Home » Construction » Naya Pakistan Housing and Construction Costs – Part II

Before we go into understanding the extent of affordability of PM Imran Khan’s Naya Pakistan Housing Program (NPHP), and the need of a range of fiscal and non-fiscal policies to attain this almost elusive affordability, it is important to examine the movement of land prices in Pakistan along with construction material costs.

Since together land and grey construction make up for majority of the total cost of any property, accounting for the way the housing asset is priced along with builders’ commercial viability will determine the steps the government needs to take to achieve affordability.

Earlier, we established that the price index for construction costs grew by 14 percent between Aug-18 and Aug-19—this is against a CPI growth of 12 percent. By Nov-19, these figures reached 16 percent and 15 percent respectively. This substantially raises the potential construction cost for the entirety of the NPHP 5-million housing program, estimated earlier by the government.

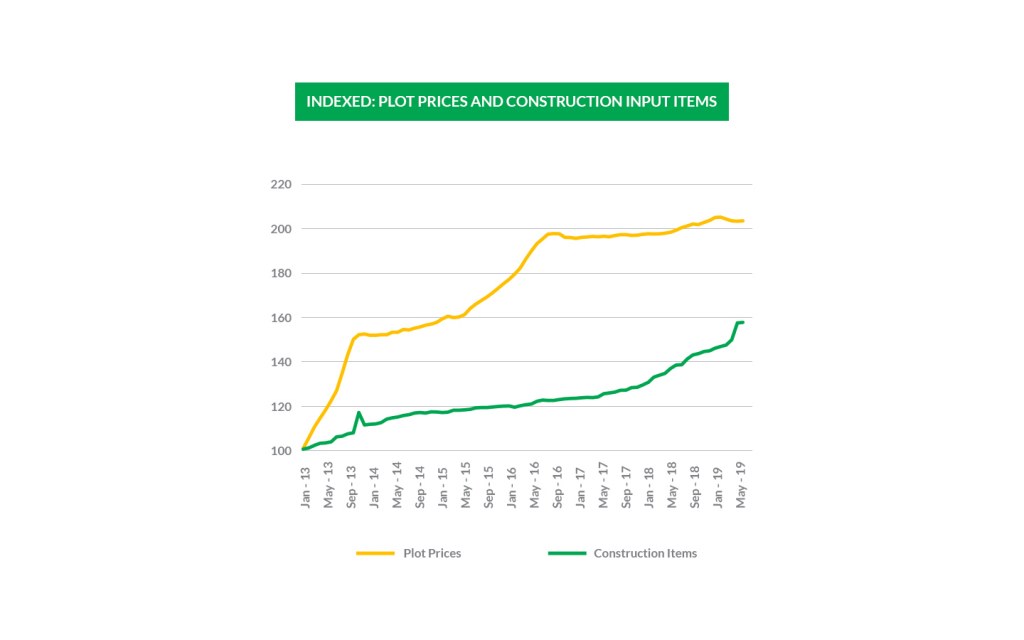

We can analyze the trajectory of prices over a longer span of time as well. The index for construction input items has grown by 57 percent from Jan-13 to Aug-19, against a CPI growth of only 46 percent. Evidently, prices for construction items tend to stay ahead of other commodities and overall inflation in the country.

Similarly, if we look at land plot prices (as compiled by Zameen.com), between Jan-13 and Aug-19, plot prices have risen by 102 percent which is close to double of the construction items inflation. In layman’s terms, this simply means, a house that cost Rs1 million in 2013 would potentially cost Rs1.84 million now, if we consider that land and construction costs have a 60:40 ratio. However, this might be an underestimation.

A recent paper by Tabadlab, a think tank based in Islamabad used the price indices between 2012 and 2018, and found that “a housing unit that cost Rs 6.6 million in 2018 would have cost around Rs 3.7 million in 2012”. The authors arrived at the 2012 costs by deflating the current construction costs using the price index of commodities including cement, steel and bricks. The authors also highlighted that “a massive 83% of the increase in cost of a housing unit was attributable to land. Land accounted for 57% of the housing cost in 2012 compared to 70% in 2018”.

Of course, all land was not created equal. The geographic location, zoning regulations, quality and access to infrastructure and public services all go into how any land is priced. Then there is also speculative interest.

Real estate is used as an investment instrument across the country. Land plot prices have skyrocketed because of the speculations of businesses, builders and individual investors alike. Since there is virtually no cost for holding a property, investors buy and sell land to earn a substantial return. Builders also conduct a cost-benefit analysis to determine if holding the land would be more profitable (by matching expected returns on investment) than spending on construction and building up the property.

This soaring land prices coupled with inflationary pressures that seem to impact the cost of construction and building materials disproportionately compared to other commodities, pose several integral questions. Can builders be expected to develop low-cost housing at market-based trade-able land and get their expected return? The answer is clearly no. Then how is the government choosing the land and at what price will it be sold for NPHP projects. Who bears the loss? If land is located on the outskirts, how will these new areas be inhabited, and who will take on the burden of developing and providing public infrastructure and basic amenities?

Less importantly, if a project is constructed even within a year, who will bear the rising cost of construction? The current announced subsidy by the government as well as the sales tax exemption—at this point—are a drop in the bucket.