Home » Laws & Taxes » Housing finance providers: Too little, but not too late

Jointly owned by the government of Pakistan and the State Bank of Pakistan (90% and 9.69% ownership respectively), the House Building Finance Company (HBFC) is the only specialized housing finance company in Pakistan. The HBFC has been providing mortgages to borrowers across the country since 2007.

However, it is only recently that the company’s role has been revived as the incoming government flexes its muscles to launch the mammoth Naya Pakistan Housing Program (NPHP). The program, aimed at bridging the existing housing gap by 5 million houses during the PTI tenure, is a tall order. Therefore, housing finance is crucial for accomplishing it. This prompts one to wonder where the housing finance providers are.

The HBFC’s mandate has always been to provide financing for the housing needs of lower- and middle-income home buyers. Of some 60,000 current mortgage borrowers, 42 percent are in the HBFC portfolio, making it the largest player in the mortgage market. In fact, the company has maintained this share over the years.

In total loan amount—the latest numbers published by the SBP do not show a bifurcation by banks—the HBFC has over 20 percent of the share (2016). Though, interestingly, if HBFC was considered to be a category in itself, it contributed less to housing finance than Islamic banks that had about 39 percent share in gross loan amount in 2016.

Though HBFC’s contribution seems big, the share of housing finance as a proportion of total development finance, in fact is very small. Though latest numbers are not available, in Jun-16, housing finance accounted for only 4.6 percent of total development finance (FY11: 5.9%)—which typically includes finance to SMEs and agriculture sector as well as infrastructure finance, microfinance and SBP’s refinance facilities alongside housing finance. Interestingly, housing finance holds the lowest share in total.

Globally, when the financial system fails to provide housing finance, specialized housing finance companies intervene to fill the gap. Research also shows that even where lending for housing occurs, there is a general disinclination of institutions to lend to middle and low-income households.

Institutional housing finance is usually low and leans toward higher income groups when the prevailing demand is overwhelmingly and disproportionately skewed toward low income groups. This creates the need for specialized institutes that can provide affordable financing for the income groups that remain unaddressed.

In India, there are over 70 housing finance companies, regulated by the National Housing Bank which was created entirely for the purpose of enabling and regulating the sector in 1988. Housing finance companies have a share of 40 percent in total loans disbursed for mortgage lending, even though scheduled commercial banks are still leading the game. But the country now also has a new category of housing finance companies called Affordable housing finance companies (AHFCs) which cater to specific target segments for housing finance.

The progress in developing a vibrant mortgage market in Pakistan has been dull. HBFC has historically dealt with a lack of institutional capacity. Over the years, default rates have also remained persistently high. The company is also government owned and there is a clear conflict of interest—given that the regulator, the Central Bank, also has holdings in the company. These issues will have to be tackled.

However, three developments have taken place over the last year or so which point toward a more hopeful future in the area of housing finance. One, HBFC is getting long-term refinancing alongside other financial institutions from the Pakistan Mortgage Refinance Company (PMRC). The PMRC has attained a $140million credit line from the World Bank to inject liquidity in the housing market, of which half has been earmarked for low cost housing.

With this refinancing, HBFC, being a beneficiary will be able to extend mortgages to meet the expected demand coming from NPHP projects. Though the existing refinancing will cover only a small share in the total incremental demand in housing, if all goes well, the World Bank may extend the credit line.

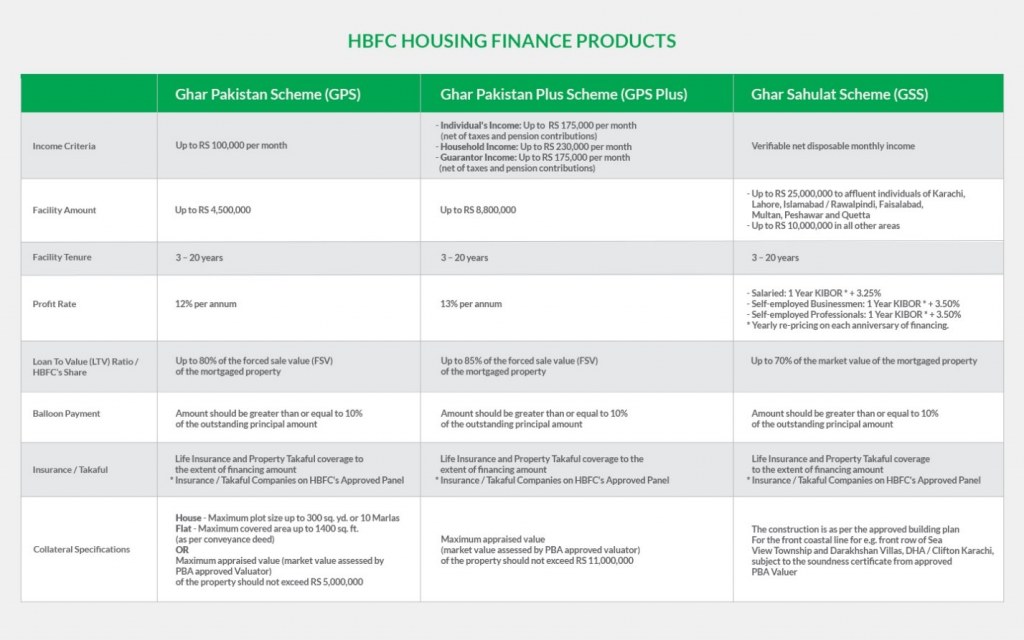

Two, HBFC has introduced several products to expand its portfolio. Its Ghar Pakistan Scheme is issued at a fixed rate mortgage (FRM) of 12 percent which is the first FRM offered in Pakistan. Given the high volatility of interest rates, this product is extremely attractive for Pakistani home-buyers. This will also lower the risk of default for HBFC which has been observed to rise when interest rates go up.

Three and most importantly, following its low-cost housing policy of Mar-19, the SBP is allowing investments into specialized Development Finance Institutes (DFIs) targeting housing finance. The SBP has relaxed the capital requirement, and believes that lower regulatory burden will encourage new investors to come in.

According to the policy: “Banks may establish their subsidiaries or new investors may be allowed to setup these DFIs with reduced paid-up capital of Rs 3 billion (instead of Rs6 billion for normal DFI) and lesser regulatory burden. Banks’ subsidiaries setup under DFI mode would be able to take benefit from the branch network and systems of parent bank with necessary firewalls”.

This could attract the private sector given the right regulatory structure in place. The SBP will have to decide who will be regulating these housing finance companies (HFCs) and safeguard itself from any future conflict of interests.

Meanwhile, though the HBFCs recent products are encouraging, they need to be backed by an excellent underwriting and credit assessment department, a robust risk mitigating strategy and a sales and marketing team which together would ensure the right borrowers are walking in the door and willful defaults are minimized. Government’s promises to implement foreclosure laws also need to be kept.