Using a personal loan for home improvement offers many benefits since upgrading a unit requires cash payments—sometimes upfront—and not every property owner can afford that. But there are some downsides to using these loans as one has to make interest payments later.

So, if you are applying for a personal loan and aim to use it for home improvement, we’ll help you understand whether it is a good option for you or not by discussing the pros and cons of using personal loans for home improvements.

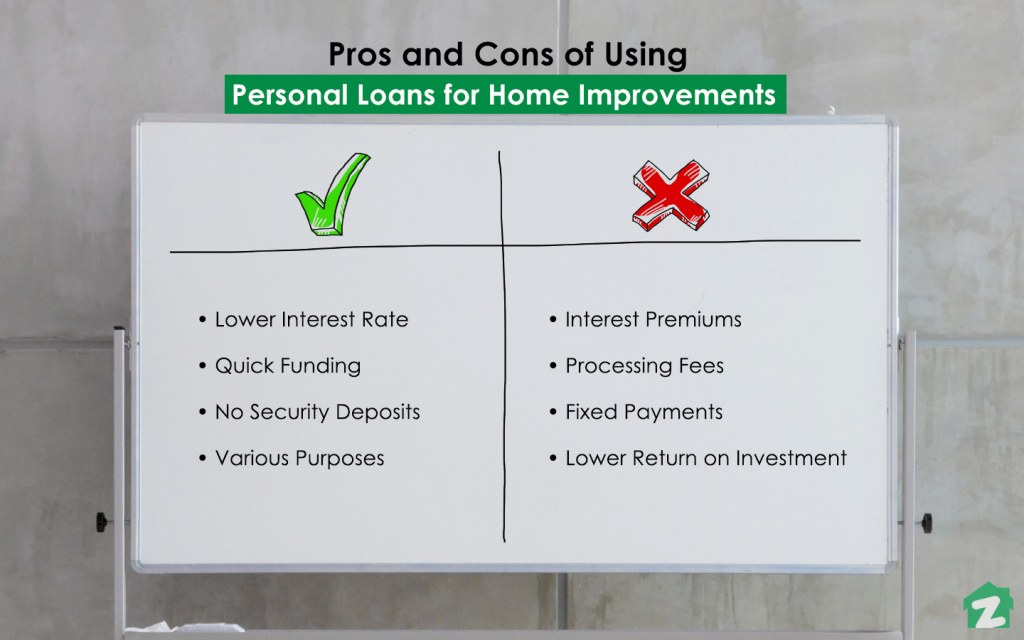

Pros and Cons of Using Personal Loans for Home Improvements

There are certain changes and fixes in your house that require immediate attention. Personal loan for home improvement, in such cases, is always a good option. For example, one can’t wait around to save up cash to fix a leaking roof. You have to fix it as soon as possible. However, as urgent as the project may be, make sure to weigh the pros and cons of using personal loans for home improvement before making the final decision.

Pros of Using Personal Loans for Home Improvements:

- Lower Interest Rate

- Quick Funding

- No Security Deposits

- Various Purposes

Cons of Using Personal Loans for Home Improvements:

- Interest Premiums

- Processing Fees

- Lower Return on Investment (ROI)

- Fixed Payment

Pros of Using Personal Loan for Home Improvement

Here are some of the biggest perks of using a personal loan for home upgradation:

Lower Interest Rates

In comparison to credit cards, the interest rate on a personal loan is usually lower. Banks in Pakistan on average offer personal loans starting from PKR 30,000, going up to PKR 200,000, with the repayment tenure of 1 year to 5 years. The interest rates vary but any reputable bank in the country charges a minimum of 16 percent of the total loan amount. It may go as high as 32 percent, depending on the amount you borrow.

Quick Funding

Applying for a home loan is quick and easy and the approval process isn’t lengthy either. In most cases, applicants can complete the entire procedure within a few hours or a day, on average. Most banks in Pakistan also provide online services, collecting basic financial and personal information from borrowers. Meanwhile, the application process is not cumbersome at all; the approval is given within a week or two and you get your funds without any unnecessary delays.

No Security Deposits

Don’t get worried when you hear that most personal loans are unsecured. It essentially means that the borrower doesn’t have to risk any asset as a guarantee; you don’t have to constantly fret about your lender seizing your possession in case you fail to pay the loan within the given timeframe. Unlike mortgages, car loans, and home loans, personal loans don’t even require down payments. Safe to say, using personal loans for home improvement is the most secure option, with almost zero risks when it comes to collaterals.

Versatility

One of the biggest advantages of considering personal loans is that it can be used for any purpose. In comparison to other, more restricted, types of loans, such as mortgages, car loans, or student loans – personal loans have specified purposes. These can be used to fix leakages, change your paint theme, or for overall remodelling, basically for anything you like.

Cons of Using Personal Loan for Home Improvement

As discussed earlier, personal loans can be utilised for upgrading a home but there are some downsides to this route as well. Let’s take a look:

Interest Payments

Even though lower interest rates are one of the advantages of personal loans, you have to pay an additional amount in terms of interest payments. Let’s say the expense to upgrade your home added up to PKR 100,000. You took a personal loan and signed up to return it within a year. The average monthly installments you will have to pay is PKR 10,000 per month, which amounts to PKR 120,000 per year. So, it goes without saying that you are paying more than the actual expense of your upgrade.

Processing Fees

Granted, a personal loan is one of the quickest ways to get funding for your home improvement project, but remember some banks also charge a processing fee (also known as origination fees) in addition to interest payments. Usually, banks in Pakistan charge around 1 percent of the amount as a processing fee for personal loans. Some even have a rule of charging a fixed value of minimum PKR 2,500, depending on which amount is higher. Borrowers are required to pay the full amount of processing fee upfront when they take this type of loan from a bank.

Lower Return on Investment (ROI)

People who remodel houses with plans for selling soon should not expect the same amount they are investing in upgrading the unit. This means if you have paid PKR 120,000 for home improvement, you will only get back a portion of the actual worth of the upgrade, especially considering how you’ll have to pay interest payments as well (as discussed above). This is why using your own funds is often a better idea if you cannot afford to pay interest and are looking for a greater ROI.

Fixed Payments

When you take small debts through means like credit cards, you can take as long as you need to pay it back with flexibility. A personal loan, however, has fixed payments that are payable within a given timeframe. If the borrower fails to meet these payments, the lender has the right to file a lawsuit against the borrower for defaulting.

So, these were some of the most important pros and cons of using a personal loan for home improvement. These will help you make an informed decision. Let us know if you have ever used a personal loan for home improvement at blog@zameen.com and please share your experience with us.

For more information, keep visiting our Facebook page. Subscribe to Zameen Blog for more tips on property management.