Home » Real Estate Trends » Gwadar Free Zone – Investment Guide For Foreign Investors

Update (October 9,2019): Gwadar Port has officially been opened for transit trade and the first ship in this regard will arrive soon. As per a news report published in an English daily, “The officials acknowledged that Gwadar Port’s main competitors would be Singapore and Dubai ports, since incentives such as no cargo demurrage charges and three months storage facility would surely divert business to Gwadar. The sub-committee also discussed the storage facilities for fish processing within or outside the port, the committee was assured that additional taxes would not be imposed on the Chinese companies to establishing such facilities and investments in this regard.”

__________________________________________________________________________________________________________________________

Pakistan has declared its beautiful, deep seaport – Gwadar – to be a tax-free zone. Following the model of Shekou Industrial Zone, which is part of Shenzhen city in China, Gwadar is all set to uplift Pakistan’s economy. Gwadar Free Zone will include a port, industrial park, residential and business areas. The total area of the free zone comprises 923 hectares of land. It is expected that the development work will be completed in three phases. The China Overseas Port Holding Company (COPHC) has been investing in the project and so far $250 million have been granted for the development and construction of the free zone.

How businesses can benefit from Gwadar Free Zone

Gwadar sea port is at the joining point of the Silk Road Economic Belt connected through China Pakistan Economic Corridor. Gwadar is situated at the mouth of Persian Gulf, just outside the Strait of Hormuz, the key oil route in and out of Persian Gulf. Gwadar has a great investment potential. Because of its deep seaport, Gwadar free zone will be a major player in regional trade because of its proximity to key shipping routes.

China Overseas Ports Holding Company (COPHC) Pakistan is an emerging company in Hong Kong. Under CPEC it has set up its regional office in Pakistan. COPHC has taken over the commands of Gwadar Free Zone on May 16, 2013, for 40 years according to the agreement. The company’s objective is to develop Gwadar’s port into a trade hub.

The COPHC has built a 25 acre modern industrial park which has all the latest facilities like water pipes, roads, communications, electricity, security fence and waste disposal facilities.

The goal of the Gwadar port free zone is to encourage the presence of global markets by attracting foreign investments and new businesses in services, general trade, logistics, manufacturing and trans-shipment business. Gwadar Free Zone will be designed keeping in view the unique needs of trading, manufacturing and service industry businesses in mind. As per information available on CPEC’s website, until now more than 30 Chinese and Pakistani businesses have moved in with around three billion yuan of direct investment in the free zone. From banking, hotel, insurance, logistics, financial leasing, oil processing, warehousing, aquatic products to home appliances, Gwadar free zone will have it all.

According to the China Overseas Ports Holding Company Gwadar website, following is the list of businesses that can be set up in Gwadar Free Zone.

- Bonded Warehousing

- Container yards

- Ambient/Temperature controlled/Refrigerated storage facilities

- International Purchasing, Transit & Distribution

- Packaging / Labeling

- Stuffing & De-Stuffing

- Trans-shipment

- Light end-assembly

- Imports & exports

- Value added exports

- Value addition to imports – Supporting Services Business Offices (Onsite Customs, Financial Institutions, Information Centre, Retail Outlets, Hotels, Restaurants, Entertainment amenities, Medical facilities etc.

- Other related businesses

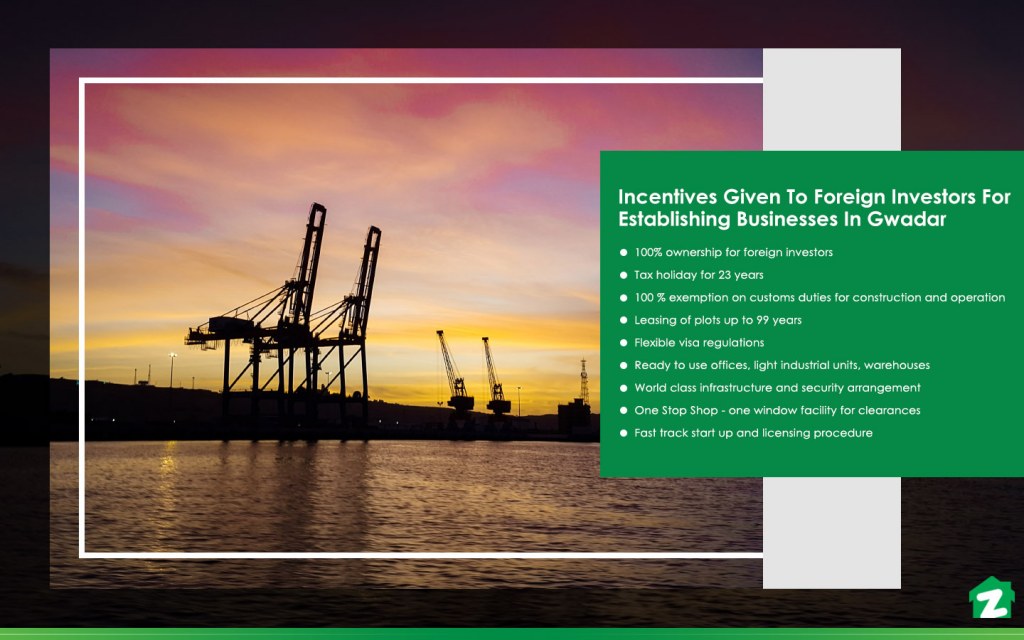

Incentives given to foreign investors in Gwadar free zone

The following incentives will be given to those who want to invest in Gwadar Zone.

- 100 % ownership for foreign investors

- Tax holiday for 23 years

- 100 % exemption on customs duties for construction and operation

- Leasing of plots up to 99 years

- Flexible visa regulations

- Ready to use offices, light industrial units, warehouses

- World-class infrastructure and security arrangement

- One-stop shop, one-window facility for clearances

- Fast track start up and licensing procedure

These benefits will encourage more businesses to set up and more foreign investment in the area. For your convenience, we are also sharing with you the set of basic requirements and also details about what documents are required as given on COPHC website.

Basic requirements

- Allows for single or multiple shareholders. A shareholder can be an individual (person) and/or non-individuals (company)

- New Company is essentially a limited liability company within the free zone

- The initial capital required for registration. The minimum requirement is US$500,000

- One-time registration fee of US$3000 is required for New Company

Documents required to set up a business in Gwadar free zone

- Memorandum and Article of Association of the Company

- Board Resolution of the shareholders calling for the establishment of a new company to carry out business activity in the Free Zone.

- Board Resolution for the appointment of the following with the power of attorney to act on behalf of the company. a) Manager b) Legal representative

- Passport copies of the directors, shareholders, manager and legal representative with two photographs.

- A business plan

Registration procedure for a new company in Gwadar free zone

The registration procedure is quite simple for an investor and involves the following steps as given on COPHC’s website.

- Submission of required documents to Gwadar Free Zone Company (GFZC)

- Payments of processing fees

- Opening of bank account in the zone and deposit of minimum capital in the account. Submission of bank statement along with the duly filled prescribed Application Form to the FZC

- The management of the FZC shall take 10 working days to scrutinize the documents and intimate the investors about the acceptance of the application. The investors shall make the payments of the following payable: a) Registration fee (one time cost) b) License fee (annual) c) Land lease/ R=rentals for pre-built offices / pre-built Warehouses/pre-built factory (Annual)

- The registration certificate, license and lease deed shall be issued in favor of the Company

- The investor shall apply the Customer Services Department (GFZC) visas for the staff. The Immigration Department shall issue the entry visas

- The investor or the employee after entry to Pakistan shall go for a medical checkup before the stamping of residence visa on his /her passport

In order to apply for the license of Gwadar Free Zone, you need to submit the following documents to get the license.

Documents required for applying for license for Gwadar Free Zone Company

The investors who want to set up a business in GFZ should submit the following documents to get a license.

- Feasibility study/business plan for the industrial/business undertaking

- Colored photograph of partners

- Copies of passports

- Bank statement of US$ 500,000 in the company account in any bank in the Free Zone

- Partnership Agreement or the following documents in case of private limited companies: a) Certificate of Incorporation b) Memorandum / Article of Association of the Company c) Resolution authorizing it to invest and carry out business in the Free Zone. d) Resolution for appointment of a representative with power of attorney for dealings with the Free Zone e) Passport copy of the representative

- The companies approved by the Free Zone shall be eligible for undertaking businesses and can apply for the following types of licenses:

- General trading

- Industrial license

- Logistics license

- Services license

- International transport (Trans-shipment)

- Application forms for issuance of license are given at Annex-E

So here is a round-up of what you need to do in order to become a foreign investor in Gwadar Free Zone as given in the investment guide for foreign investors in Gwadar Free Zone.

Step 1

- Cover letter

- Submission of duly filled application form

- Business plan/feasibility study

- Board Resolution to show commitment for investment

- Bank statement

- Scrutiny fee US $ 260 for Free Zone Company and 150 US$ for branch office

Step 2

- Evaluation and due diligence of investors by the Customer Support Department and by HSE Consultant for industrial units for assessment of pollutants. (processing time = 2 weeks)

- Approval by the management of GFZC

- Issuance of letter of acceptance or letter of rejection to the client

- Signing of agreement on commercial terms of the Zone as a commitment by the investor

Step 3

- Submission of specimen signatures, copies of passports

- Two colored photographs of manager, legal advisor, directors and shareholders of the company

- General Power of Attorney in favour of the manager and legal advisor for dealing with the zone

- Opening of bank account in the Zone with a balance of initial capital of US $ 50,000

Step 4

- Selection of definitive office space, warehouse or plot for industrial unit

- Payment of fees for registration, license and lease

- Issuance of Registration Certificate and license

- Signing of Lease Agreement between investor, GFZC and Gwadar Port Authority (GPA)

Step 5

- Handing over of possession of plot, office or warehouse to the client

- Submission of building plans / detailed drawings, application for utilities and details of effluents in case of industrial undertakings

- Approval of construction drawings. Start of business / Start of construction for industrial units

Step 6

- Submission of documents for grant of entry visas

- Issuance of resident visas for the staff and officials

- Provision of utilities to the industrial units.

- Start of industry operations

If you have further queries you can call at the COPHC branch office in Karachi or visit their office at the address given below

Address:Karachi branch office

3rd Floor, (Ext.), Bahria Complex – IV, Chaudhary Khaleeq-uz-zaman road, Gizri, Clifton, Karachi, Pakistan

Contact: 021-35155081

So, are you planning to invest in Gwadar free trade zone and enjoy a tax holiday of 23 years? Share with us your views at blog@zameen.com.

You can also check out for various properties for sale in Gwadar city. If you want to know further about CPEC opportunities, then read our detailed piece on Pakistan’s friendly relations with China and subscribe to the best real estate blog in Pakistan.