IN THIS POST:

– Quick Stats About Pakistan’s Economy

– Pakistan’s Position on the Economic Freedom Index 2019

– What an Increase in Economic Freedom Means for Pakistan?

– About the Index of Economic Freedom

– Global Scores of the Economic Freedom Index 2019

Washington-based Heritage Foundation conducts thorough research every year to rank 186 countries over 12 different categories to determine the economic freedom made available by various nations. As per the Economic Freedom Index 2019, Pakistan has risen 0.6 points in terms of economic freedom over the previous year, elevating its total score to 55 points. What does an increase in Pakistan’s economic freedom mean for investors, how does the index analyse data, and which factors is it based on? We’ll discuss all this and more below.

What do the Statistics Say on the Increase in Pakistan’s Economic Freedom?

Before we begin a detailed analysis of Pakistan’s rank on the Economic Freedom Index 2019, let’s overview some key facts about Pakistan.

Quick Facts About Pakistan’s Economy

| Population | 197.3 million |

| GDP | |

| Purchasing Power Parity (PPP) | $1.1 trillion |

| Growth | 5.3% |

| 5-year Compound Annual Growth | 4.3% |

| Per Capita Income | $5,358 |

| Unemployment | 4.0% |

| Inflation – Consumer Price Index (CPI) | 4.1% |

| Foreign Direct Investment (FDI) Inflow | $2.8 billion |

Pakistan Stands at 131 on the 2019 Index

Scoring an economic freedom score of 55.0, Pakistan is the 131st freest country in the world as per the 2019 Index. With an increase in Pakistan’s economic freedom by 0.6 points, it beats the country’s 2018’s score by a small margin but is a big leap from the 52.8 points scored in 2017, as can be seen in the graph below.

Based on Pakistan’s current score, the country is also ranked 32nd among 43 countries in the Asia-Pacific region, with most of its scores being well below the regional and world averages, as we’ll share below.

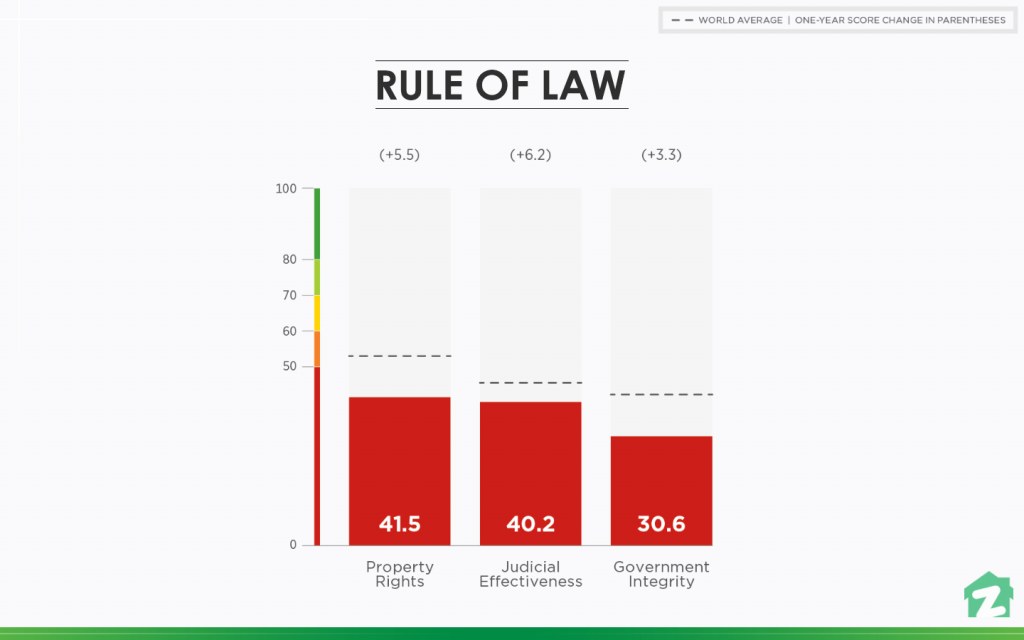

Pakistan’s Score as per Rule of Law

The Rule of Law is the first of the 4 criteria and focuses on Property Rights, Government Integrity, and Judicial Effectiveness, the scores of which you can see in the graph below.

This particular criterion takes the protection of property rights into account, observing whether clear laws are in place by the government and the judiciary to ensure private ownership of property and its protection. Lack of government laws, restricted freedom for private ownership, or corruption within the judiciary automatically rank a country lower in terms of points.

With regards to Pakistan, the scores indicate that the protection of property rights is weak, with the judiciary being subject to influences by high-ranking government officials. The legal system is also outdated and in dire need of a revamp. On the plus side, all three of these areas have gotten better scores than previous years, and this rise signifies that good times are on their way, and something positive is being done by the government and the legal system to ensure better security for private ownership.

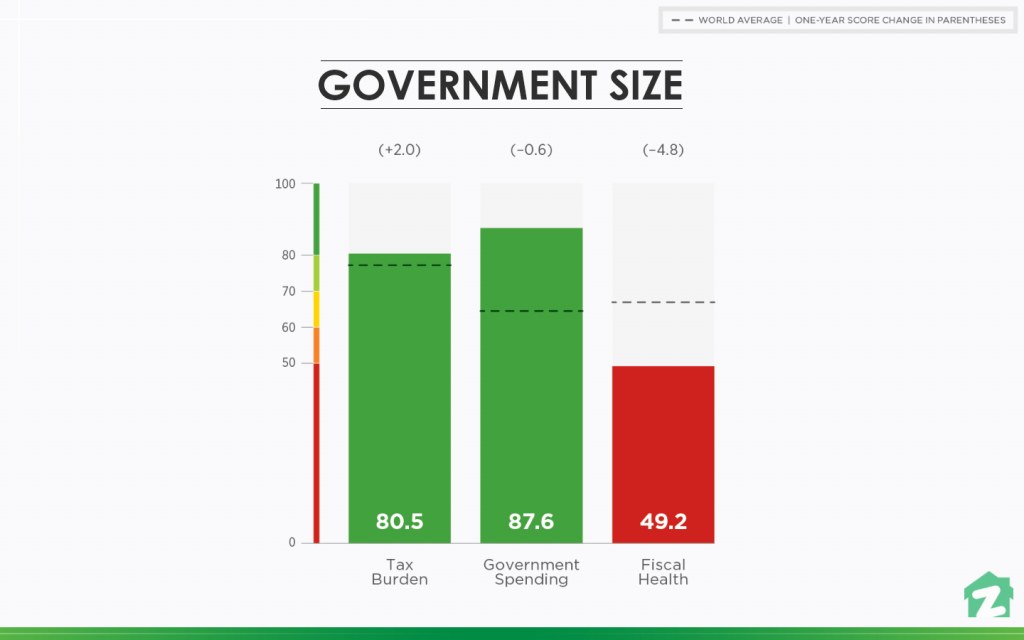

Pakistan’s Score as per Government Size

Government Size is the second criterion considered for a country’s rank on the Index of Economic Freedom, which includes the scores of Government Spending, Tax Burden, and Fiscal Health.

Primarily focusing on how much the government spends on its people, how many taxes are imposed on the people, and the overall fiscal health of the nation, this criteria is a difficult one to score. Generally, the more a government spends on its people, the better it should be, but if it has to take hefty loans to spend on the people, its overall fiscal health will suffer.

While the overall fiscal health of Pakistan is well below the world average, both the government spending and the tax burden are above the global average scores. The tax system of the country requires simplification, and reforms have been introduced to cut down the rates as well. Both the top personal income tax rate and the top corporate tax rate have a cut-off rate of 30%, while the overall tax burden on the economy equals 12.4% of the total domestic income.

Meanwhile, government spending has increased by up to 20.3% of the country’s Gross Domestic Product (GDP), and average budget deficits are 5.1% of the GDP. With regards to fiscal health, public debt has risen by an alarming 67.2% of the GDP, keeping the scores fairly low.

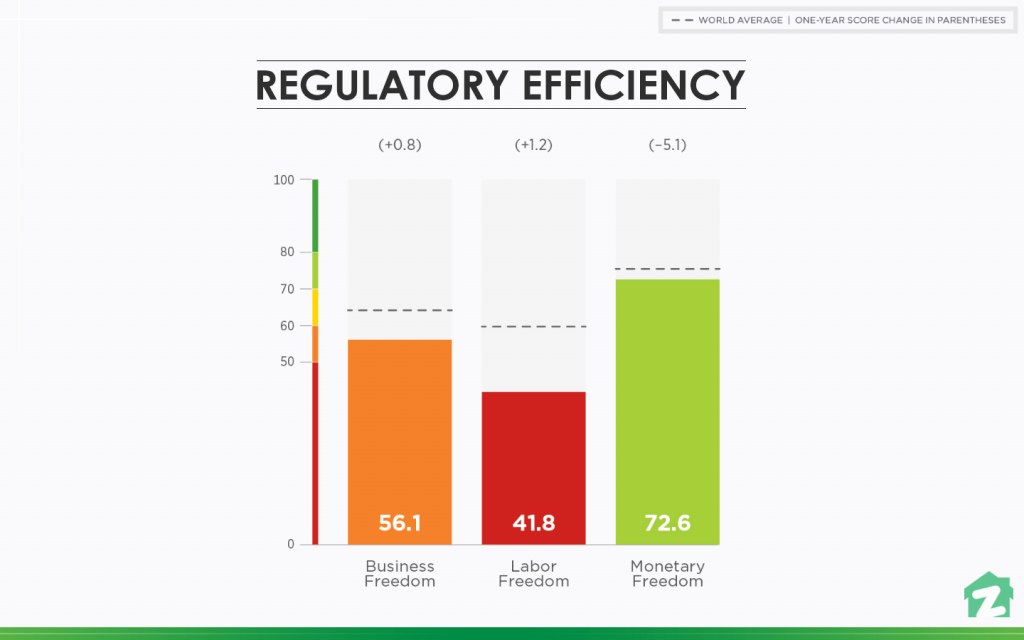

Pakistan’s Score as per Regulatory Efficiency

The criterion of Regulatory Efficiency considers Business Freedom, Labour Freedom, as well as Monetary Freedom as its major classifications, with Pakistan’s score in all three mentioned in the graph below.

First off, business freedom refers to the ease of doing business within a particular country based on the regulations set by the government. The difficulties associated with starting, operating, as well as closing a business are quantified based on specific formulae to get the required score.

Next up, labour freedom quantifies the regulatory and legal framework of a country’s labour market, where the major concerns are related to minimum wages, severance requirements, laws prohibiting layoffs, regulations related to hiring employees, and the number of work hours allowed per week.

The third sub-category here is of monetary freedom, where both a hike in prices due to inflation as well as a stabilisation of prices due to price control are considered as the key markers for monetary freedom.

Keeping Pakistan’s score in mind, there’s been a slight improvement in the ease of doing business in the country, but the cost of licensing a business is still a major hindrance for many entrepreneurs. Labour freedom, though, remains in the red, because a large section of the workforce is still unemployed. However, the Budget for the Fiscal Year 2018–2019 did improve monetary freedom, increasing subsidies for the construction industry and everyday goods, such as food, water, power, and textiles by around 36%.

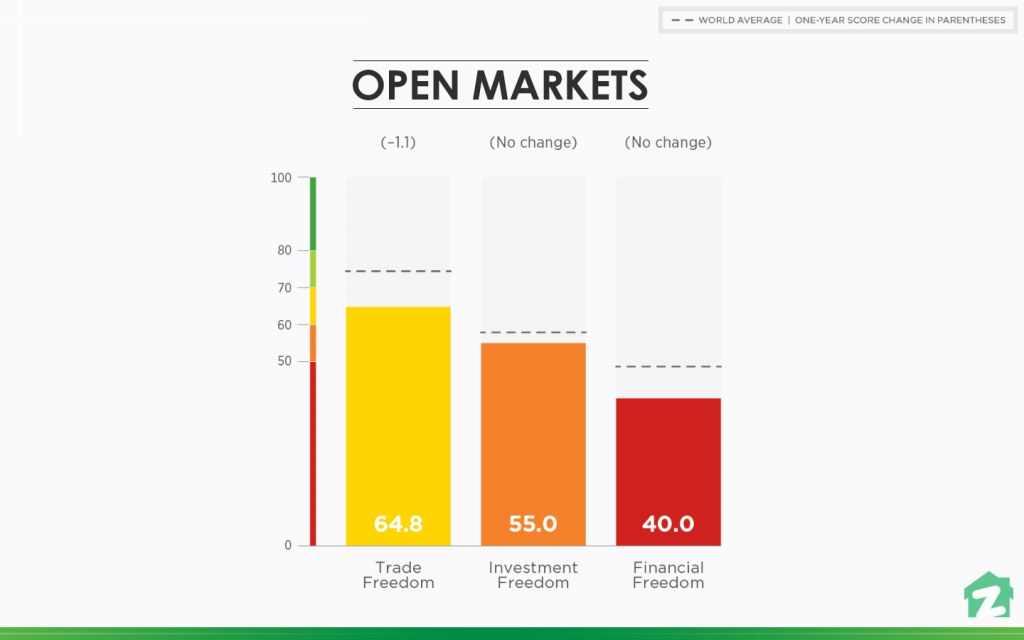

Pakistan’s Score as per Open Markets

The last criterion of Open Markets includes the quantification of Trade Freedom, Investment Freedom, and Financial Freedom.

The Index of Economic Freedom considers trade in the open markets based on tariffs imposed on imports as well as other non-tariff measures imposed by the government to restrict import and export of certain goods.

In terms of investment freedom, a genuinely economically free country would have no regulations binding the flow of capital in and out of the country and into different investments. Still, in practice, most countries do impose a set of restrictions in this regard. These restrictions are considered in this sub-category, with fewer points being awarded to a country that imposes more restrictions.

Lastly, financial freedom measures the efficiency of the banking sector along with the amount of independence it is given by the government. The lack of interference from the financial sector of the government is also considered positively here.

With respect to Pakistan, 25.8% of the GDP is made up of a combination of both imports and exports, with an average tariff rate of 10.1% being applied. In addition to that, as of July 2018, the World Trade Organisation (WTO) states that Pakistan has nearly 66 non-tariff measures in place that hinder import and export activities. The state is also excessively involved in the banking and financial sector, hindering not just financial freedom but also adding restrictions to foreign investments. There’s also a large portion of the population that keeps its distance from the banking sector, with only 25% of the adult population having access to a bank account with a formal banking institution.

Overview of Pakistan’s Economic Freedom Index 2019

The data compiled above shows that economic freedom has advanced in Pakistan in recent years, but low levels of foreign investment and less-than-ideal government policies have resulted in erratic growth patterns and an underdeveloped economy. Excessive regulations, the involvement of the state, and the difficult process of getting bank credit also hinder private businesses from playing a more active part in the economy.

This is all fairly in line with what Mr. Muhammad Hammad Azhar had to say about the state of Pakistan’s economy when he sat with us on Zameen Interviews. He also emphasised that the current government was working hard to get out of the way to the financial sector and the private investors so that more money could be invested into local projects with the least amount of restrictions.

About the Index of Economic Freedom

The Index of Economic Freedom has been analysing data and giving clear, tailored, and detailed accounts of the economic freedom enjoyed by citizens of different countries for over 25 years. The Index focuses on every individual’s right to his property and labour and the freedom to use them as they please. In an economically free society, individuals are free to work, consume, produce, and invest without facing any constraints or coercion from governments or law and order situations, giving them complete liberty.

The Heritage Foundation is Washington’s top research institute and the brains behind this detailed global analysis. The purpose behind the analysis is to bring better awareness to the masses, where, in spite of the prosperity in today’s time, the world is rife with poverty, sickness, ignorance, and deprivation. The Index of Economic Freedom covers four key criteria: the rule of law, government size, regulatory efficiency, and access to an open market, with each criteria having three sub-categories. Each of the 12 sub-categories is then evaluated on a scale of 0 to 100 points, with a country’s overall score being derived from the average of the 12 individual scores.

Overview of the Economic Freedom Index 2019

Since the Index ranks countries on a global scale, the following 6 countries are categorised as being Completely Free (scoring between 80 to 100 points) in terms of economic freedom:

| Country | Overall Score |

| Hong Kong | 90.2 |

| Singapore | 89.4 |

| New Zealand | 84.4 |

| Switzerland | 81.9 |

| Australia | 80.9 |

| Ireland | 80.5 |

These top six nations are followed by the UK, Canada, the UAE, the US, Malaysia, Qatar, and Japan, along with several other European nations—all of which fall into the Mostly Free (scoring between 70 to 79.9 points) category. The next category is that of the Moderately Free (scoring between 60 to 69.9 points), where many Middle Eastern, Asian, and European nations are joined by several of the small island nations of the Caribbean.

The Index then moves on to its Mostly Unfree (scoring between 50 to 59.9 points) category, which includes Pakistan, along with several Central Asian, South Asian, and African countries. A number of African and South American countries, such as Zimbabwe, Ecuador, Venezuela, and Mozambique, then fall into the Repressed (scoring between 40 to 49.9 points) category, along with North Korea. There are also six nations which have not been ranked, including Iraq, Libya, Liechtenstein, Somalia, Syria, and Yemen.

Keeping the increase in Pakistan’s economic freedom in mind, we can conclude that investors will find it easier to invest in the country with time, the proof of which will be Pakistan’s score improving with every passing year. Stay with us on Zameen Blog as we cover the top news stories and updates related to Pakistan. You can reach us on blog@zameen.com for any queries or suggestions.