Home » Laws & Taxes » File Income Tax Returns On The Go

Filing income tax returns can be a stressful experience for many, especially for first-timers, as it involves a lot of technicalities. Sometimes, people hire tax professionals to do the job for them, which can be expensive. With the launch of an online portal, the Federal Board of Revenue (FBR) has made the process of filing income tax returns quite easy. In a recent bid to help people file tax returns on the go, FBR has launched an app as well. Now, you can file tax returns via FBR’s Tax Asaan App, by downloading the app on your phone.

Why You Should File Income Tax Returns via FBR’s Tax Asaan App

Although tax situations vary according to the properties you own or investments you make, doing it on your own will not only save you a few bucks but also a lot of hassle that you have to go through when hiring a pro.

If you hire a professional to file returns for you, don’t expect they will deal with your case immediately. They might prefer clients who pay a good amount for their services and so you will have to wait for your turn. What if you miss the deadline and have to face consequences for it?

Filing income tax returns on your own gives you a lot more control of your tax situation. Nobody else knows about your sources of income more than you do, so if you miss out on any important information while filing returns, you can immediately fix it. Since the biggest advantage of filing tax returns on your own is that you can save your hard-earned money, why not take benefit from FBR’s Tax Asaan App.

Here Is How To File Tax Returns via FBR’s Tax Asaan App

To facilitate the taxpayer, FBR has introduced a new feature in the recently launched Tax Asaan App. This feature has simplified the process of filing tax returns. The app will ask you a few interactive questions, familiarizing the user with tax related issues as well.

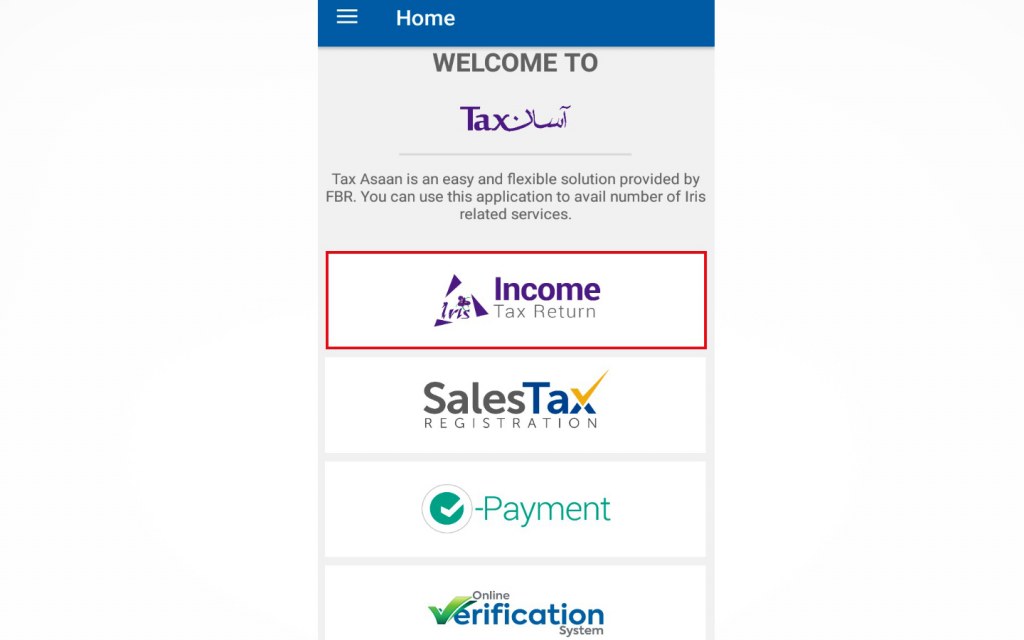

To experience the smooth process of filing tax returns you must first, download FBR’s Tax Asaan App through Google play store. It is available for free for both Android and iOS platforms. Now, let us take you through the steps to file income tax with Tax Asaan App. When you have installed it, you will find the app icon under your app icon list. Click on the “Income Tax Return” option. You can also sign in if you are a registered user, by opening up the main menu.

How To File Income Tax Returns For Resident Pakistani Taxpayer

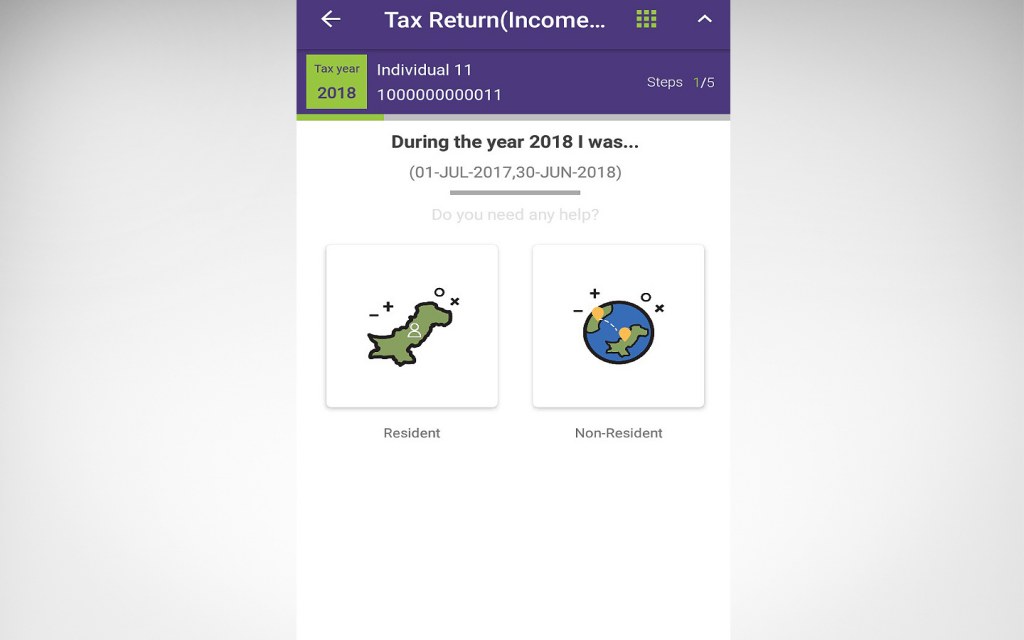

Tap on the Income Tax Return tab and select the year for which you need to file tax returns. You will be directed to a page where you have to choose the resident status.

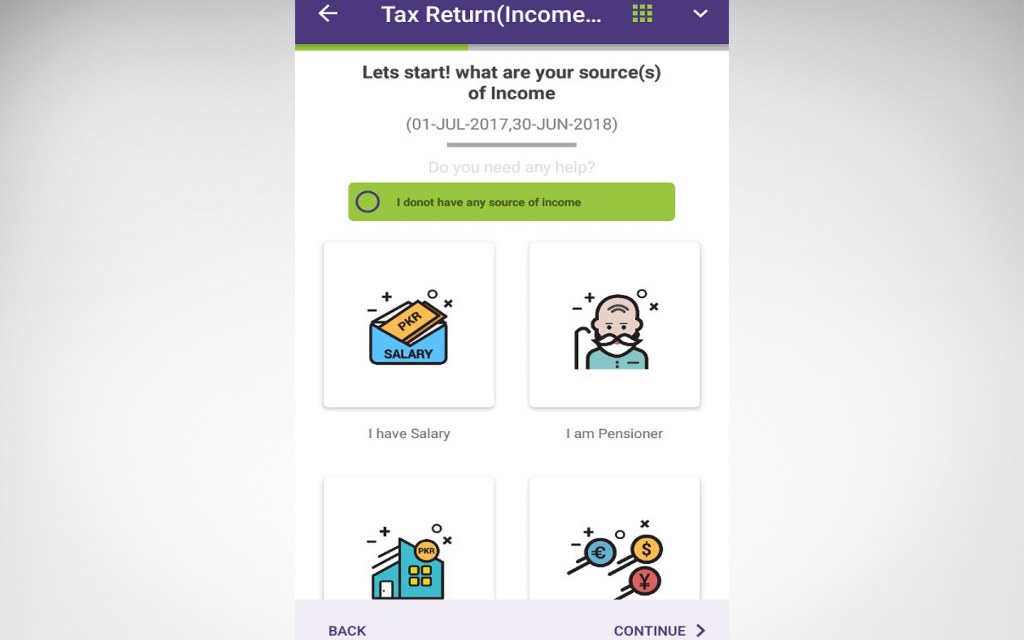

Once the page is loaded, the app will ask you the source of income. There are small images reflecting each source of income.

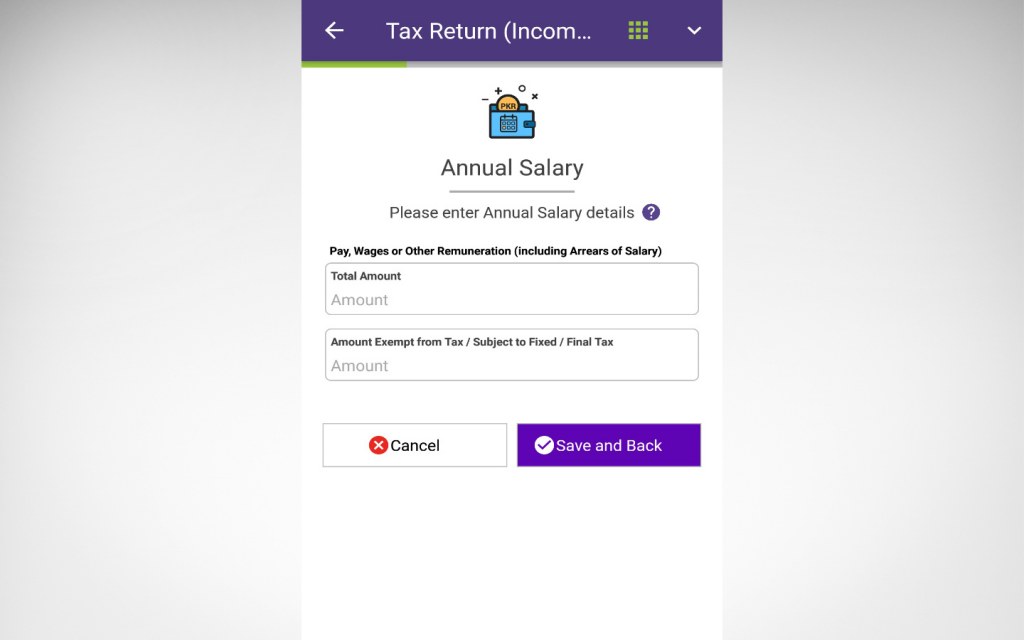

If you are a salaried individual, select ‘I have salary’ tab. A page will open up where you will have to enter your Annual Salary details.

When you have added the Annual Salary details, hit the save button. You will be redirected to the source of income page. Add the data against multiple sources of income by repeating the same process one by one. You can also edit any of the information you add against each source of income. Click on the delete button if you need to remove any information.

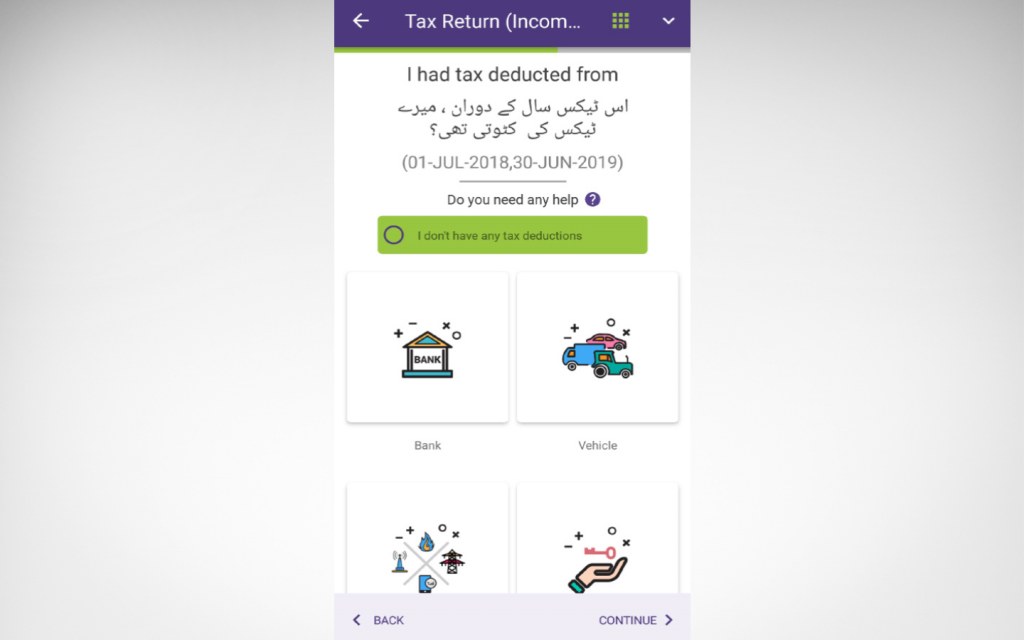

Tax Deductions

When you have entered all details against each source of income, add tax deductions by choosing from the available options from where your tax has been deducted.

For instance if you choose Vehicle Token Tax, add details of tax deductions as shown in the picture below.

You can add multiple records, by clicking on ‘“Add Another” button. Once you have added details click on the “Continue” button to move on to the next step to file income tax returns via Tax Asaan App.

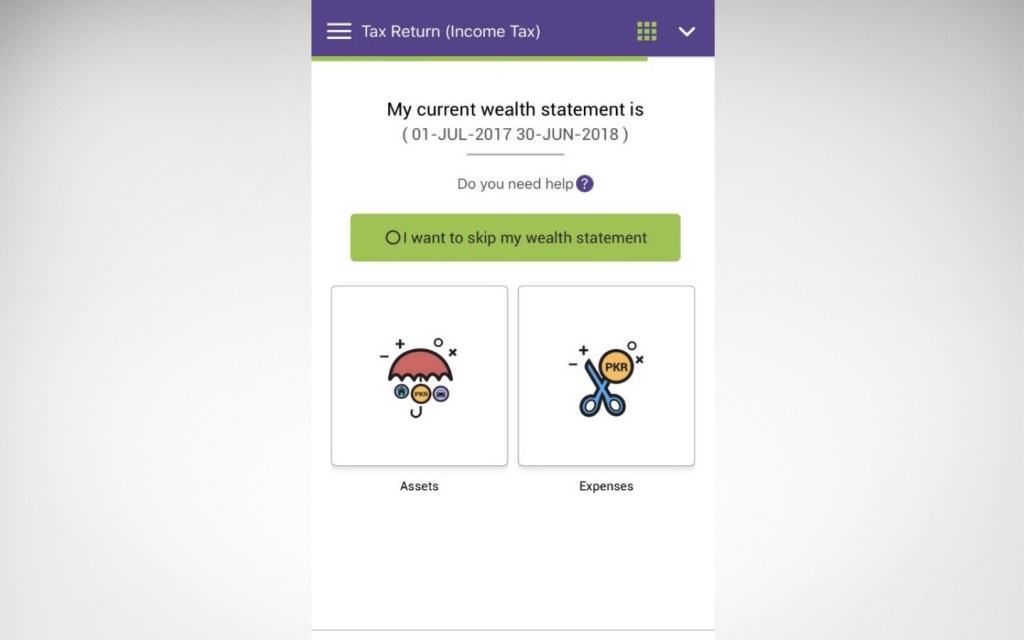

You can add information on the “Wealth Statement” page where there are two options being shown. One is “Net Assets” and the other is “Expenses.” If you click on the Net Assets Previous Years icon you can enter information for your assets for previous years. Enter the net amount in the given field. Click on Ok button to save the record. You can edit or delete any of the information you have put in relevant fields. Similarly, you can add the relevant information in the Expenses section.

When you have filled in both the Assets and Expenses, click on the “Continue” button to reconcile assets.

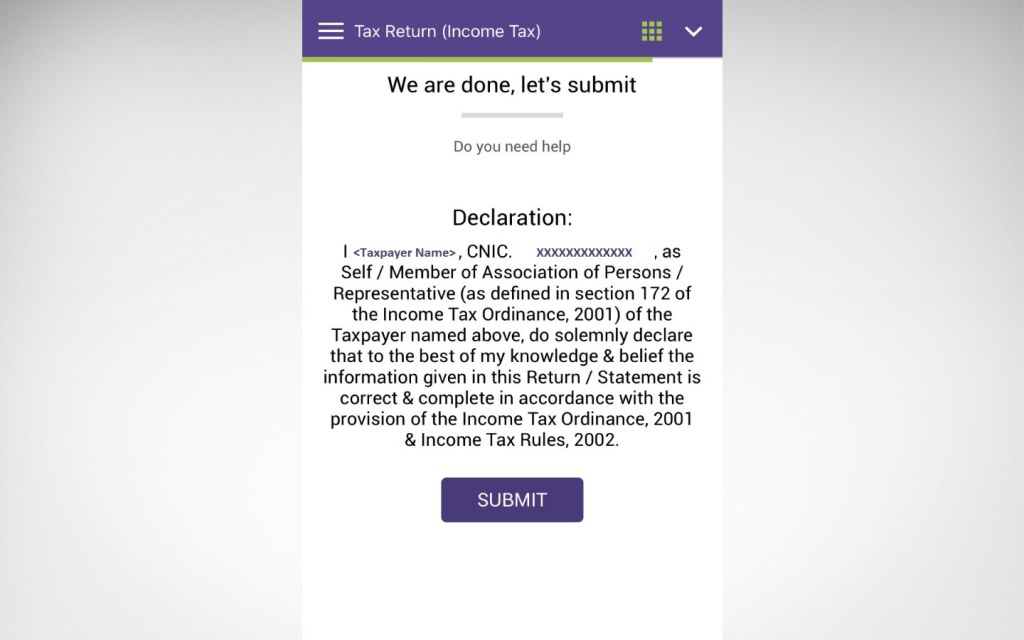

On successful reconciliation, you will be redirected to the “Declaration” page where you enter your taxpayer name and CNIC and press the Submit button. Congratulations! You have successfully filed income tax returns via FBR’s Tax Asaan App.

A summary report of your tax returns will appear along with a congratulatory note.

How To File Income Tax Returns For Non-Resident (Overseas) Pakistani Taxpayer

The process of filing tax returns for overseas Pakistanis through the app will be the same as discussed above. However, initially you will have to choose Non-resident Pakistani after selecting the tax year. You can also view Income Tax Return Summary anytime during the process of filing tax returns.

If you have pending payments at the time of reconciling assets, then you will be redirected to ‘Attach Payments’ page where you can attach CPR slips before submitting your returns. Remember: You can only submit tax returns after attaching CPRs that are equivalent or greater than the due tax amount.

Hope this post has helped you in filing income tax returns via FBR’s Tax Asaan App. The government of Pakistan is providing quick measures to encourage more people to file income tax returns. Besides, there are many benefits of becoming a filer that you might want to explore before filing returns. If you are also looking to pay taxes on the go, then check out our step by step guide on how to make e-payments through FBR’s Tax Asaan App.

Stay tuned to the best property blog in Pakistan for more informative posts. Do share your feedback with us at blog@zameen.com