Home » Laws & Taxes » Learn All About Property Taxes in Pakistan

In This Post:

– What is Property Tax?

– Types of Property Taxes in Pakistan

– Tax on Sale of Property in Pakistan

– Tax on Property Purchase in Pakistan

UPDATE (Feb. 16, 2021): Good news for non-resident Pakistanis (NRPs)! President Dr Arif Alvi has promulgated Tax Laws (Amendment) Ordinance 2021 to facilitate non-resident individuals who wish to open non-resident Pakistani Rupee Value Accounts (NRVAs). The ordinance has:

– Extended 4 percent super tax on banks indefinitely beyond the tax year 2021

– Imposed withholding tax (Rs 50,000-Rs 200,000) on different engine capacity vehicles on persons who sell locally manufactured vehicles within 90 days of delivery

– Offered tax exemptions for electric vehicles and locally manufactured mobile devices

– Directed a person responsible for attesting, registering or recording the transfer of any immovable property to collect advance tax at the rate of one percent from the seller or transferor. If the buyer or transferee is an NRP holding a Pakistan Origin Card (POC) or a National Identity Card for Overseas Pakistanis (NICOP) or a Computerized National ID Card who acquires the immovable property through a Foreign Currency Value Account (FCVA) or NRVA maintained with authorized banks in Pakistan, the tax shall be the final tax for such a buyer

UPDATE (Sept. 8, 2020): According to an amendment in the Income Tax Ordinance 2002 through the Finance Act 2020, the holding period and tax rate on CGT has been reduced on the disposal of immovable property. For your understanding, a longer holding period means that a property was not bought for the purpose of making any profits and hence it leads to lower taxes, a shorter holding period means a higher amount of CGT earned, which results in a higher tax rate. With the recent amendments, now you can hold an immovable property for no longer than 4 years and the percentages of taxable capital gain have been rationalised with reference to the holding period. The details are shared below:

- There is no difference between plots and any constructed property

- The holding period for CGT has been reduced to 4 years

- 100% of capital gains to be taxed if the holding period is less than 1 year

- 75% of the capital gains to be taxed if the holding period exceeds 1 year but is less than 2 years

- 50% of the capital gains to be taxed if the holding period exceeds 2 years but not 3 years

- 25% of the capital gains to be taxed if the holding period exceeds 3 years but not 4 years

- No CGT to be taxed after 4 years of holding period

The rate of CGT on the amount of annual gains through the disposal of immovable property has also been reduced by half and can be broken down as follows:

| Annual Gains in PKR | Rate of Tax on Value of Property Before Finance Act 2020 | Rate of Tax on Value of Property After Finance Act 2020 |

| Gains less than 5 million | 5% | 2.5% |

| Gains higher than 5 million but lower than 10 million | 10% | 5% |

| Gains higher than 10 million but lower than 15 million | 15% | 7.5% |

| Gains more than 15 million | 20% | 10% |

Update (Apr 21, 2020): The government of Pakistan usually charges about 5% to 20% Capital Gains Tax (CGT) when selling ready-to-move-in houses and developed plots. But with the introduction of new incentives for the construction industry due to the spread of COVID-19 disease in the country, families who want to sell their house during this period, will not have to go through the hassle of paying the Capital Gains Tax. Apart from this incentive, the sales tax is also being reduced in collaboration with the provincial government.

Plato, a Greek philosopher, said, “When there is an income tax, the just man will pay more and the unjust less on the same amount of income.” Plato was right – you can see the clever ways in which people evade taxes these days. For instance, when buying a property, the seller and the buyer both agree to show less value for the purchased property on the sales deed, just so they can pay less taxes. Withholding tax is to be paid by the buyer and Capital Gains Tax is to be paid by the seller. Now you may ask what these taxes are and how many kinds of property taxes there are in Pakistan. We will discuss all of these in great detail.

Different Types of Property Taxes in Pakistan

Following are the different types of property taxes in Pakistan:

- Capital Gains Tax (CGT)

- Capital Value Tax (CVT)

- Stamp Duty

- Withholding Tax or Advance Tax

Paying property taxes is like going to the dentist. It is important although you aren’t really happy about it. However, if you are trying to find a way of not paying property taxes, you might get into deep trouble with Federal Board of Revenue. FBR receives information – every bit of detail about your income, the investments you have made and real estate transactions. In short, all kinds of details pertaining to money matters. FBR will take some time in matching up your income with the filed tax returns and if there is a disparity, they will send you a notice or they will charge you a penalty fee or they might freeze your assets.

With new policies and developments taking place, there is good news for overseas Pakistanis wanting to tap into Pakistan’s real estate market. The government has loosened the noose around those expats, who are non-filers of income tax returns. Overseas Pakistanis can now invest in the real estate sector of Pakistan with ease. Before we discuss various kinds of taxes levied on property purchase and also on sale of property, let us look at the topic in view of the current news snippets related to taxes in Pakistan.

Widening gap

Federal Board of Revenue (FBR) realized that there is a huge gap between “deputy commissioner (DC) rates” and market prices of the said property. Due to this gap, undocumented money circulated in the market. This resulted in tax evasion. Since DC rates were low as compared to the actual market rates, real estate transactions took place based on DC rates, while in reality the actual sum of money traded between sellers and buyers was recorded as per the market value. For instance, if a 240 sq yd plot with a DC rate of Rs 30,000, but a market value of Rs. 70,000 is sold, on paper it shows DC value, while seller gets Rs. 70,000. This difference of Rs. 40,000 is black money. Because of this, neither the government nor income tax authorities could identify the total amount of income sellers were making in real estate sector business.

Bringing provinces into the tax net – a taxing process

To bring those earning black money into the tax net, the government of Pakistan and FBR have revised valuation tables for properties. Abolishing DC rates, these new property valuation rates will determine the actual property value. According to FBR Valuation Tables 2019, property valuation for the real estate sector have seen an increase across 20 major cities of Pakistan. This might result in a slight dip in the real estate sector’s business, but these tax policies by FBR should continue. Although for a few days to come there will be a decline in trading activity, property prices may also see a dip. At low property prices, people belonging to the middle class sector can fulfill their dream of becoming a homeowner. For the common man, there is a light at the end of the tunnel.

Increase in property tax collection

According to a news report published in The News on April 23, 2019, “Tax experts said the establishment of the directorate created a fear and people preferred to declare property values near to the fair market values. They said the valuations notified by the provinces are very low but due to transactions at the higher rates the property tax collection increased significantly.”

The same report further revealed Punjab is leading the race by collecting PKR 5.02 billion during the first half of the current fiscal year. Around the same time, Sindh raked in PKR 1.83 billion from July to December. Both the provinces recorded a sharp increase in the amount from the last fiscal year: while Punjab showed a 22.64 percent increase, Sindh witnessed 73.83 percent growth in tax collection. Khyber Pakhtunkhwa (KPK) and Balochistan received PKR 450 million and PKR 83 million, respectively.

What is a Property Tax?

Property tax in Pakistan is a provincial tax levied on annual rental value of the property, based on Urban Immovable Property Tax Acts of respective provinces. Tax rates are different for every province. It is either a flat rate, or a percentage of the annual rental value. Rental value does not mean that the property has to be rented out. It simply gives an assessed value by the government of how much rent would be generated, had the building been let out. For each province, rate of taxation differs depending on whether the property is rented out or self-occupied.

According to Excise, Taxation & Narcotics Control Department, Punjab, there is a 5% annual rental value that is levied as tax. Annual rental value is determined by assessing properties based on their type – residential or commercial, locality and whether it is rented or self-occupied. As per the Excise, Taxation & Narcotics Department Sindh, it doesn’t matter whether the property is rented out or not. The tax is levied at a rate of 25% of the annual rental value of the property. For a comprehensive breakdown of property taxes, you can check out our blog on understanding property tax rates in Pakistan.

Kinds of tax on sale of property in Pakistan

When it comes to taxes on sale of property in Pakistan, there is Capital Gains Tax which needs to be paid on the gain of profits. Let’s discuss it in detail.

Capital Gains Tax (CGT)

Let us now understand what is Capital Gains Tax on property in Pakistan 2018-2019? Capital Gains Tax (CGT) is a federal tax to be paid by the seller. When the seller makes profits on selling property (capital asset), it is the profit (capital gain) which is taxed, hence the name. According to the Finance Act 2017, CGT is levied only when the property is sold within three years of its purchase. The rate of taxation is 10% for the first year, 7.5% if sold during second year and 5% if sold during the third year. These gains are to be calculated according to the fair market value, based on FBR’s valuation table. Any property held for more than three years will not make the seller liable for payment of CGT.

Types of taxes on property purchase in Pakistan

When a person decides to buy property in Pakistan, they want to know everything: do they have enough resources? Do they need to apply for a home loan? Are there certain steps to follow when applying for a home loan? Should they buy properties in Karachi? Or should they invest in plots in Lahore? How much tax is levied on property purchase? They want to weigh all their options before making this big decision. Let us discuss property purchase tax in Pakistan in greater detail.

Capital Value Tax (CVT) & Stamp Duty

Those interested in buying property, keep in mind that they have to pay quite a few taxes before becoming owners of the property. Capital Value Tax (CVT) is a provincial tax and is paid by the buyer at the time of buying property. As the name suggests, it is payable on the capital value of an acquired asset. The Capital Value Tax or CVT is levied at the rate of 2% of the recorded value according to Finance Act, 2006.

Property that is transferred as a gift, an exchange or relinquishing the rights on a property all come under Capital Value Tax. However, transfer of property between parents, spouse or any of your blood relatives either as a gift or through inheritance have been excluded. In cases where it is a gift or exchange, or where property value is not mentioned in the transaction, the value of the property is calculated according to the values determined through the valuation tables.

According to Budget 2018-19, federal government had recommended the abolition of DC rates. Recommendations had also been made to reduce the CVT and Stamp Duty to a total of 1%. Neither of these recommendations have been implemented by the provinces so far. So, currently the total of CVT and Stamp Duty for urban property still stands at a total of 5% (2% CVT and 3% Stamp Duty).

Stamp Duty is basically a tax paid on the legal document at the time of purchasing property. Under the Stamp Act 1899, Stamp Duty is levied at 3% of the DC rates of the property.

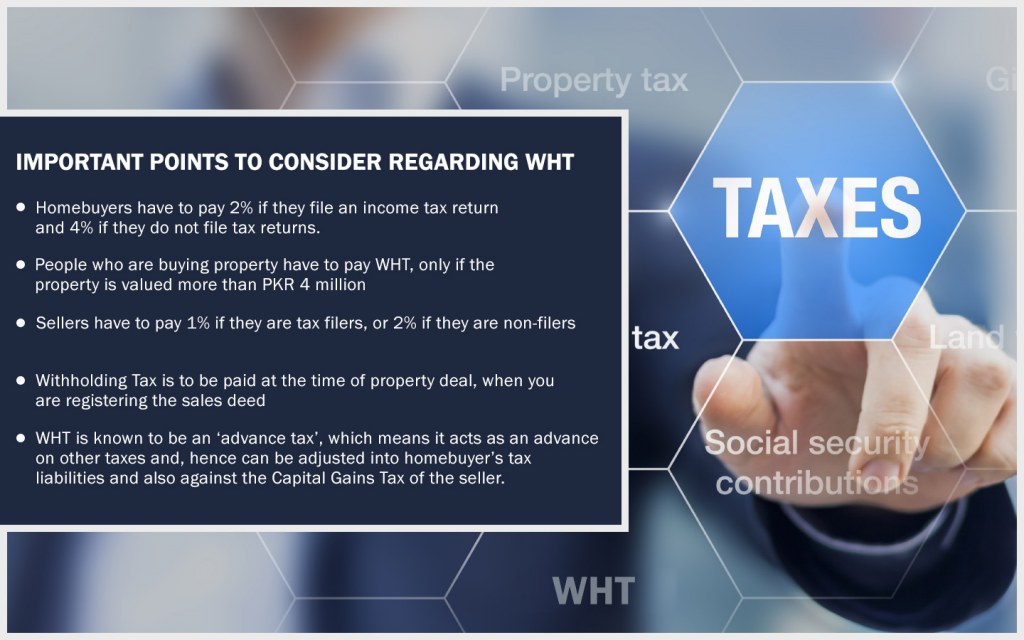

Withholding Tax (WHT) to be paid by both buyers and sellers

In addition to CVT and Stamp Duty, Withholding Tax (WHT) is of utmost importance. It is a federal tax payable by both buyers and sellers on a property deal. Few points need to be taken into consideration:

- Homebuyers have to pay 2% if they file an income tax return and 4% if they do not file tax returns.

- People who are buying property have to pay WHT, only if the property is valued more than PKR 4 million

- Sellers have to pay 1% if they are tax filers, or 2% if they are non-filers

- Withholding Tax is to be paid at the time of property deal, when you are registering the sales deed

- WHT is known to be an ‘advance tax’, which means it acts as an advance on other taxes and, hence can be adjusted into homebuyer’s tax liabilities and also against the Capital Gains Tax of the seller.

Under the Budget 2018-19, FBR rates were to be abolished, sellers would no longer have to pay Advance Tax and rates would change for buyers as well. However, to ensure that the declared values of properties are fair, the government has formed the Directorate of Immovable Property (DGIP). The plan to establish it was declared in Finance Act 2018. It will be authorized to conduct geo-mapping of plots, apartments and all kinds of housing schemes and projects. It will also determine the valuation of properties. It will also track those areas of real estate where tax evasion is a possibility – especially while collecting Withholding Taxes.

These are some of the most common property taxes in Pakistan. Through the property tax calculator you can also calculate property taxes for 2018-2019 for Sindh and Punjab from the official websites of Excise Taxation and Narcotics Control Department, Government of Sindh and Government of Punjab, respectively. These are a few updates on taxes on property purchase and also related to taxes on sale of property in Pakistan. For more updates, stay tuned to the best property blog in Pakistan.

Comments are closed.

very informative blog.thanks for sharing it.

Since our government is no good for nothing, perhaps zameen.com should develop an online tool on this website where people can calculate their total cost of buying or selling certain property. Also an online searchable list of DC & FBR rates would be nice.

It can be something similar to Pakwheels website where they let you calculate “on the road price” for any new car.

Need More Information about Property Tax

Anything specific you’d like to know?

HOUSING SCHEMES RUN BY COMPANIES HOW MANY TYPE OF TAX IMPOSE ON THESE COMPANIES PLEASE GUIDE ME UPON COMPANIES TAXES WHICH RUNS HOUSING SCHEME

We will something on that soon! Please keep following the blogs.

There is also an advance tax to be paid by seller 1% for filer and 2% for Non Filer. Further, pls. provide reference for CGT rates as I didn’t find it anywhere.

Advance tax is the same thing as WHT as explained in the article. You can check Finance Act 2017 to confirm the CGT rates.

Hi, what are the tax implications for overseas Pakistanis on selling a property.

As such, there are no particular rules which classify people into local or overseas Pakistanis. It does, however, classify people into filers and non-filers for the purpose of taxation.

Is the advanced tax(WHT) adjustable against annual income tax of salaried person.

e.g the amount of WHT on property is 30,000 and annual income tax is 50,000, can the amount of 30,000 adjusted against 50,000?

Yes, WHT/Advance Tax is adjustable against income tax.

In case the property is disposed of during the same year when it was acquired then the advance tax/ tax withheld is the minimum tax. Thus in case of disposal of property within the same tax year after acquisition, no adjustment is admissible.

Capital value tax (CVT) and Tax on Immovable Property(TIP) is same or they are different? CBM collect TIP on transfer of property as per their valuation.

TIP is a separate tax and it generally only charged by the cantonment boards.

AOA. What is the CGT tax implication of the property that was inherited in Aug 17 and will be sold in Mar 18? Will the purchase price be used for the CGT calculation or fair value as of Aug 17?

Salam, I have bought a 10 Marla house in Bismillah Housing Society and recently received a property tax bill. The bill is on the name of previous owner. I have asked concerned officials to change it on my name and send me a revised bill from the date of purchase. However, they have refused to do so on the grounds that a Government Registry needs to be done on my name as they dont accept the society’s registration documents. My argument is how can I pay something which is not even on my name and it is not my obligation. They are sending us letter to seal the property. I reside abroad and my parents live in the house. Any suggestions how do I get this sorted. i am willing to pay it if they send a correct bill on my name from the date of purchase but dont want to do Govt.registry as I might sell the property.

Seek help of a lawyer:

Zargham Lukeser: 0300-847-4169.

Salam,

Please tell me if the value of property in sale deed is PKR 5,000,000, then how the taxes will be applicable?

1. CVT TAX 5,000,000 * 3% = 150,000

2. Stamp Duty 5,000,000 * 2% = 100,000

3. Advance Income Tax (Filer) 5,000,000 * 2% = 100,000

Total Value of Property (Inclusive of all taxes)

5,000,000+ 150,000+ 100,000+ 100,000 = PKR 5,350,000

These laws are going to change. Here’s the updated and detailed breakdown on how Budget 2018-19 affects real estate. This includes changes in taxes. I suggest you go through it: https://www.zameen.com/blog/budget-2018-19-the-real-estate-question.html

I have to find out 01 thing about property which can only be explained by some expert. I have to find out property and related taxes. I am leaving in a flat on 120 Sqr ft in

Kharadar from last 45 year. This building was owned by my Uncle (Dada)but my uncle has shifted his name in placed of my Uncle Now he has agreed to give the ownership of this flat but telling to pay all property taxes and water & sewerage taxes which he had payed during last 45 years. I have to confirm which type of property taxes will be involved during the tenure. Your expertise can be helpful to me.

You won’t have to pay any extensive taxes. Particularly if you are going to use the apartment for your own residence, the tax you have to pay will be nominal. The tax you pay will depend on the location of your apartment but I think you will find this blog helpful: https://www.zameen.com/blog/understanding-property-tax-rates-in-pakistan.html

Salam,

Please tell me, the taxes will be applicable this way or not, if i Purchase an ?

For Example value of property as per sale deed is 5,000,000

Taxes will be applicable as,

VAT: 5,000,000 * 3% = 150,000

Stamp Duty 5,000,000 * 2% = 100,000

Advance Income Tax(Filer) 5,000,000 * 2% = 100,000

So total Value of property inclusive of tax will be 5,350,000

Time of Payment:

Advance income tax will be paid at the time of purchase of property to authority registering the property,

To which authority the rest of two taxes will be paid? e.g CVT & Stamp duty & what will be the time for payment

CVT and Stamp Duty is paid to the provincial government at the sub-registrar’s office.

Salam,

If anyone can help the matter that, if the family property ownership is really really old and family members want to sell the property after mutation.

I like to ask if the CGT would be applicable in this case because the ownership is change on paper, although not through the cash transaction but through Inheritance.

No, CGT does not apply in case of inheritance. But if you are selling the property, CGT will apply.

Bro i am purchasing the property more than 4 Million but the area where the property is situated has not been declared the Rating area by the FBR .My question is whether i have to pay advance tax 4 percent or not

This article is old and based on Finance Act 2017. You don’t have to pay such tax according to the new budget. We will soon update you with the latest information according to the new budget. Please keep following the blogs.

Taxes will change under the new budget. Here’s the updated and detailed breakdown on how Budget 2018-19 affects real estate and how taxes and valuation rates will change: https://www.zameen.com/blog/budget-2018-19-the-real-estate-question.html

what are the tax rates to the seller if he sells a property and if you wish to to take the proceeds overseas is there any further implication? thanks

Tax rates and their implications have changed after the new budget, we will soon post the updated situation as a result of the new budget. Please keep following the blogs.

Taxes will change under the new budget. Here’s the updated and detailed breakdown on how Budget 2018-19 affects real estate and how taxes and valuation rates will change: https://www.zameen.com/blog/budget-2018-19-the-real-estate-question.html

thank you..very informative..we expect updated information on this site.

This information is old. A degree of confusion exists about the taxes and how they will be imposed going forward. Particularly since the provinces have to decide on their end of the things as mentioned in Budget 2018-19. We will update this as soon as complete information is available. Meanwhile, you can check our latest blog on the measures introduced in Budget 2018-19. That will help you understand the situation better:

https://www.zameen.com/blog/budget-2018-19-the-real-estate-question.html

sir ihave one shop ,i take rant 5000/month

how much my annual property tex.

It will depend on the location, I suggest you contact the local Excise and Taxation department to confirm the exact amount of taxes. You will also find this blog helpful:

https://www.zameen.com/blog/understanding-property-tax-rates-in-pakistan.html

is it applicable for tax year 2019?

CGT and Property Tax are, but the WHT on property has been replaced with Advance Adjustable Tax (1%) for the buyer only. Meanwhile CVT and Stamp Duty haven’t yet been changed but the federal government recommended that they be changed. The provinces haven’t changed them yet.

farhad bhi . how we can generate Gain tax challan …….

I think you will find this article helpful:

https://www.zameen.com/blog/become-a-tax-filer-how-to-register-online-to-file-your-income-tax-returns.html

Sir, I purchased a plot in Lahore @ Rs.4,50,000 per marla in Oct-2017. I sold the plot at the same rate i.e. 4,50,000 in July 2018. Did I have to pay the Gain Tax and if to be paid on what percentage?

Thanks waiting for ur reply.

If you haven’t gained anything, if you have not made any profits, you don’t have to pay any CGT.

Aoa. Sir, we want to purchase a plot in village for masjid @1.1 million. The seller is saying that we will have to pay some 17% on account of some tax/duty etc. If they donate then nobody will have to bear the extra 17% on this. Is that true?

My specific question is; Will we have to pay any tax or duty extra if we go to purchase a plot of worth PKR 1.1 million only for masjid?

Different tax laws apply on donations than on sale/purchase, so it is likely that the seller is right. I will confirm and get back to you as soon as possible.

Thanks for responding. Somebody also advised to purchase and waqf for masjid. Is that a better way to do this.

Sure, I look forward to detail.

an owner of 3 stories commercial building on adyala road rawalpindi cat. D,

detail:1-front two hall are on rent,back of these halls are space 1766 sq ft is practically blocked (no approach).2-FF was girl college self occupied now vacant since 4 years. 3- 3rd floor under construction (only roof). 4- mobile communication tower is on the roof top.please calculate annual property tax. also:

1-Is tax rate is same on ground floor and 1,2 n 3 floor.

2-one kanal is 514 or 600 sq yards in calculation.

3-blocked space with no approach will be considered on main road or off road.

i am retired govt officer residing in a house which was constructed on one kanal plot gifted to my wife in DHA.This house is in our personal use.Do i have to pay property tax?

Yes, sir, you will have to pay property tax but it will nominal.

Thank you Farhad sahib for prompt response.May i further bother you to know how much tax would it be?Any approximation? i am residing in Sector.L Phase.v DHA. i shall be grateful.

Can you please give me a guess, if I buy a 6 Marla house of 73,00,000, how much will be all taxes??

Hi,

Thanks for your very useful and easy to read explanation.

If a property is sold after 43 years where do we declare the capital gain when filling out FBR tax return. I am overseas and the FBR helpline does not work form here for some reason.

Thanks in advance!

Hi Naveed sab, you don’t have to pay any CGT after three years. In the Section 114 (1) Return form, there is a section of Property, where you can put in your property loss or income. There is also a capital assets section where you can input capital gain/loss. I hope this helps.

Thanks a lot for your quick response and help. It is very much appreciated. JazakAllah. May you be rewarded for all of you efforts in helping the community.

Dear Mr.Muhammad Farhad,

is CVT Adjustable.. Or will be minimum/Final…?

As far as my understanding goes, only WHT is adjustable, I would suggest you contact the relevant authorities to be sure that is the case.

Where we mention WHT in filing returns against purchase of property?

Are the above rates also applicable for purchase of commercial properties like office space in clifton. If they are different than please also mention the same.

Rates for provincial or local taxes may vary. For example, CVT is slightly different in Sindh and it varies between commercial and residential property. However, the federal taxes remain the same. You will have to contact your local authorities to get the complete details of the taxes applicable specifically to your case.

If a piece of land is purchased in Islamabad Rural area in Feb 2016 and being sold now on profit. Is there any CVT or WHT applicable for a filer?

A seller may have to pay WHT (since the old WHT rates still apply until the directorate is formed and new rules applied) and you will have to pay CGT as well. But not CVT. CVT is for the buyer to pay.

Asslam-u-Alaikum,

Sister Samra,

With regards to tax relaxation for non-filer overseas Pakistanis. Can a non-filer, without registering him/her self in FBR, purchase any agricultural land for farm house or for the purpose of live stock.

Regards,

No, these departments have such setups in place to record all major real estate transactions, be it commercial property or agricultural land.

My question is if i purchase property worth rupees 4500000(forty five lacs) on October 10 ,2018 and pay advance tax 2%(filer) secondly after about 5 days i purchase property worth rupees 2500000( twenty five lacs) then again i shall have to pay advance tax 2% or not?

Yes, in my understanding, you will have to pay the second time as well. However, you will be able to have a rebate for all of this when filing/paying your taxes next time.

You have to pay 2% advance Tax per Deed if you are filer. if you want any more information regarding tax matters, reply to me.

sir its very informative ,i ask one question sir i purchase my house 5 month before all the transfer documents are done, but sir i cheek my property in online (Excise, Taxation & Narcotics Control Department) web site and its not change from sale person to my name ,sir please inform me early as possible how it will be change to my name.

thank you sir

Where exactly did you check this, sir?

I purchased one apartment in Karachi 2 Years back and builders submit papers for the lease now when I followup with the builder about the lease he said lease file is stuck in KDA because of gain tax non payment. Please explain what is this tax and why buyer have to pay this?

Buyer does not have to pay capital gains tax, seller has to.

Dear,

I have a house self resident of 1415 sqf and its (covered area G/Floor 1305 sqf and First Floor 1305sqf) in “cat C” off road, Rawalpindi punjab. The property tax may be workout. please details calculation and reply how many property tax i will pay this years i.e. 2018. Thanking you.

Salaam,

I am looking at buying 5 acres of rural land. There is no built structure on the land. The current use of the land is for agricultural purposes. The buyer wants 4 million for the land. I have a few questions. Please note, only 1 out of the 5 share holders is a Tax filer in Pakistan.

Q1. What taxes and amounts do I have to pay?

Q2. If there are 5 share holders, then does the tax amount alter?

Q3. If 4 out of 5 share holders are Non Resident Pakistani’s, then does the tax amount differ?

Many thanks in advance for your help and feedback.