Home » Laws & Taxes » FBR Introduces Real-Time Point of Sale (POS) Invoicing System

As major authorities in the country move towards digitization to facilitate citizens, the Federal Board of Revenue has also introduced a new Electronic Device System (EDS) that will allow big retailers to report their sales in real-time for taxation purposes, according to leading newspapers. In order to make sure the tax amount paid by the customers at the cash counter is actually deposited in the FBR, the board has asked businesses to integrate their points-of-sale with the POS Invoicing System in Pakistan.

Effective from Dec. 1, it will be mandatory for all shopping malls, hypermarkets, brand outlets, chain stores, hotels, cafes, restaurants and snack bars to install the POS invoicing app. The app will connect the cash machine with the FBR through Electronic Device System and provide a concurrent report of sales and tax payments.

It is important to mention the Federal Board of Revenue has amended Sales Tax Rules 2006 to make the installation of POS Invoicing System in Pakistan mandatory for all tier-1 retailers. As per a report published in a leading English daily, the board said it aims to integrate the Point of Sale Invoicing System with 20,000 outlets and businesses at the point of sale till June 2020 to bring them into the tax net.

However, it appears that big retailers aren’t the only ones who will have to install the POS invoice software.

Earlier in October, FBR Chairman Shabbar Zaidi reportedly suggested the board was also considering installing point of sale invoicing system in all big private hospitals for proportionate tax collection.

Since this move impacts both the retailers and customers, here are a few things about FBR’s Point of Sale Invoicing System that you should know.

What is POS Invoicing System?

For those who might be confused, ‘point of sale’ refers to the location where a retail transaction, either sale or purchase, is carried out. Point of Sale (POS) system, which you see at the cash counter of big retail outlets and supermarkets, is basically a computerized system that records sales data, manages inventory and maintains customer data. Integrating the FBR’s new invoicing software with this widely-used system will allow customers to verify if the sales tax they paid actually reached the concerned tax authority.

As for the POS invoicing system, it is a real-time sales documentation system that will link the electronic systems at the outlets of all tier-1 retailers with the FBR via the internet. Moreover, the retailers won’t have to purchase new machines as they can simply download the invoicing app on their existing systems in a manner prescribed by the board.

Using this system will not only end periodic inspections by the Federal Board of Revenue but will also help retailers prepare their sales tax returns without much hassle. Once the POS Invoicing System is downloaded, a QR code or a barcode will get printed on every receipt generated by the point of sale system following each sale. Meanwhile, the invoice data will be uploaded on the FBR’s servers automatically on a regular basis.

How to Install and Integrate POS Invoicing System in Pakistan

Here is how big retailers can link their computerized systems with the POS invoicing app.

- Register each point of sale with the eFBR website

- Download the software

- Install the software (stable internet connection is required for this step)

- Integrate the taxpayer system with the FBR.

Let’s take a further look at the process.

POS Registration

This is the first step to install and integrate the FBR’s point of sale invoicing system for retailers.

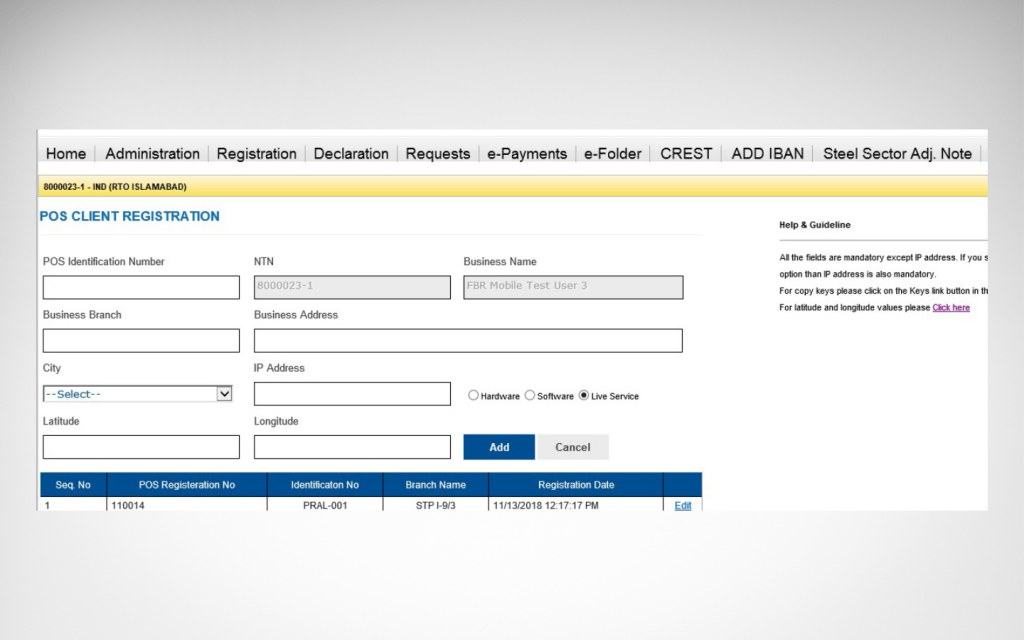

As a retailer, you need to visit the eFBR website and enter your credentials to access the ‘POS Client Registration’ page.

You will be required to enter the following information in order to obtain a POS Registration Number.

- POS Device Number

- POS version

- National Tax Number

- Business name and address

- Branch details

- City

- IP address

- Latitude and longitude

- Mode

POS Invoicing System Installation and Integration

Here are the steps to installing the system:

- Download the ‘Software Fiscal Device’ from the official website

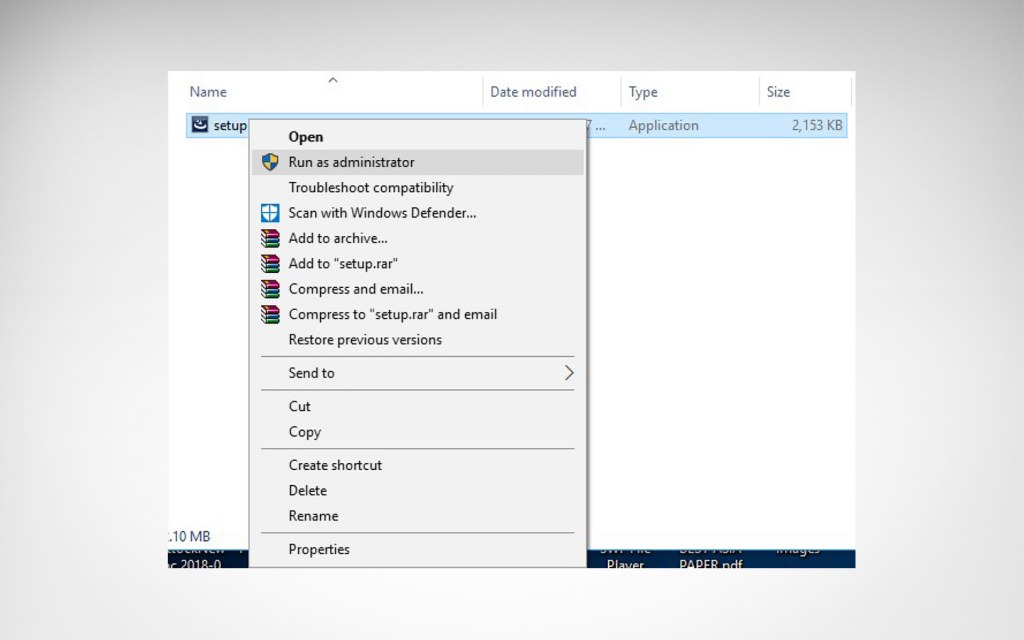

- Run setup.exe as Administrator

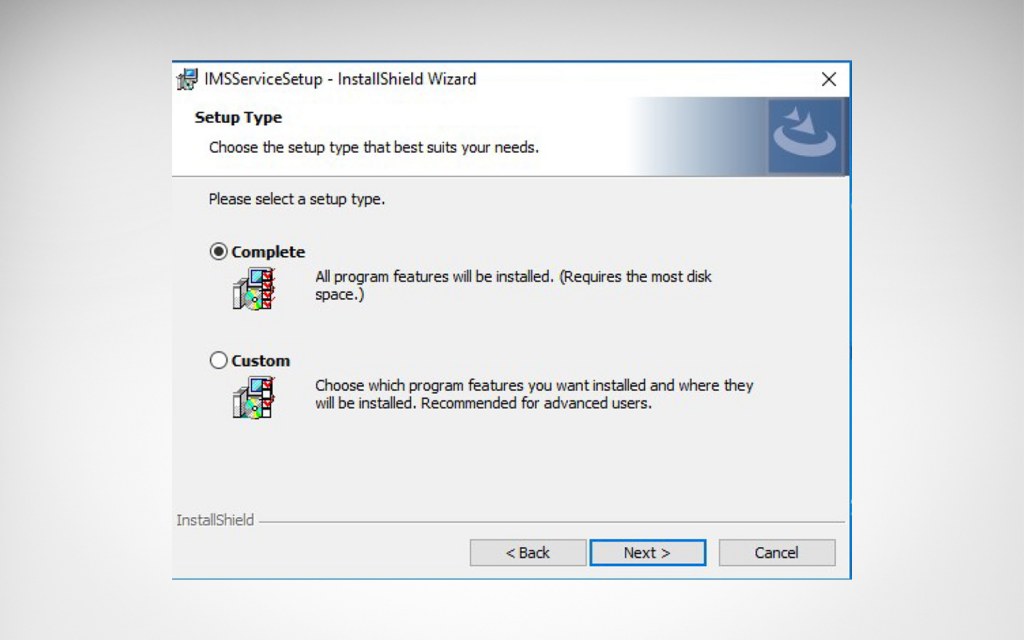

- Select ‘Complete’ setup type and click ‘Next’

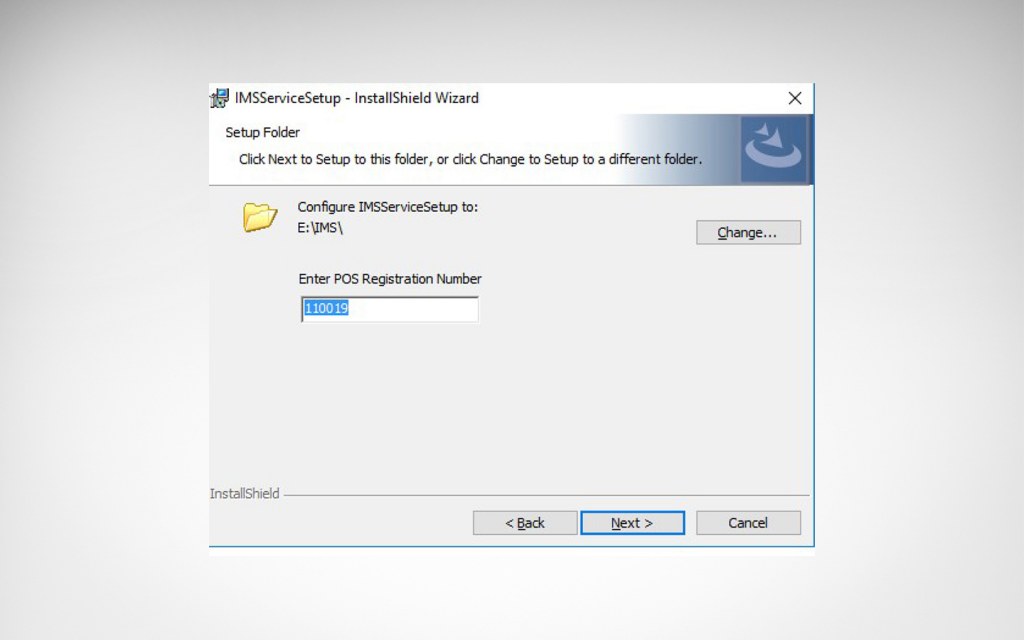

- Select the target folder

- Enter POS Registration Number

- Click ‘Finish’ to complete the installation.

Please note you will require a Windows 7 (or above) operating system to install the software fiscal device.

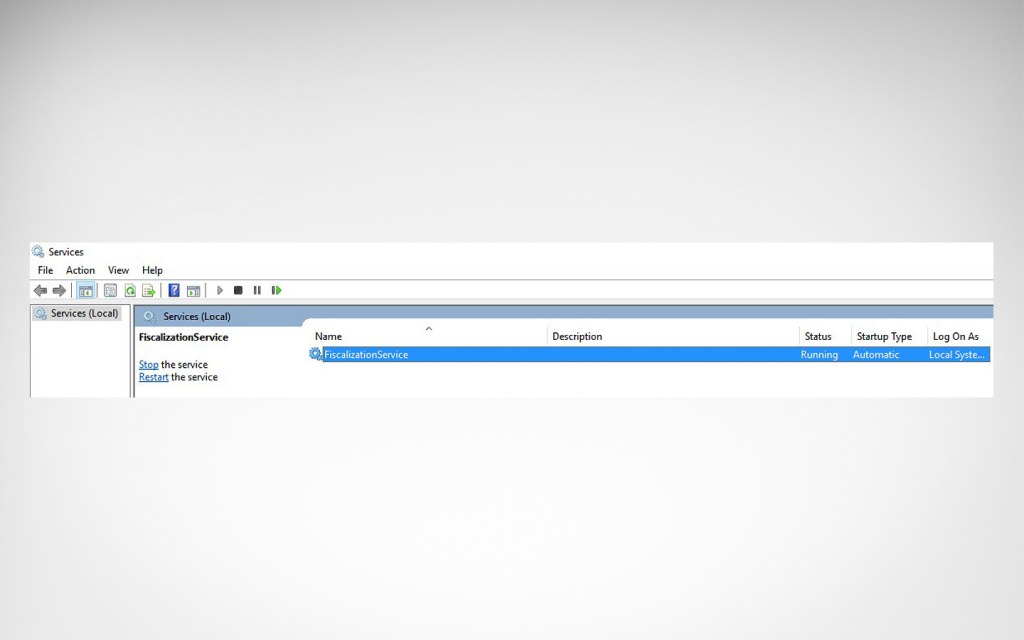

After the installation, the invoicing system will provide two service modes to its users for configuration i.e. NET.TCP and self-hosted HTTP. Once the device is configured, you can check if it is running in the ‘System Service List.’

*The technical information regarding registration, installation and integration process of Point of Sale Invoicing System has been taken from the official FBR website.

Which Retailers are Included in the FBR’s Tier-1 Category?

Before we discuss how invoicing system for retailers and real-time sales invoicing will benefit consumers, here’s a list of retailers that fall under the FBR’s tier-1 category:

- Retailers who operate as a franchise or a branch of a domestic or foreign outlet/chain of stores

- Those who operate in air-conditioned shopping malls (excluding kiosks)

- Retailers whose aggregate electricity bill during the last one year exceeded PKR 6 lakh

- Wholesalers or retailers who import goods in bulk and then supply the retailers on a wholesale basis and to general consumers on a retail basis

- Those whose stores are equal to or exceed the area size of 1000 square feet

How Is FBR’s POS Invoicing System Going to Benefit Consumers?

One of the main benefits of FBR’s Point of Sale Invoicing System is that customers will be able to instantly check if the sales tax has been deposited in the FBR. To verify the sales tax payment, you’ll have to download and install the FBR’s Tax Asaan App on your smartphone, open it and go to the ‘Online Verification System’ service. Then go to POS Invoice and scan the QR code printed on the invoice for confirmation.

Moreover, customers will also get a sales tax discount while shopping at textile and leather brand outlets linked with the FBR’s invoicing system.

Meanwhile, you can also check out our comprehensive guides on how to file income tax returns for businesses and how to file your tax returns on the go via Tax Asaan App to make the filing process as smooth as possible.

For more information about laws and taxes in the country, stay connected to Zameen Blog – Pakistan’s best real estate and lifestyle blog. If you want to get in touch with us, drop us an email on blog@zameen.com. You are also encouraged to subscribe to our newsletter on the right to receive the latest updates about the real estate market in Pakistan.