Home » Construction » Affordability of Naya Pakistan Housing’s Pilot Project

In the first two parts of this series (read part I and part II), we established that price movements—particularly of land and construction materials—against overall inflationary pressures in the economy have demonstrated a greater momentum. And this has serious implications on housing prices, as well as the government’s on-going policy to fix them under the Naya Pakistan Housing Program (NPHP).

It is clear that the government will have to introduce fiscal or non-fiscal measures to keep a control on the housing prices in this project. Evidently, if the program is to increase the supply of housing—particularly in the middle to low-middle income categories where housing shortage is concentrated—affordability will have to be front and center.

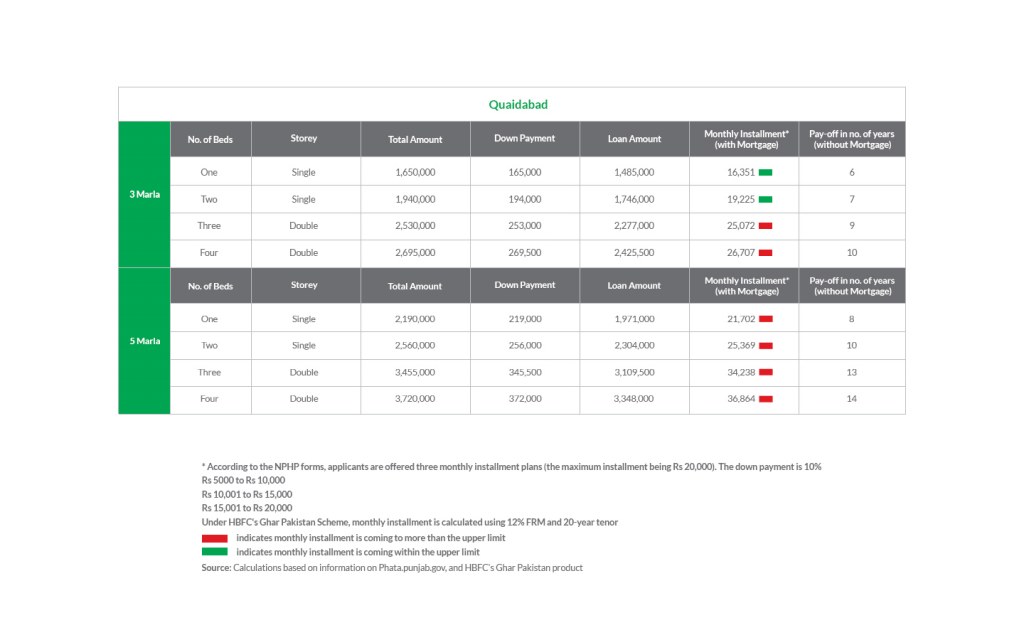

The information available on the Punjab government’s website for Punjab Housing and Town Planning Agency (PHATA) is scanty, but it does provide fixed housing prices for three key locations where the pilot project will run: Bhakkar, Layyah and Qaidabad. The prices are for 3 and 5 Marla houses on single and double storeys and up to 4 rooms, and it has been assumed that the approved applicants will pay an up-front 10 percent of the cost.

The housing prices range from Rs1.8 million to Rs2.95 million for up to two bedrooms and 3-marla houses across these three locations while they vary from Rs 2.5 million to Rs4.11 million for up to four bedrooms and 5-marla houses.

According to the NPHP registration forms, there are three different installment plans that each applicant can choose from. The lowest category includes installments of Rs5,000 to Rs10,000, the middle category from Rs10,001 to Rs15,000 and the highest category from Rs15,001 to Rs20,000. The question is, if these installment plans are fixed and are aligned with the housing prices.

Let’s assume that these applicants apply for the most affordable mortgage financing product available in the market—the House Building Finance Company (HBFC)’s Ghar Pakistan Schemes. This scheme is available for a house pricing up to Rs4.5 million, which falls within the price ranges under the pilot project mentioned above. The product is a fixed rate mortgage (FRM) of 12 percent with a tenor of 20 years. The tenor together with the FRM—which is much lower than the current prevailing mortgage rates of Kibor+4%—makes this an attractive product. Part of the reason is that currently, due to the asset-liability mismatch issue, banks are unable to provide a mortgage of over 12 years. But more than that, the interest rates at the moment are simply too high. Ghar Pakistan, though it has limited funding available, is the safest bet.

Considering this HBFC product, the estimated monthly installment for the above listed properties are mostly above Rs20,000—with the exception for a few. Applicants who choose the first and second installment plan can certainly not avail the HBFC funding because even the upper limit of Rs20,000 seems not entirely enough to pay off this loan.

The second option is to go without this mortgage. Households can pay-off the housing cost without taking on a loan between 6 and 15 years considering that they pay the upper limit of the monthly installment i.e. Rs20,000. Of course, this seems entirely unreasonable because developers typically exit once the project is constructed (which is estimated to take 1-3 years depending on the size of the project) and need to get their profit as well. That cannot be done if the property price is not recovered for as long as 15 years. The government needs to come up with mechanisms for the developers to recover their cost and get their profit, and the applicants to complete the pay-off in the required time.

In the first option, the difference of mortgage installment to be paid to HBFC and the monthly installment picked by the applicant will have to be met. Will it be a cash subsidy, an interest rate subsidy or any other mechanism? How much fiscal obligation will that mean for the government? We will explore in the next part.