Home » Laws & Taxes » Pay Your Taxes On The Go via FBR’s Tax Asaan App

FBR’s Tax Asaan App is revolutionizing the tax system. It is a mobile application that has been recently launched by the Federal Board of Revenue (FBR). With the many features available in the app, now you can easily pay your taxes on the go. For your convenience, we will provide a step-by-step guide to help you make e-payments via Tax Asaan App.

How to make e-payments via Tax Asaan App

There are three features of the Tax Asaan App.

- E-payments

- Online Verification Services

- Sales Tax Registration

Moreover, the Federal Board of Revenue is constantly making efforts to speed up the processes for filing of taxes. Previously, we explained how to file your income tax returns online; the good news is that soon there will be a new icon within the app to help taxpayers file their income tax returns via Tax Asaan App.

So, without further ado, let us get you through the process of making e-payments via Tax Asaan App. You can easily create Payment Slips i.e. PSIDs for Sales Tax and Income Tax through the smart application. There are two options available to pay taxes through the app. Either you log into your IRIS account and then begin with the e-payments via Tax Asaan App or you fill out the details and generate the pay slips without signing in. Whichever way suits you better.

How to generate income tax pay slips without signing in

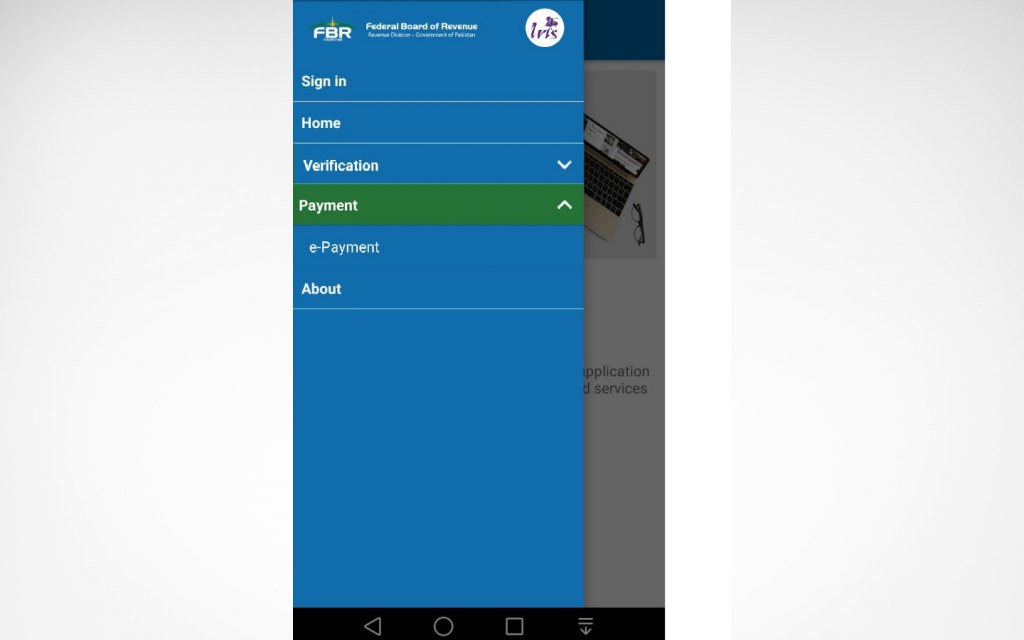

You need to first download the Tax Asaan App through Google Play Store. Once you have installed the application on your phone, now you can easily use its features. When you open up the app, you see a Payment Tab on the left control panel. Upon clicking it, e-payment option appears. Click on it and the user will be directed to another page as shown in the image below.

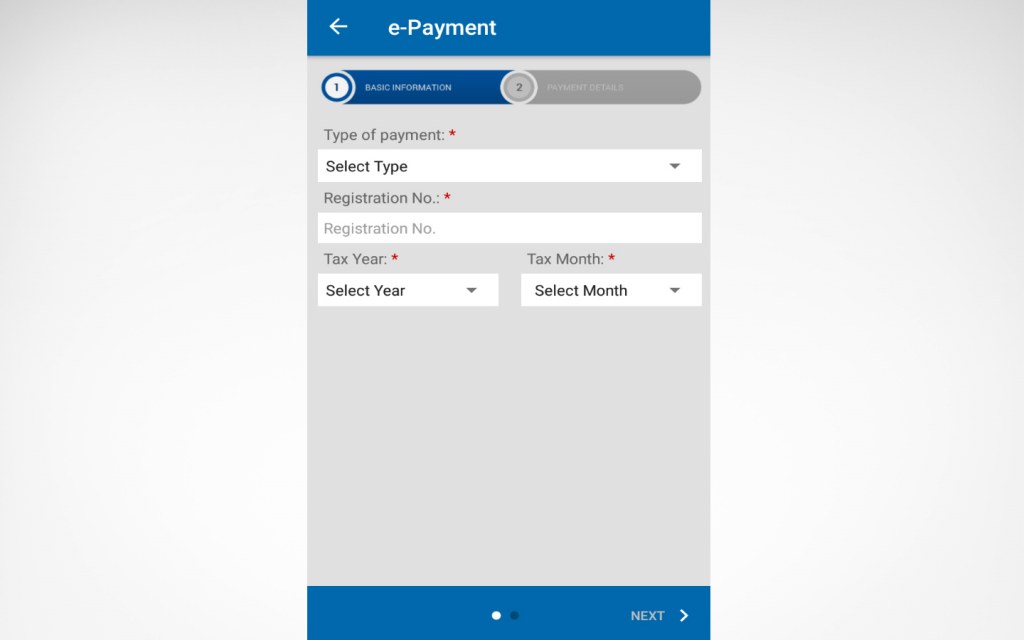

Select Type of Payment

Choose the kind of e-payment you wish to make. Are you generating payment slips for Federal Excise, Income Tax or Sales Tax. The application for the respective field will open up once you select the payment type.

For Sales Tax, the user must have the Sales Tax Registration Number as you can’t proceed with the application with the Income Tax Registration Number.

Registration No. for Income/Sales Tax

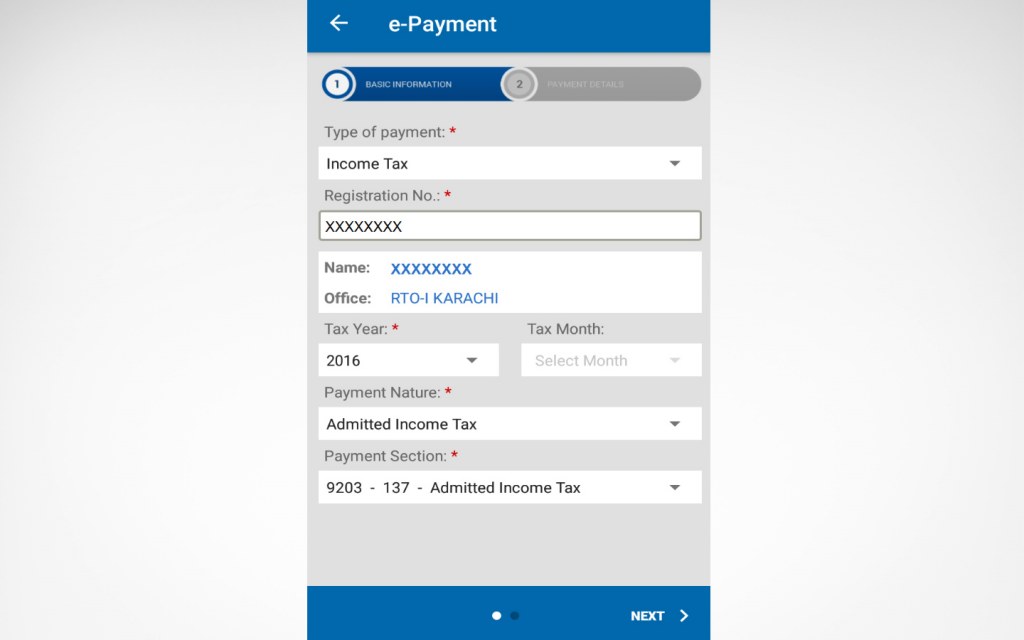

You need to choose the type of payment and registration number which is mandatory. The moment you enter the Registration Number, the information which is already stored in the FBR’s repository will appear in the given fields i.e. your name, office address and the name of the business will appear automatically.

If you are making e-payments via Tax Asaan App for Sales Tax then you need to fill out the month as well. For those wanting to generate payment slips or challan for Income Tax the month field will remain disabled.

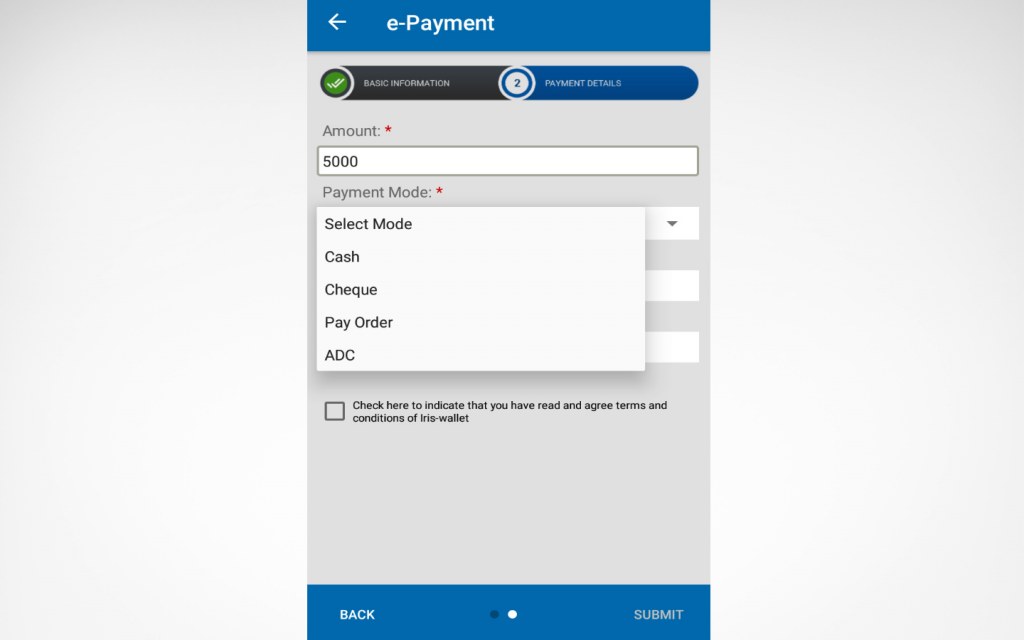

Also, once you have filled out the basic information, then click on Payment Details tab and enter the amount you need to pay and select the mode of payment. The modes available are cheque, cash, Alternate Delivery Channels (ADC) and pay order.

To make e-payments via Tax Asaan App of FBR you need to select one payment mode for each payment you make every time. You can pay through ADC modes after mentioning your email address.

It is always a good idea to read the terms and conditions before hitting the Submit button. But wait, don’t just click on the Submit button without going through the details once more. It’s important to remember your form, once submitted, is irrevocable.

How to generate income tax pay slips after logging in

If you have signed in using the sign in option then you don’t need to fill out all the fields when filling out the taxpayer profile. Moreover, the email address and phone number fields are also not mandatory to fill in and in case their phone number has changed they can update it by entering the phone number in use in the respective field.

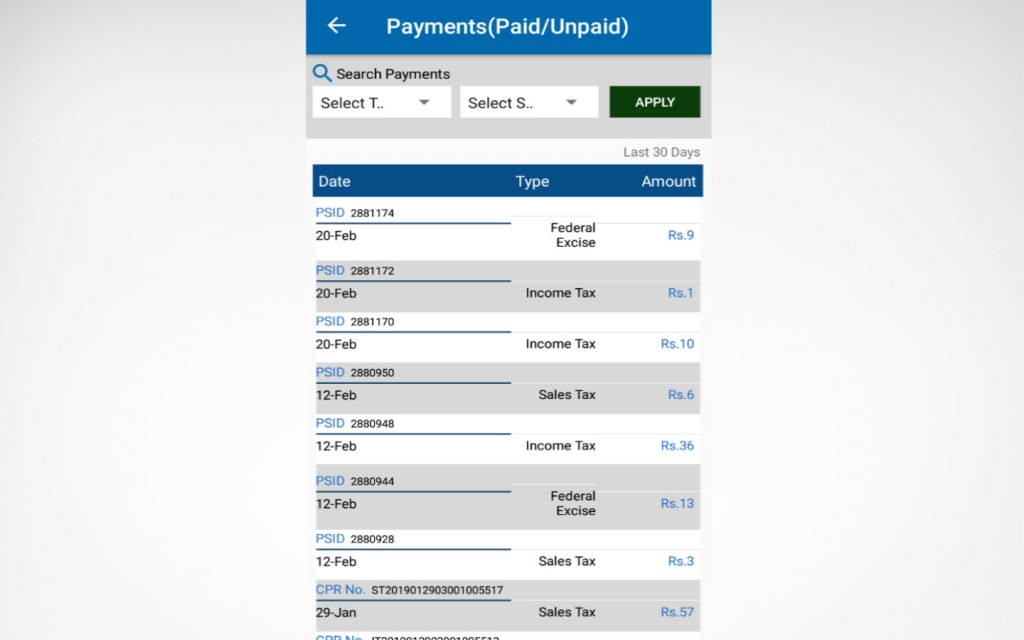

Another important feature, which is only available for logged in users, is that you can view the payments of the last 30 days. You just have to sign in using the registered account and then click on My Payments tab just under the e-payments section.

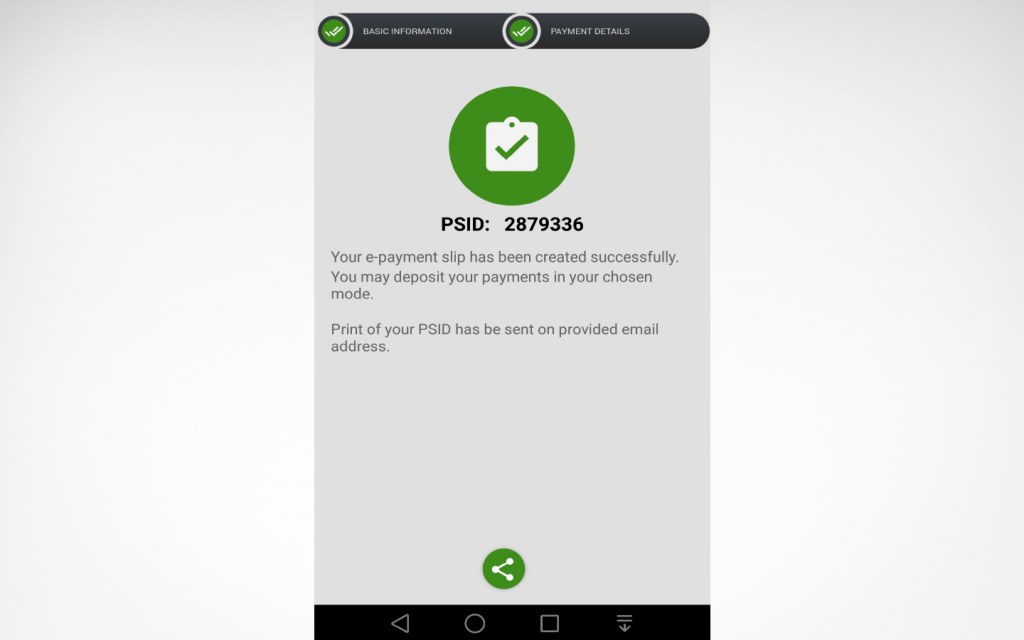

Once you click on Submit button, the payment slip ID will be generated, which will be followed by email and SMS alerts as provided in the payment details by the taxpayer. You can also share the PSID using Whatsapp, Facebook, Messenger and Email options.

Now, that you are familiar with the process of making e-payments via Tax Asaan App by FBR, do let us know if this information helped you out. You can write to us at blog@zameen.com.

If you are a business owner, you can also have online sales tax registration done through the app, which is a brand new feature that can help accelerate the process of sales tax registration for businesses. For more informative posts related to laws and taxes, stay tuned to the best real estate blog in Pakistan.