Home » Construction » Naya Pakistan Housing and Construction Costs

In Pakistan, housing developers’ pleas for tax benefits or concessionary treatment in order to ensure low selling prices under the Naya Pakistan Housing Plan may have lent ears to the right government quarters. PM Imran Khan has announced that the government will not collect any sales and fixed taxes from construction activities, under the Naya Pakistan Housing Program (NPHP). Let’s see how significantly it impacts the ultimate selling prices of houses.

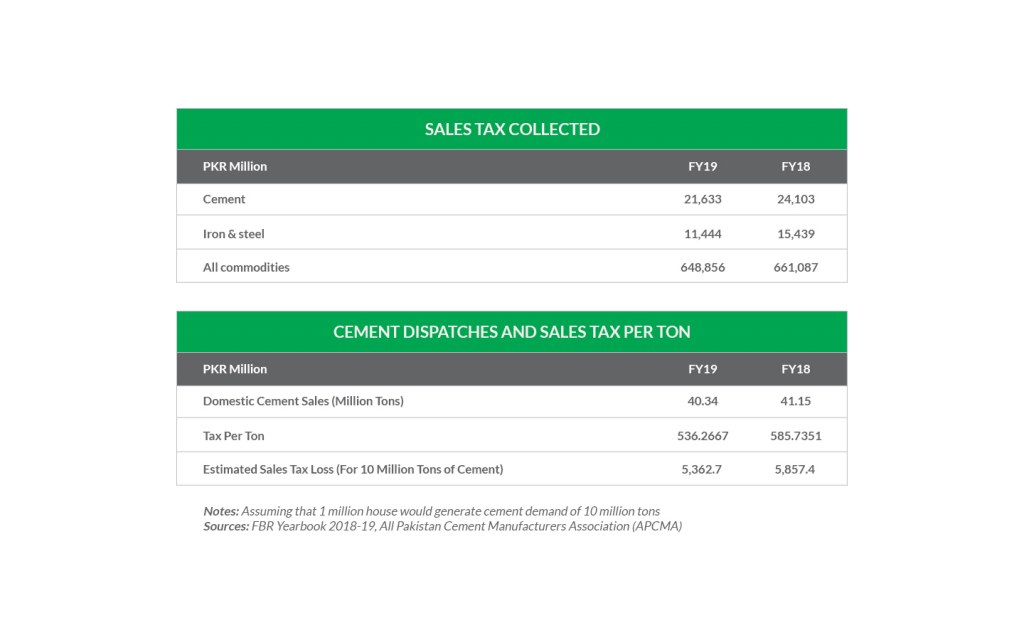

According to the Federal Board of Revenue’s (FBR) yearbook, sales tax collected from cement and steel industries alone made up 5 percent of total sales tax collected from commodities. In FY19, using the figures for total dispatches and total sales tax collected from the cement sector, tax collected per ton was calculated to be PKR 461. Based on a simple estimate made by Elixer Securities, 1 million houses (2.2 marla or approximately 600 sq ft.) could generate demand for 10 million tons of cement. At this rate, 5 million houses would generate demand for 50 million tons of cement.

Using these estimates and doing the calculations, it can be seen that the government would be losing over PKR 5 billion in annual sales tax revenues just from cement alone (In FY19, total sales tax revenue collected on cement by FBR was PKR 21.6 billion where total dispatches stood at 46.88 million tons). The total amount will be even higher if steel and other important building materials are added to the equation.

No doubt, the government would make up for this loss of revenue by levying higher taxes elsewhere. The question is, what difference would it make to the final cost of the houses?

Let’s Consider the impact of inflation on construction costs. The Consumer Price Index (CPI) grew by 12 percent between Aug-18 to Aug-19. According to the Pakistan Bureau of Statistics (PBS), the price index for construction items, however, grew by 14 percent during the same period. Similarly, from Aug-18 to Nov-19, CPI increased up to 15 percent, while construction item inflation rose up to 16 percent. If we use the total construction cost of PKR 4.5 trillion to build 5 million houses, quoted by the Naya Pakistan Housing Authority (NPHA) early last year, the construction item inflation should alone add PKS 630 billion to that number.

Moreover, with the increase in demand, cement, and steel, manufacturers are likely to raise prices further. The incremental cost of construction seems simply too high. The question is whether or not the developers will eventually be able to keep housing prices low, at a level where they are affordable for low-income households, given that the taxes are exempted. More importantly, how can affordability be enhanced in the current economic scenario? It is also important to gauge the affordability of pilot projects, announced under the Punjab Housing and Town Planning Agency (PHATA). Further details on this will be discussed in part II.