Home » Property » Opening Up the Real Estate Sector: Unlocking Construction Sector’s Potential to Boost Growth

Scope of Construction in Naya Pakistan

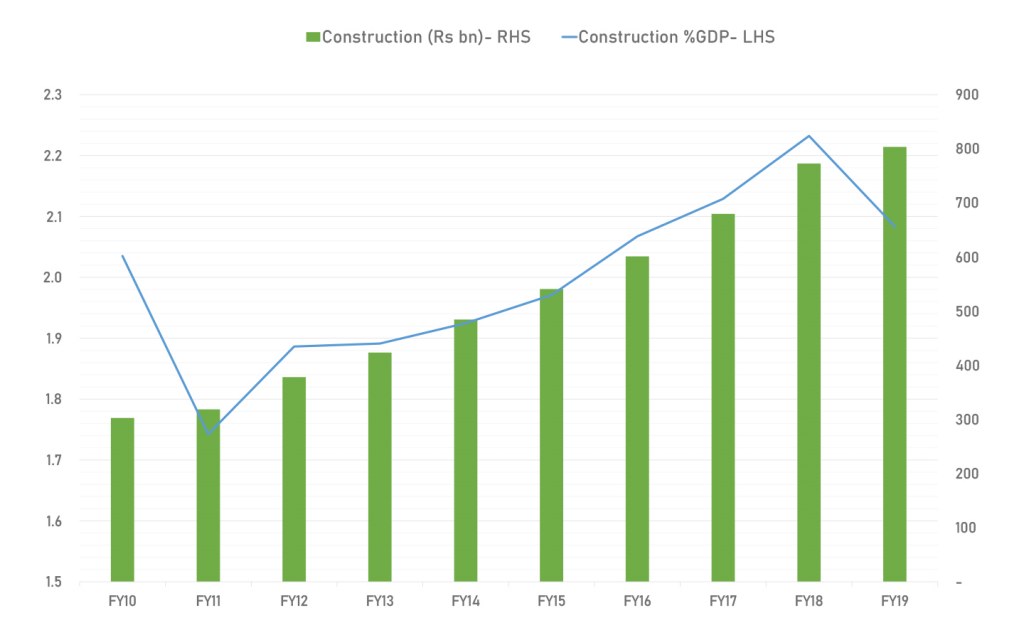

The fact that construction industry is an engine of economic growth and employment has been realized by subsequent governments in Pakistan. Globally, when economies try to address housing deficit issues driven by growing populations, they venture into public spending and launch new public projects. The model in Pakistan has been similar. Both the federal and provincial governments spend a substantial amount from their respective development budgets on brick and mortar.

Source: Ministry of Finance

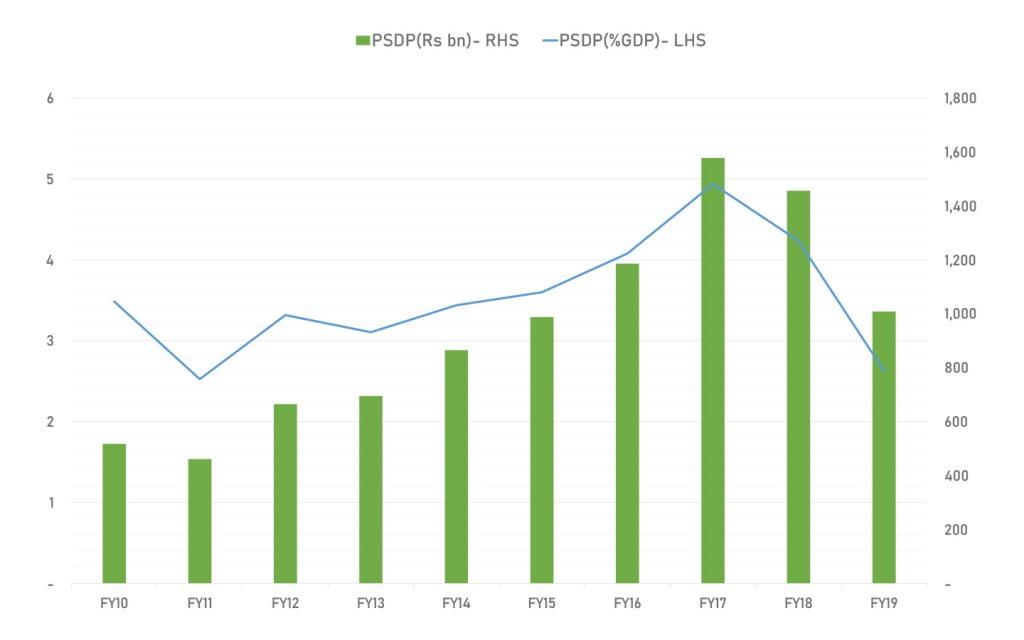

But the problems faced by government during the process are two-fold: the first is specific to Pakistan’s perennial macroeconomic challenges. The capacity of government to launch large public development projects is constrained by tight fiscal budget. As a proportion of GDP, the governments’ spending on development has shrunk over the last few years.

Source: Ministry of Finance

The second challenge is endogenous and often universal—that government-led spending tends to be inefficient and economic returns tend to be far less than that of the same spending done by the private sector.

The solution is to move from the current model to a public-private partnership (PPP) structure with a greater involvement of the private sector. This would solve both the problems at the same time. With the private sector entities running the projects, inefficiencies from the system earlier run by government will be eliminated, and private sector will be encouraged to finance the projects, bringing in more investment.

While it is true that PPP can also face challenges in designing and implementation of projects, strong mechanisms can be built to tackle them. In the short-run, solution to develop brick and mortar seems to be in providing space to private sector investment.

Motivation for Involving the Private Sector

It is very likely that the current government will bring such a solution. A handsome package has already been proposed for the real estate sector and its approval by the Ministry of Finance is underway. This will ease regulatory hang-ups for developers and builders and kick-start new development.

The government wants to bring private sector expertise in building construction into commercial and housing construction at a much grander scale. This will be different from earlier regimes, as earlier the emphasis of development was on building roads, highways and bridges. The PTI government’s primary focus is on housing issues. Under the Naya Pakistan Housing Plan, a project PM Imran Khan announced right after joining office, the government aims to bridge the rising housing gap estimated to be somewhere between 10-12 million units. The project hopes to support building 5 million houses and generating 10 million jobs.

Due to hindering economic stabilization policies and slowdown in the economy, the project has come to a standstill state. But the government has to shift gears soon. The main stumbling block for the aforementioned package, considering the fiscal concessions, is the pending approval of the IMF.

The good news, however, is that in the ongoing first review of the Fund programme, most of the quantitative targets are met. This is a propitious sign of success since it gives government leverage to get allowance on announcing a real estate development package.

Boosting Investments in Real Estate

While such a great initiative has been taken, it is important that the government make sure the existing challenges associated with the real estate investment are addressed so that not only does the project enhance investment in the real estate sector, but also boost the economy in general.

First and foremost, the government must eliminate the fear of tax man to encourage fresh investments. Historically, the sector has largely remained notorious due to its informal nature, wide circulation of grey income, wealth accumulated by the developers and builders, as well as transparency and traceability issues.

According to builders, property buyers and end-consumer do not have enough white money to buy apartments or houses in posh localities of the urban centers. Because of this, the builders are hesitant to undertake new projects. The agents in market also prefer not to be interrogated regarding their sources of income.

That in no way means that other agencies cannot intervene in the cases where money is generated through illegal means. In such cases criminal proceedings could be applicable. In fact, there is a subtle difference between tax authorities asking questions or other agencies probing on the money trail. The latter is of great importance given that Pakistan is on the FATF grey list and the government cannot afford to not document the money trail.

Once investment is made in a real estate project, the government should be able to fully document it. The transactions ought to be recorded on real value or close to real values and the tax to be deducted on the income generated upon selling after development.

The builder community however, desire much lower tax rates. They are seeking a flat rate of Rs70/square feet and Rs210/square feet for residential and commercial construction respectively. These rates are very low and seem unreasonable. The cost of relatively less pricey apartment is around Rs7,000/square feet in Karachi, and assuming 40 percent return, the income tax rate is calculated at 1.4 percent. Instead, these taxes should be calculated at actual income. The builders should also be encouraged to keep their books clean.

One fear is that the opening up real estate sector for black money—with no FBR investigation on the source of income—will attract speculators. Real estate prices may go up and make properties unaffordable for end buyers. That has to be controlled by heavily taxing empty plots that remain undeveloped for a stipulated period of time. For example, empty plots for single units can be taxed after 2 years, and those for high rise units can be taxed within 3-5 years, depending on the height of the building. The tricky part would be to be watchful of potential practice of plot transaction among speculators within the stipulated time.

For now, the market is anticipating the approvals and announcements of concessions which may become part of the finance bill, or be promulgated through presidential ordinance. It is pertinent to note that these concessions would revive the existing market, but for cost-effectiveness more has to be in offering in terms of tax concessions on inputs and lower income tax rates. For that, economic authorities have to address economic stabilization issues first which may take another 6-9 months.