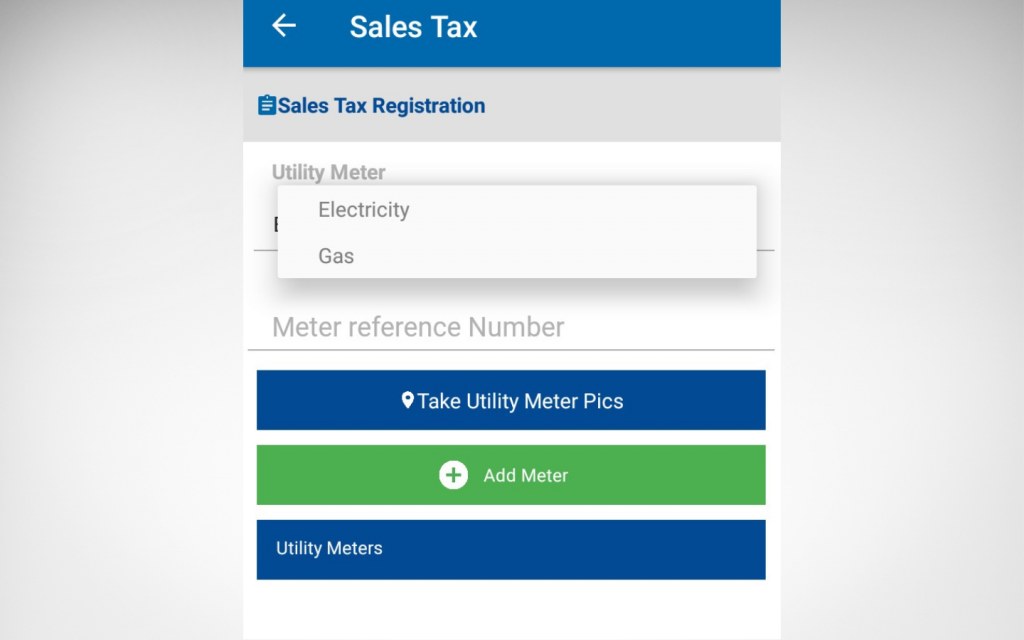

Select the Utility Meter type whether it is gas or electricity. Enter the Utility Meter reference number and click Add Meter to record the utility meter as shown below.

Once you are done with this, click on the ‘Register’ button to complete the online sales tax registration process for businesses.

So, this was a detailed process of how to register business for sales tax through the Tax Asaan app. If you found this blogpost useful, then do write to us at blog@zameen.com. For more informative posts subscribe to Zameen Blog, the leading property blog in Pakistan.