Home » Laws & Taxes » Here is a Complete Guide on How to File Income Tax Returns in Pakistan

Update (Sep 28, 2022):

Time’s Running Out. File Your Income Tax Returns Now!

Haven’t filed your annual income tax return yet? Do it as soon as possible because the deadline is just 2 days away. According to the official sources of the Federal Board of Revenue (FBR), the window to file your income for the tax year 2022 is closing on September 30, 2022.

To learn all about the income tax return filing process for 2022, continue reading this blog!

Before we get into the details of the process, it is important to mention here that all individuals with an annual income of PKR 600,000 or above must file their tax returns in Pakistan. If you think your annual income meets this threshold and you haven’t become a tax filer yet, then you’re in luck. We have covered a detailed guide on how to become a tax filer in Pakistan that would walk you through the entire process. Also, there are many benefits of being an income tax filer in Pakistan, such as tax exemptions, duty waivers and more.

Now, without further ado, let’s begin with our step-by-step guide on how to file income tax returns in Pakistan.

Process To File Income Tax Returns Online in 2022

The process of filing income tax returns online has become fairly easy. Now, anybody can easily file their taxes online by visiting the Federal Board of Revenue website. Here is how you can file tax returns in Pakistan.

How to login to IRIS portal and file income tax returns

- File income tax returns by first logging into Iris. Iris is an online portal where income tax return is filed. Enter your username and password

- In case you forget your password, click on ‘Forgot password’

- Once you have successfully logged into the portal, click on ‘Declaration’ menu on top of the portal

- Select the tab under Forms which states: ‘114(1) Return of Income Filed Voluntarily for 1 Year)’

- Click on the Period tab, where you have to enter the Tax year

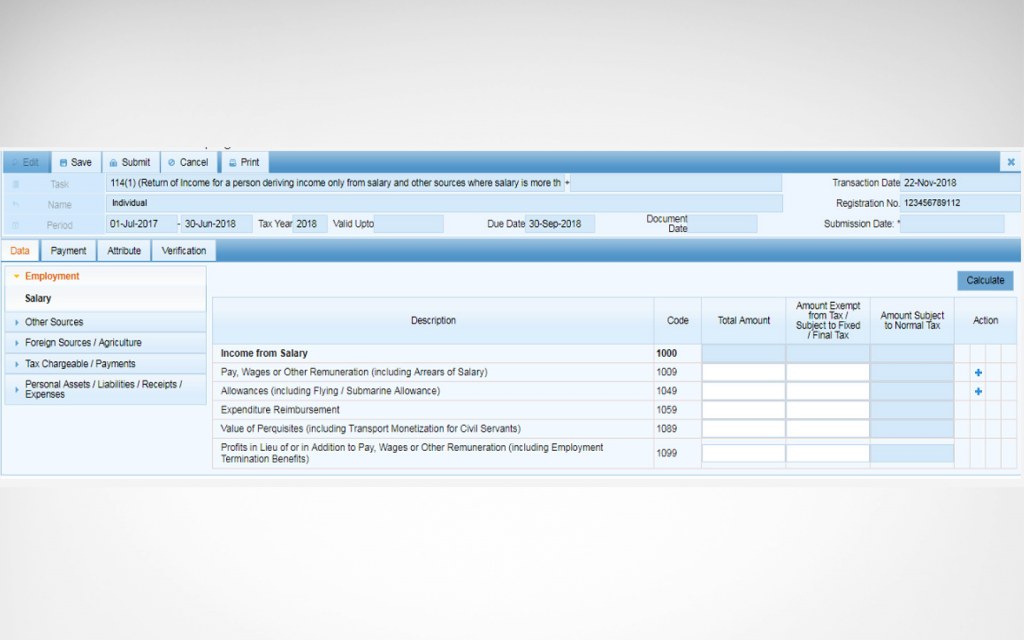

Employment section

- Now, a page will open up, where you click on Employment section

- Select Salary Tab

- Enter the annual income in salary in the Total Amount section

- If the salary you have includes the amount that is exempted from tax mention it under the heading ‘Amount exempt from tax’

- Once you are done click on Calculate button

- Provide total tax, amount exempt from tax and subject to final tax in input fields and then click on Calculate button

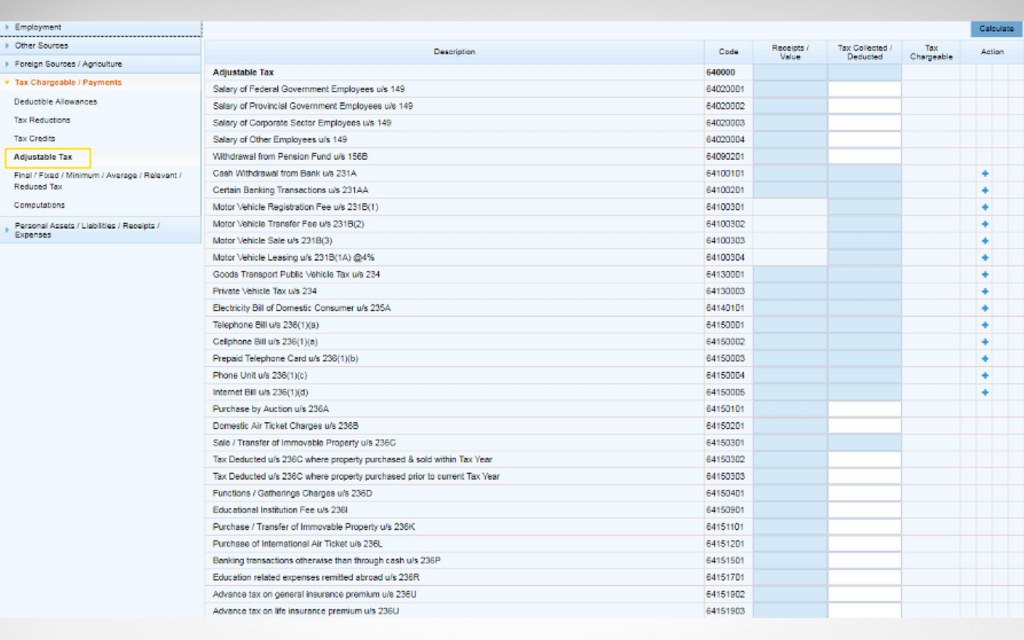

Adjustable Tax and the amount of tax deducted

- Click on Tax Chargeable/Payments tab and select Deductible Allowances tab where any amount that is deducted in the name of Zakat or charitable donations should be entered

- Fill out Tax Chargeable, Tax Reductions, Adjustable Tax and Tax Credits field

- On Adjustable Tax screen you need to fill out the details of the taxes that have already been taxed or charged to you during your tax year

- If you are a federal government employee, then enter tax amount against 64020001 code

- For provincial government employees, enter the tax amount against 64020002

- If you are a corporate sector employee, then enter your tax amount against 64020003 code

- You can also adjust the tax deducted by your bank on various sections like when you withdraw cash from bank in 64100101. Other banking transactions like any bonds or savings should be entered in the code 64151501.

- You can also adjust the tax deducted by your bank on motor vehicle registration fee, transfer fee, sale and leasing against their respective codes

- A dialogue box shall appear asking for vehicle details like E&TD Registration No. and provide further details related to its make, model and engine capacity. Once you are done with it then click on Calculate Tab button

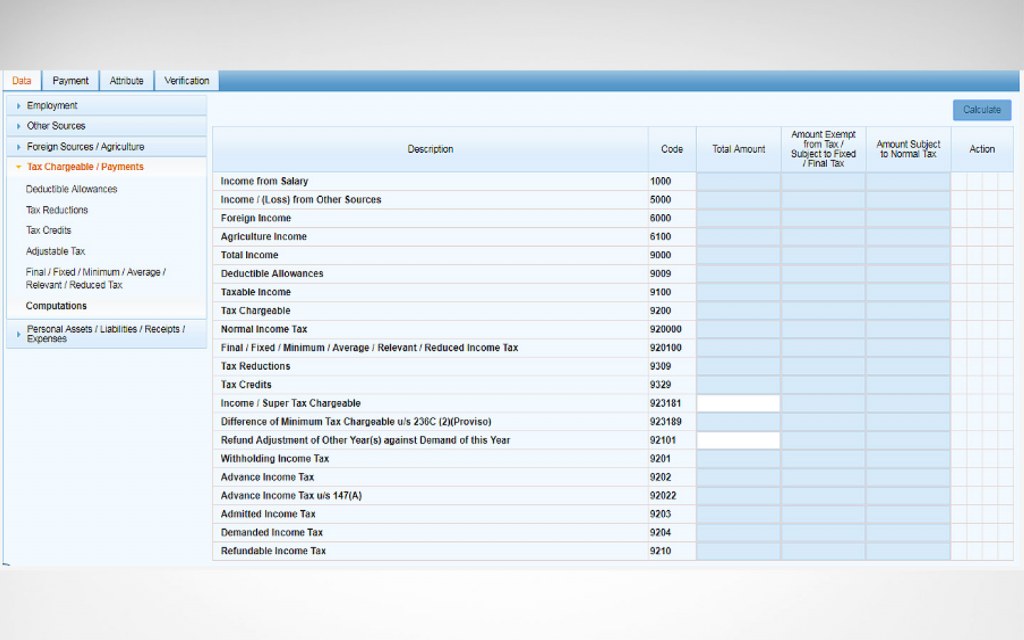

Tax Chargeable/Payments

- Select Tax Chargeable/Payments tab and you will see all the details of your income and chargeable tax

- Check out the tabs Admitted Income Tax and Demanded Income Tax

- If you find any amount against the Demanded Income Tax tab then you must pay it and attach relevant CPR

Net Assets

- Click on Personal Assets menu to provide information about your assets

- Enter the total amount for the previous year net assets and also of the current year

- Enter the amount of annual income in the inflows and outflows field

- Click on the Calculate button after filling out all the details

- The ‘Unreconciled Amount’ must be zero when submitting income tax returns

Payment for demanded tax

- When you have paid the Demanded Tax either through Alternative Delivery Channel (ADC) or through cash by visiting any authorized branch of National Bank of Pakistan, then you need to submit the details of your returns in the following steps

- Select Payments tab and click on the + sign on top right corner

- A dialogue box shall appear asking for payment details

- Enter CPR no. Amount Code or Paid Amount and click on search option

- The entire list of details of your payment will appear, click on the OK button and then save

Verify Income Tax Return Form and submit it

- Once you have added and calculated all required fields, you should now verify your identity.

- Your name and registration number shall already be populated

- Enter the verification pin that was given to you at the time of registration and click on Verify Pin tab

- Once you are given the details, you can now file income tax returns by clicking on the Submit tab

This was a comprehensive guide on how to file income tax returns in Pakistan. We hope you found this piece helpful. If you have any questions or feedback, feel free to drop us an email at blog@zameen.com. You may also like to read our blogs on this year’s Federal Budget and the Income Tax Slabs for FY 2022-23.

Also, if you want to read more informative lifestyle guides and property updates, log on to Zameen Blog — Pakistan’s most popular real estate blog. Subscribe to our email newsletter if you haven’t already.