Home » Laws & Taxes » Here’s how you can avail the Tax Amnesty Scheme 2018

The Tax Amnesty Scheme 2018 was announced by the former Prime Minister Shahid Khaqan Abbasi on 5th April 2018. The amnesty scheme and the following budget are comprehensive efforts by the state and former government to formalise the economy and, more urgently, shore up Pakistan’s foreign currency reserves.

The situation was slightly ambiguous previously. The Supreme Court had yet to give a ruling on the scheme, so a lot of people were cautiously holding back to see how the situation unfolds. Now that the Supreme Court has given the green signal to the amnesty scheme, people have begun availing it in large numbers and the scheme seems geared for success.

There’s still a week to go before the period of Tax Amnesty 2018 ends on June 30, 2018. There have been calls for extension of the amnesty scheme period, but whether or not that happens, there is still ample time for you to avail the scheme. This is what the blog is about. It takes you through the entire process of registering for and availing the Tax Amnesty Scheme 2018.

1. Register on FBR Iris system.

There are two ways you can do this: you can register exclusively for the amnesty scheme, as shown below, or you can register normally on Iris. It is recommended to simply do the latter since you cannot file your taxes if you register only for amnesty scheme. To do that, you can check our post on how to register online to file your income tax returns as it takes you through the entire process of registration on Iris.

Note that if you are already registered on Iris, you don’t need to register again. If you are looking to simply register for the Tax Amnesty Scheme 2018, you can follow the steps below. The process is almost the same as normal registration:

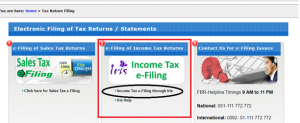

i. Visit FBR website and click “File Returns”, as shown in the image below.

ii. From there, you can go to Iris:

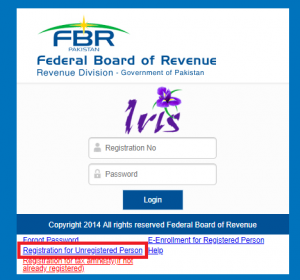

iii. Next, you will have to click “Registration for tax amnesty(if not already registered)”, as outlined in the image below:

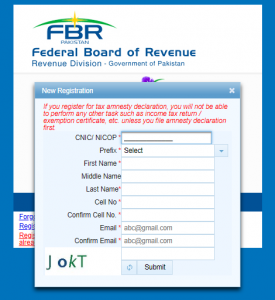

iv. This will open a dialog box that you will have to fill:

v. Once you fill out the details, and click “Submit,” you will receive a text containing your login details, on both your email and mobile phone (if the number is Pakistani). You will be able to use those to log into the Iris system.

2. Calculate your taxes

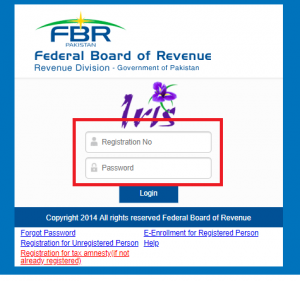

Once you have registered, you will be able to log into Iris, as outlined in the image below:

Calculating taxes on foreign assets:

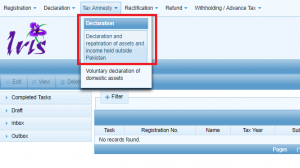

i. When you log in, you will directed to the page as shown below. If you are looking to declare your foreign assets, you will need to click the “Declaration and repatriation of assets and income held outside Pakistan” as encircled below:

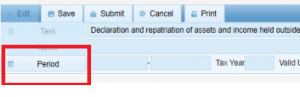

ii. You will be directed to the page, as shown below. Once there, you will have to add the tax “Period” first, as outlined:

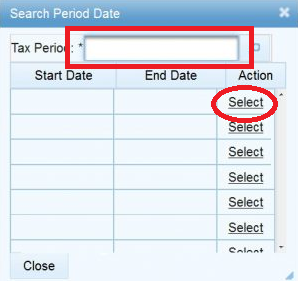

iii. The following dialog box will open. You will have to input “2018” in the “Tax Period” and click the search icon. “Select” the relevant period, as shown in image below:

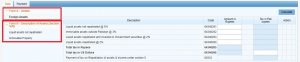

iv. As a result, you will be directed to the page shown below, where you can input the details of the foreign assets that you want to declare. Clicking on “Foreign Assets”, “Liquid assets not repatriated” and “Immovable Property” will open screens where you can input the details of your property. You just have to input amounts in the field where editing is enabled. In places where you may have to input additional details about the amounts, you will see the “+” sign and you can click it to add the details.

Once you have added all the details, you will need to “Calculate”.

v. You will find out the amount you have to pay in taxes on these foreign assets.

Calculating taxes on domestic assets

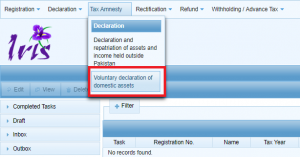

i. The process for this is not much different. You will have to select “Voluntary declaration of domestic assets”, as shown in the image below:

ii. You will have to select period, as explained in points ii and iii of the previous section on foreign assets.

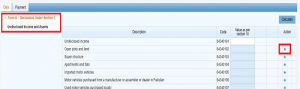

iii. Once the period has been added, you will be directed to the page shown below. There you can add details of your domestic assets, and where needed, you can add further details about your property by clicking the “+” sign.

iv. When you “Calculate”, you will be able to find the amounts you need to pay under the domestic assets as well.

3. PSID generation

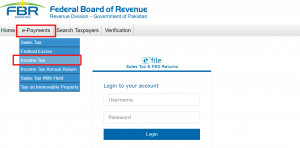

i. To make payments under either of the above options, you will have to visit the FBR portal . That’s where you will be able to generate Payment Slip ID (PSID).

ii. Click on “e-Payments” and then click “Income Tax” tab within it, as outlined in the image below.

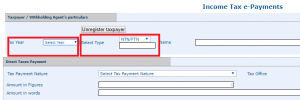

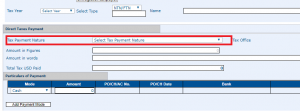

iii. You will be taken to the following page, where you will select the “Tax Year” (2018) and change the “Select Type” (outlined in the image) to “CNIC”. Finally, you will have to write your CNIC number in the section right below it, with dashes. The system will fill out the remaining details for you.

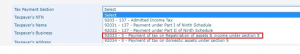

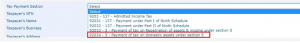

iv. In the “Direct Taxes Payment” section below, you will have to “Select Tax Payment Nature”. For amnesty scheme, choose “Admitted Income Tax.”

v. To pay taxes on foreign assets, further select “92033-5- Payment of tax on Repatriation of assets & income under Section 5”.

vi. For taxes on declared domestic assets, select “92034-5- Payment of tax on domestic assets under Section 5”.

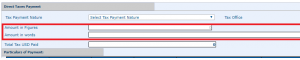

vii. Add amount.

viii, Add payment method, enter the amount in the proper section again, enter your mobile number and email, and click “Create”.

ix. You will be directed to the following screen. There, you can note down the PSID number or print out the PSID.

4. Payment under Tax Amnesty 2018

Foreign Assets

i. Finally, on the payment part, to pay taxes on the foreign assets, you will have to remit the taxes due, in USD, to the following SBP account:

Name of Payee: State Bank of Pakistan

Payee’s Address: I.I. Chundrigar Road, Karachi, Pakistan

Payee’s SWIFT Code: SBPPPKKA

Bank Name: National Bank of Pakistan

Bank Address: New York, USA.

Payee’s Account Number: 55854560

Bank SWIFT Code: NBPAUS33

When you have paid the taxes to the SBP account, you will have to email the copy of wire transfer and other details, including your CNIC/NTN number and signed copies of your PSID to SBP email address: tax.foreignasset@sbp.org.pk

SBP will send you back the scanned copy of Computerised Payment Receipt (CPR).

ii. To repatriate liquid foreign assets so they could be credited into your PKR account and/or invested into Federal Government bonds, you will have to remit your liquid assets to the account mentioned above. You will also have to email the same details as above. Other things you will have to send will include:

a. An application with signed statement to have the liquid assets invested in Government bonds and the amount to be credited to PKR account of tax payer.

b. A copy of your CNIC

c. Complete details of your PKR bank account where you will be credited with the liquid assets and be sent the profits on your investment. These include bank and branch name, account title, and IBAN of your PKR bank account.

d. You will receive confirmation from SBP that your assets have been invested.

Domestic Assets

i. For payment of taxes on domestic assets, you can make the payment online through your bank account, billing it to the FBR, using your PSID Number.

ii. Or you can visit an ATM and follow the same procedure as paying a bill to the FBR, again with the help of your PSID number. These are new services launched by FBR to facilitate payment of taxes for the taxpayers.

iii. A Computerised Payment Receipt (CPR) will be sent to your email, and you will also receive a confirmation SMS. CPR will also be available on your Iris account for any future use.

iv. An alternative is to visit your nearest State Bank of Pakistan (SBP) or National Bank of Pakistan (NBP) with your CNIC and the printout of PSID. Consequently, you will get a stamped copy of your CPR from the cashier at the bank.

5. Submission of Amnesty Declaration Form

i. This is the final step in the process. You will have to log into FBR Iris, and then on the screen that appears, click “Draft”, as indicated below:

ii. Consequently, you will see two drafts in the tax section (if you are availing both domestic and foreign assets side of the scheme). When you click either of them, you will be able to “Edit” them, by pressing the tab indicated in the image above.

iii. You will be led to the following screens, depending on whether it is a foreign or domestic asset.

In case of domestic assets

In case of foreign assets

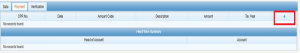

iv. In both cases, you will have to click “Payment” tab. This will lead you to the following page, where, you will need to click the “+” button on the extreme right, as indicated in the image below.

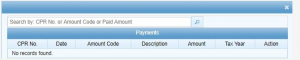

v. You will be led to the following screen, where you can add your CPR number and search for it:

vi. When the CPR has been added, you will to click the “Verification” tab as indicated below:

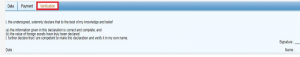

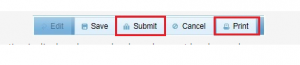

vii. You will have to read the declaration and enter your PIN (sent to you when you make IRIS account) and then, finally, click “Submit”, as shown in the image below:

viii. Once you submit declaration, it cannot be changed and will become read-only.

ix. You can print that declaration by clicking the “Print” button shared above.

That’s it, folks! If you have followed all the steps from the top, you assets have been legalised. If you have any questions about, you can ask away in the comments section below. You can also head to the Zameen Forum for a detailed conversation.

Comments are closed.

Dear Mr.Farhad,

I have a personal use house for living worth exceeding worth of 4 million.

would i have to pay tax and at what percentage???

thanks and regard,

Rizwan

You will have to pay nominal, small amount of Property Tax annually, as usual. But no new taxes have been imposed on property already owned and in use. You have to become a filer only to buy new property.

Thanks,

Right now Im a non-filler, so i have to pay how much percentage of house value??

The blog below will help you determine how much tax you may have to pay annually, it depends on the location. You can contact Excise and Taxation office to know which category your house falls in. That will help you determine the property tax you pay.

https://www.zameen.com/blog/understanding-property-tax-rates-in-pakistan.html

Hi,

I am an oversees Pakistani and have a plot in Islamabad which I bought through my hard earned money transferred through the banking channel. However I am not a filer. When I bought the plot, I paid a lot of tax (non-filer tax amount). If I become filer and declare my plot, will any tax be applicable on me?

No new tax will be imposed on your plot. You will have to pay the normal, nominal Property Tax which you are likely already paying.

Thanks for the response

Dear Sir,

I got the NTN in 2005 based on ——Associates on my name because I was doing some consultancy works (part time) and started to file the returns annually. After three years I left the country and I am still working in Gulf. Till today I am filing returns as “Nil” annually. I am maintaining one account in Pakistan and one residential plot, Both are never mentioned in return. Please advise me.

I suggest you contact your lawyer to discuss your options! As it, it does not seem as if you need to avail the scheme but I would strongly suggest you discuss it with a lawyer or an accountant.

Dear Mr Farhad

Assalamoalaikom

Hope you are doing well. Thanks for the valuable info

I have a one Kanal plot in Bahria Rawalpindi on which i am starting building my house. Will i need to pay anything for that in tax? i actually paid around 275K tax when i bought this plot in 2016

Also i have 2 plot files in islamabad for which i paid around 60% of the price. I got these plot files in 3/2018. One of the plots more than 40 Million. Will i need to pay anything for that . will there be a problem when the plot will be actually transfered to my name?

Also can you help me to know if i need to pay any tax returns as overseas pakistani ? and if i have to be how to be a filer?

Thanks in anticipation for ur time

Regards

W.salam Ahmad sab,

1. You don’t need to pay any new tax on your Bahria Town plot.

2. This will need to be confirmed by the authorities or a lawyer, depending on your unique circumstances. On the face of it, it seems that you will have to pay taxes when it is actually transferred to your name. For now it is not in your name. This may need you to be a filer and/or pay taxes. However, I would suggest you confirm it with the authorities. You can contact FBR helpline, I have always found them very helpful.

3. You will need to file returns, even if they are zero and you have no source of income in Pakistan.

4. You have to be filer if you want to buy property valuing greater than PKR 5 million (this was changed from 4 to 5 million when budget was actually passed) or new cars in Pakistan.

I hope these help. If I can assist you in any other way, do tell me!

I live in Saudi Arabia and recently I have been inform by bank that I have to file zero tax return in order to buy property in Pakistan. I have registered myself in FBR but which form I should select and how to show zero tax? Can you explain the process for overseas Pakistanis?

It is a detailed process, you will have to submit your wealth statement and income tax returns, perhaps see if you can find these two forms. But if you can’t, you will find useful information on that on FBR’s website. I suggest you go through that!

You can also contact FBR’s helpline for quick help. I have always found them very helpful!

Dear Farhad,

I am living in Dubai and own house and plot in Lahore for that i am already paying the annual property tax. Do i need to pay any additional tax and what need to do further to buy a property in Pakistan

Regards,

Affan

You will need to be a filer of income tax returns if you are looking to buy property valuing greater than PKR 5 million. You will not have to pay any additional taxes just because you become a filer, however.

I have agriculture land about 12 kanal ,can i pay Tex on it kindly guide me, I am employ and already tax payer on my salary.

Regards,

Abdul Rauf Khan

I suggest you discuss the matter with your lawyer, about whether any of your property is taxable.

I* am doing business in Pakistan and submitting my annual return regularly since 2006. In 2015 I also formed a co in Dubai and opened account in free zoon with AED 25000/ remitted from my $ account in Pakistan. I am still doing business there. Should I declare Dubai business in my annual return in Pakistan as there is no Income Tax in Dubai as such. or should i go for Amnesty for the accounts in Dubai. There is no Fixed Assets in Dubai except business accounts.

Pl guide me for line of action. your early response shall be appreciated.

Regards

Sir, I feel this is something you discuss in detail with your lawyer or accountant who will be better able to guide you on how you should proceed depending on your unique circumstances. If, however, you decide to apply for amnesty (if it is applicable on you), I will be here to guide you through that possible, if you have any questions about that!

Who would you suggest as a Tax Accountant who can file on my behalf if I provide him/her with relevant documents. Is there any based in Islamabad or Rawalpindi who would provide tax filing services. If you know anybody that would be a great help.Thanks.

I am sorry, sir, I don’t think I could help you with that. If, however, you have any questions on the process itself, I am here to help 🙂

For PSID creation, you are suggesting to select Tax Year as “2018” – whereas the FBR guideline (See Link http://help.fbr.gov.pk/?p=2516) suggests “2019”. Since the tax year on Domestic Assets Declaration form is also “2018” I think Tax Year on PSID should also be “2018”??

Also, please guide on FBR valuations of properties in Karachi. How are they calculating the prices of DHA City Karachi and Bahria Town Karachi?

Hi

I am a Active Tax Filer. Today i have got following email, I am not sure is that a general notification sent to every tax payer or specific to me. I have filed my tax returns every year.

Dear Taxpayer

AoA,

The last date for availing Tax Amnesty Scheme is,

*July 31st, 2018. *

Kindly note that this date shall not be extended any further.

Avail this opportunity to avoid any proceedings or penal action on the basis of information available with the FBR.

FBR GOP

Yes, it was a general message sent to all taxpayers. Nothing to worry about.

Dear sir, today got msg on cell phone from FBR GOP as stated here but being non-filer how I became filer or tax payer when? that I received this msg as well from FBR.

secondly, I have 1 house got balloted in Faziaia PAF Karachi which installment not yet completed (means still on-going until 2022), shall I have to file return under this amnesty scheme? although I made very hard earned money only this property under my name only?

Thanks, Fazal