Home » Laws & Taxes » File Income Tax Returns for Your Business With Ease Using Our Guide

There are many benefits of filing income tax returns in Pakistan for individuals and businesses. Plus, the recent digitisation of the taxation system in Pakistan has made things a lot easier, allowing individuals and companies to file income tax returns online. So, if you are also looking for the procedure of how to file income tax returns for businesses than here is a detailed step-by-step guide for you along with screenshots to make sure that you are going the right way.

How To File Income Tax Returns for Businesses?

If you are about to file income tax returns for your business, the very first step is to visit the Federal Board of Revenue’s official website and log into the online portal of IRIS by logging in with your username and password.

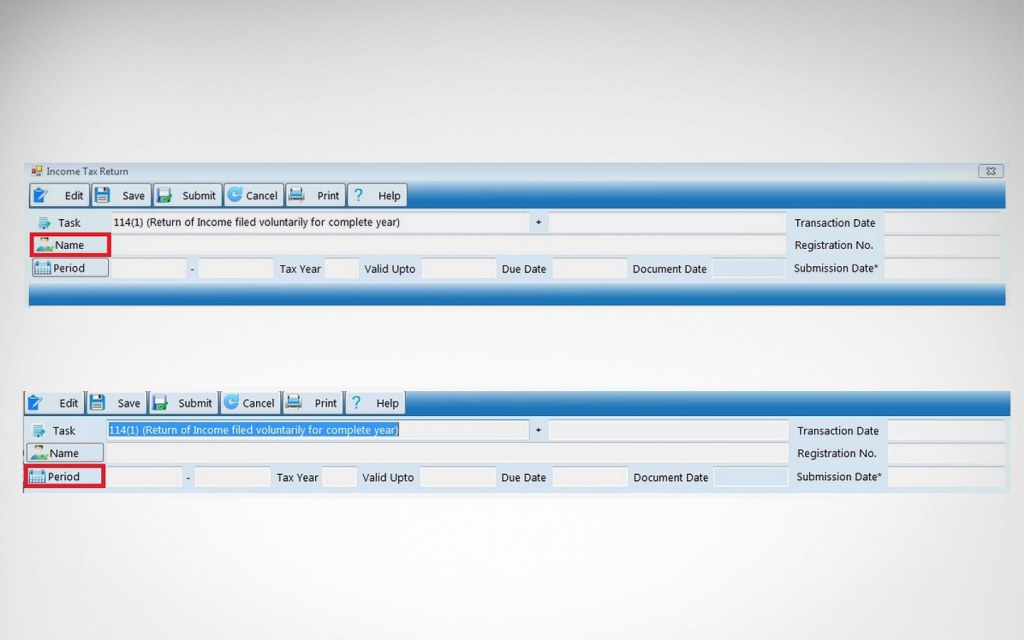

Click to open the “Declaration” menu on the top-left corner of the screen. Select the “114(1) (Return of Income Tax Filed Voluntarily for Complete Year)” link.

- Click on the “Name Field” and enter your full name according to the CNIC

- Click on the “Period Field” and the following pop-up will appear

- Enter the relevant year for which you are filing tax returns

- Click the option of “Select” appearing in the “Action” column against your chosen tax period

Fill Income Tax Return Form

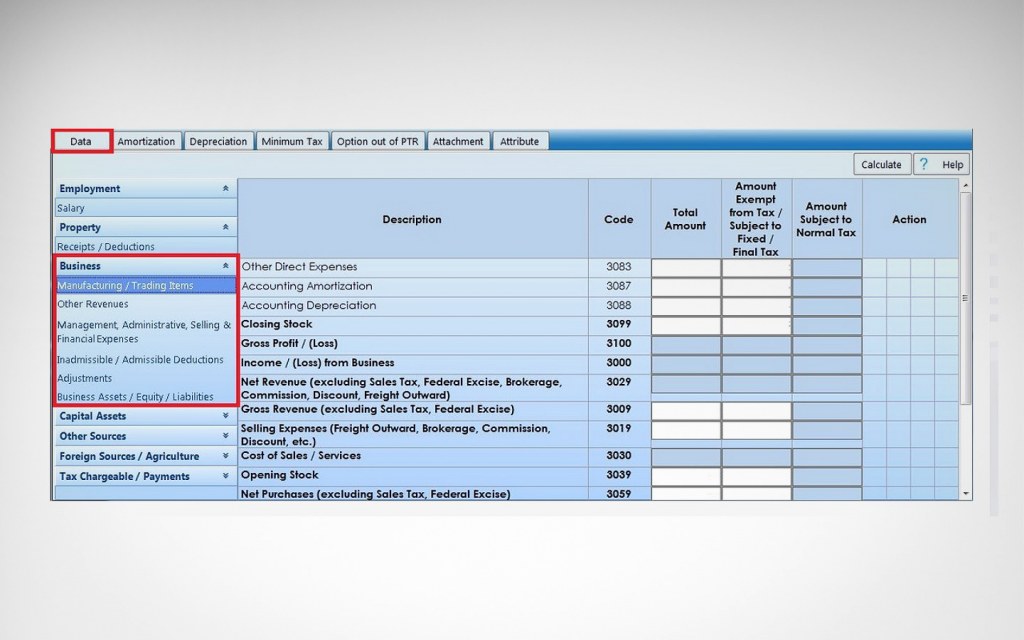

To fill up the Income Tax Return Form, you first need to click on the “Data” tab.

- Select “Business” tab

- Navigate through fields shown under the tab of “Business” while filling them with relevant information about the annual income of your business

- The form has fields like Closing Stock, Gross Profit, Income/Loss from Business, Net Revenue, Gross Revenue, Selling Expenses, Cost of Sale/Services, Opening Stock and Net Purchases

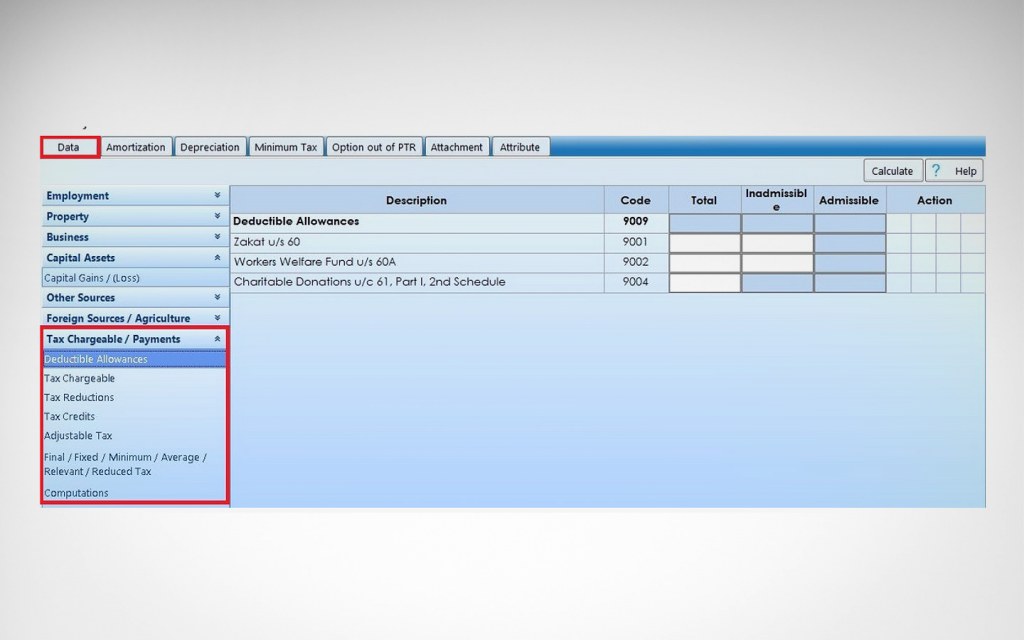

Tax Chargeable/Payments

Click on the menu of “Tax Chargeable/Payments” to fill in the information about the adjustable taxes on the annual income of your business.

The fields you have to fill in on this screen are Deductible Allowance Tax Credits, Tax Reduction and Adjustable Tax.

Fields marked with “*” are mandatory and should be filed with relevant details.

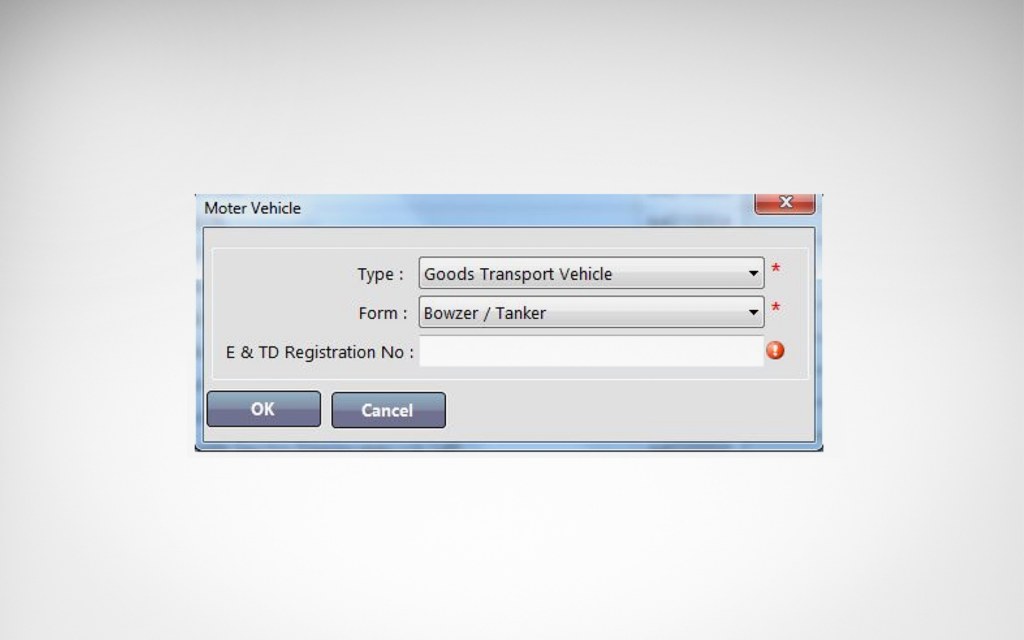

Motor Vehicle Detail Submission

Click on the “Motor Vehicle” tab in Adjustable Taxes to fill in the relevant information.

- Provide details like E&TD Registration Number, engine capacity, model and make.

- Once all the information is punched, click on the “Calculate” button.

Fields marked with “*” are mandatory and should be filled with relevant details by individuals filling tax returns for businesses.

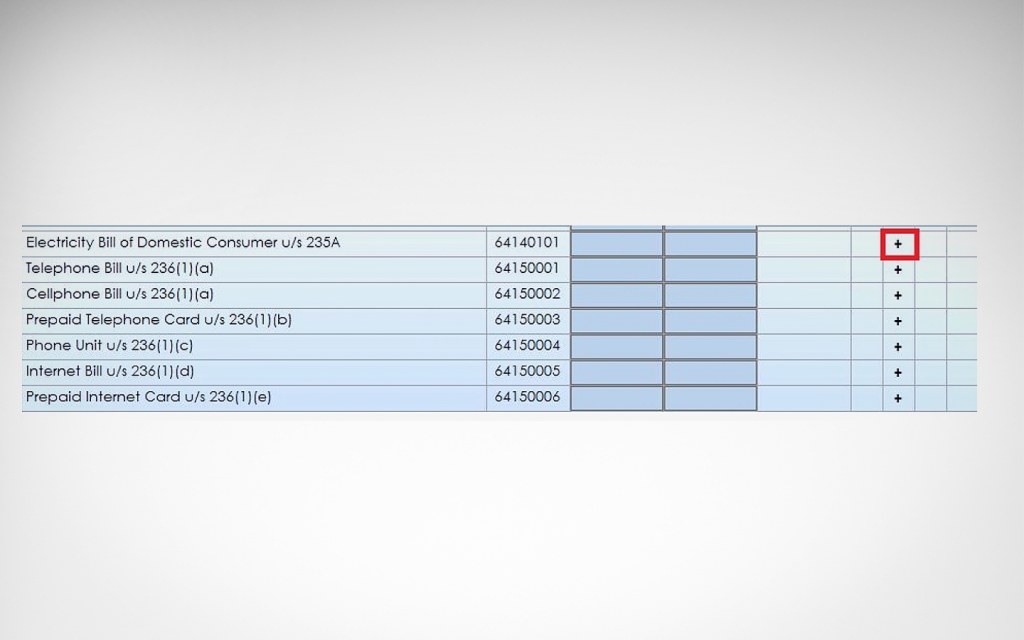

Utility Connection Details Submission

Click on the “Utility Connection” tab in Adjustable Taxes to fill in the relevant information

- You will see a list of different fields on your screen. Each field is dedicated to a specific type of utility bill.

- This list contains fillable fields for utility bills like Electricity, Telephone, Cell Phone, Prepaid Telephone Card, Phone Unit, Internet Bill and Prepaid Internet Card.

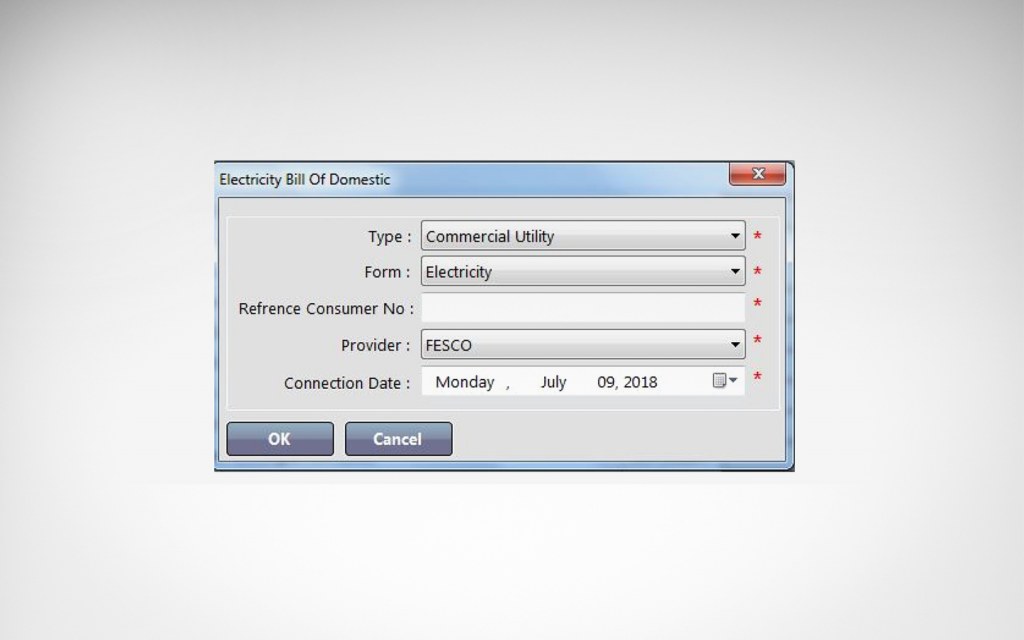

- By Clicking on the “+” button, an additional screen will pop-up as shown below

- Here you have to select “Commercial Utility” against the first field which says “Type.”

- Specify the type of utility connection (electricity/telephone/internet) against the “Form” field.

- Enter your Reference/Consumer Number in the third field.

Select your utility service provider name in the next step like FESCO, HESCO, QESCO, LESCO, etc. - Enter the connection date in Day, Month, Date and Year format.

Insert relevant values in “Receipt” and “Tax Collected/Deducted” fields. - Repeat the above steps for all the types of utility connections you have.

Fields marked with “*” are mandatory and should be filed with relevant details by individuals filing tax returns for businesses.

Computation Section

Once you have inserted all the mandatory information, you have to click on the “Calculate” button for the calculation of final tax amount as per the provided details.

The calculated results are displayed in “Computation Section”, which contains relevant columns.

Procedure to Edit and Change Data

The electronic process that helps you to file income tax returns online for your business also allows you to delete/change/edit any incorrectly entered information in two very easy steps.

- The first step involves the deletion of incorrect data/information.

- In the final step, you need to add the correct data/information in the relevant field.

Verification and Submission of Income Tax Return Form

Once you have thoroughly checked all the inserted information, you click on the verification tab.

- On the next screen, all your provided business identification details will be retrieved and displayed automatically.

- Enter your Verification Pin, which is provided to you while you are registering on the IRIS portal, and click “Verify Pin” button.

- After all these steps, the process to file income tax returns for businesses gets completed. All you have to do now is to click on the “Submit” button.

Important note: Once you have submitted the information on the online IRIS portal, it cannot be deleted, changed, edited or modified.

This was the complete process of filing income tax returns for your business online. If there’s any confusion or you have any questions related to the above-mentioned process, let us know at blog@zameen.com and we’ll try our best to promptly get back to you.

Meanwhile, if you are a salaried individual, then you should read our step-by-step guide to file income tax returns for employees in Pakistan.

For more informative pieces on laws and taxes, keep following Zameen Blog, Pakistan’s most popular lifestyle blog.