Home » Real Estate Trends » Price trends for residential plots in Islamabad – 2018

Over the last couple of years, investment activity in major cities has been relatively low. Several factors contributed to this, including the expected revision in Federal Board of Revenue (FBR)’s valuation tables. Yet, quite interestingly, a gradual rise in real estate values was recorded in Lahore, Karachi and Islamabad in 2018.

According to a report released by the State Bank of Pakistan, average prices of plots in Islamabad rose by 53% during the last five years. You might be interested in knowing how market rates for various plot sizes fluctuated in 2018.

This report gives you an exclusive insight into Islamabad’s property sector. The report is based on states available at Zameen Index.

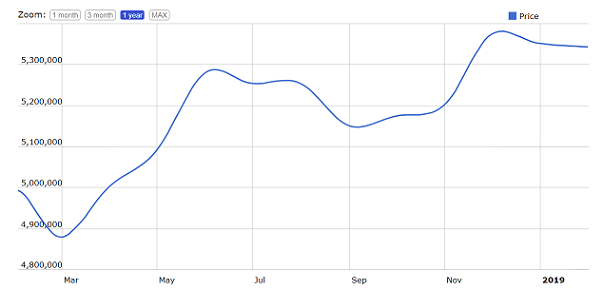

5-marla residential plots

Between January and December 2018, the average value of a 5-marla plot in Islamabad increased by 7.16%. In terms of rates, prices of this plot size rose from PKR 4.99 million to PKR 5.35 million between these months.

Looking at these trends for each quarter, we have learnt that rates largely remained stable in the first quarter (Q1). The price appreciation recorded in the second quarter (Q-2) was highest for the year. During these months, the average market rate of a 5-marla plot in Islamabad increased by 3.27%.

Contrary to Q2, market rates started to plunge in Q3 at a negative rate of 1.54%. Q4 reversed the negative trend a bit by increasing the rate of a 5-marla residential plot by 2.92%.

This is how the prices for this plot size appear on a graph:

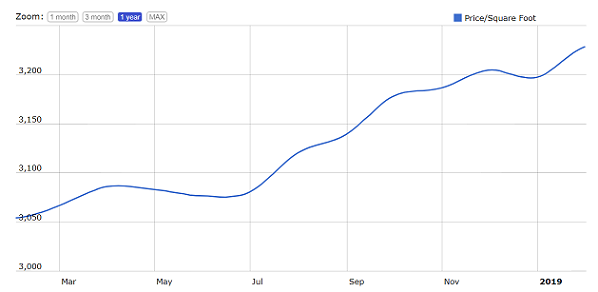

10-marla residential plots

Unlike their 5-marla counterparts, the 10-marla residential plots had a rather smooth 2018. For most part of the year, market rates for this plot size continued to increase, although only gradually.

During 2018, the average market value of a 10-marla plot increased by 4.68%. The price changed from PKR 6.87 million in January to PKR 7.19 million in December.

For this plot size, the quarterly variation in rates is rather subtle.

During Q1, the rate increased only marginally by 1.05%. In Q2, a negligible drop of 0.10% was noticed. On the other hand, Q3 brought along a price rise of 1.83%. The momentum, however, could not last in Q4 where prices inched up only by a fraction at 0.35%.

Here is the graph showing the price:

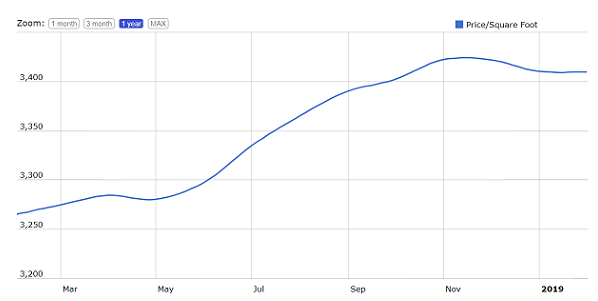

1-kanal residential plots

For this plot size, no major variations in rate were recorded during the year. The stable trends for this plot size are encouraging, because slow market activity usually leaves a negative impact on larger plots. And this was not the case here.

Between January and December 2018, the market price of a 1-kanal plot rose by 4.44%. In other words, the average market price rose from PKR 14.69 million to PKR 15.35 million during these months.

Looking at the quarterly performance, it is noticeable that price appreciation during Q1 was only marginal. Q2 and Q3 performed slightly better by bringing a rise of 1.65% and 1.10% respectively.

The trend, however, could not continue as the rate started to plunge once again in Q4. The drop was, nonetheless, only marginal at 0.35%.

Following graph gives you further clarity on price trends recorded for 1-kanal residential plots in Islamabad:

Where is the market headed now?

As per the figures recorded during January 2019, rates for all except 10-marla plots in Islamabad plunged. In addition, the rates per square foot of 10-marla plots were also the lowest among the above-mentioned options.

As many housing schemes offer smaller plots, 10-marla and smaller plots may still remain the popular option. It is advisable to consider and compare the per marla rates before picking your preferred plot size.