For many young adult professionals, getting a credit card is somewhat a rite of passage into a financially independent life. However, at the same time, owning this shiny rectangular card is a huge responsibility. Although they have become an important financial tool and a popular method of payment, people who don’t use their credit cards sensibly can actually end up in serious trouble. So, if you are on the fence about getting one for yourself, here are a few things you need to know about credit cards in Pakistan in order to make an informed decision.

Our guide is a must-have for all first-time credit card users in Pakistan.

How Do Credit Cards Work?

A lot of new credit card users in Pakistan tend to get confused between credit and debit cards, even though the two couldn’t be more different. When you use a debit card to buy something, the money is deducted directly from your bank account. Meanwhile, when you purchase something using your credit card, you are essentially borrowing the money from your provider with a promise to repay it later.

To put it simply, credit cards allow users to take a loan from the bank every time they use it to make a payment. Usually, banks in Pakistan send their customers a bill on a specified date. Failure to pay the total amount by the due date or only paying the minimum amount can lead to additional interest charges not only on the outstanding amount but also on every new purchase and transactions you make until the debt is cleared off.

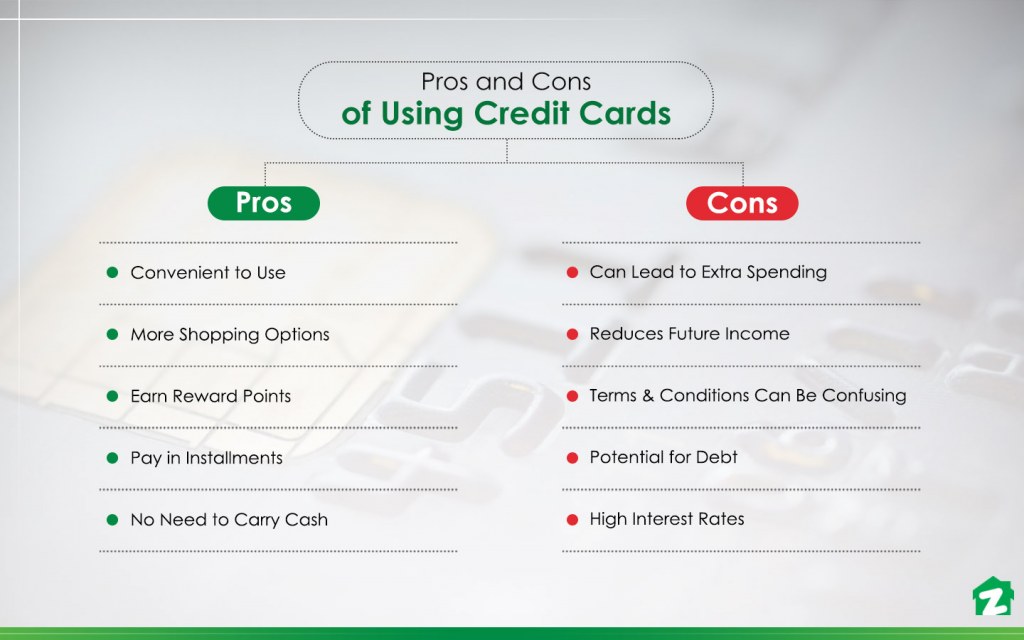

Pros and Cons of Using Credit Cards in Pakistan

Here are some credit cards pros and cons that first-time users must know before applying for one.

One of the main benefits of using a credit card in Pakistan is that it allows you to move around without carrying your wallet. Not to mention, having a credit card opens up more avenues for shopping, as you can use it to buy goods and services online and even on the phone. Some credit cards also allow customers to earn reward points with every purchase, which can be redeemed later. Apart from convenience and access to online shopping in Pakistan, credit cards also let users pay for their purchases in instalments instead of all at once. They can also be very useful in case of emergencies when you’re out of cash or don’t have it on hand.

On the flip side of it, credit card users in Pakistan (and everywhere else in the world for that matter) have the potential of accumulating debt if their spending habits don’t match their monthly income. Since credit card users don’t pay money physically to the cashier, using it might tempt them to buy more than they can afford. In addition to that, credit card bills also eat up a chunk of your monthly income before you even receive it. Another risk of using credit cards is the possibility of misuse or fraud. Interest rates and late fee can also be rather expensive and reading the fine print can be very confusing.

So, if you think you can stick to a budget and pay in a timely fashion, you should consider getting a credit card. However, if you have a tendency to spend more than you can pay off, a credit card might not be the best option for you.

How to Apply for a Credit Card in Pakistan?

Applying for credit cards in Pakistan is fairly easy.

Banks in Pakistan offer more than one types of credit cards to their customers. These credit cards vary on the basis of their credit limits, reward points, discounts, annual fee and interest rates among other factors.

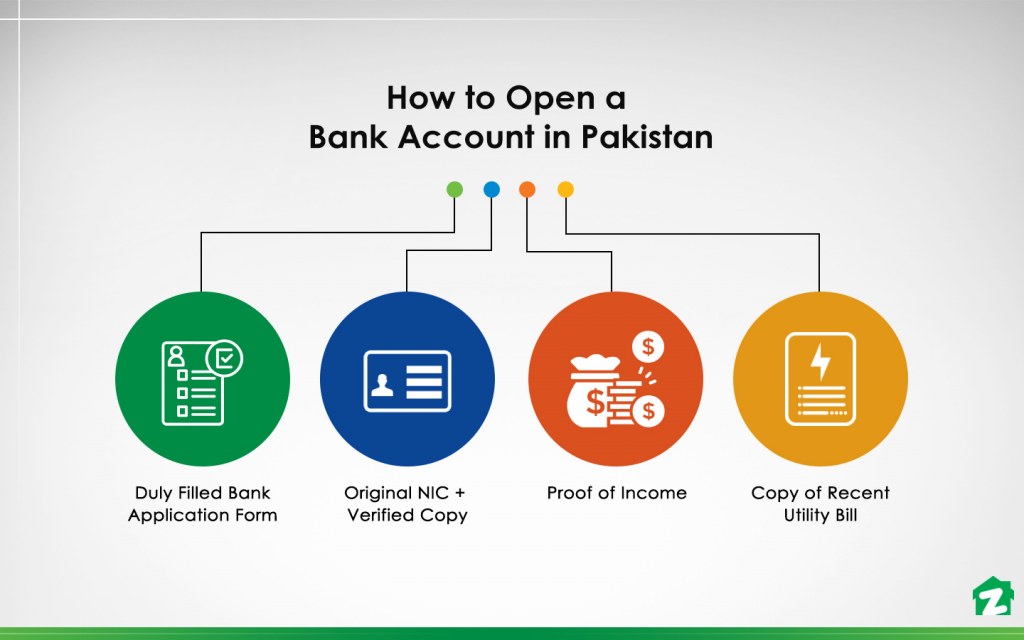

However, to start off, you need to open an account in your desired bank. Generally, banks offering credit cards in Pakistan require these documents:

- Original CNIC or NICOP (for overseas Pakistanis) along with a verified copy

- Proof of income (the latest salary slip etc.)

- Copy of a recent utility bill

- Copy of Form-B or Birth Certificate (for minors)

- The student ID card and proof of income of the guardian (for students)

Along with filling an account opening form, customers also need to fill an additional form that states the credit limit, primary charge, rate of interest, minimum payment and other essential terms and conditions.

Almost all banks also send a handbook along with the card to help first-time credit card users.

It is really important for the user to read the fine print and clear any confusions with the bank beforehand.

For those who already have an active bank account, you can the phone banking service for more information on the topic.

Tips for First-Time Credit Card Users

Here are a few tips all first-time credit users in Pakistan need to keep in mind.

Be careful with your PIN code

PIN or Personal Identification Number is a numerical code that you need to use in order to make any electronic transactions. No one else, besides the cardholder, should be privy to this number.

Here are a few ways you can keep it secure.

- Refrain from using an easy-to-guess number, such as your birthday, your address, the last digits of your phone number etc.

- Choose a random combination of number as your PIN code, but make sure it’s still easy for you to remember it.

- Change your PIN codes regularly.

- It’s better if you don’t write down the code anywhere as it can be misused by someone

- Always use a different code for each of your cards, be it debit or credit.

- When using your credit card in a crowded place, such a supermarket, shield the machine with your hand while entering the PIN.

- Do not put your PIN code on the internet.

Keep Your Credit Card Safe

- Never leave your card out of sight. Even when you have to use it to pay bills at restaurants and other places, make sure it’s done right before your eyes.

- The code at the back of your credit card should not be shared with anyone, even with your bank. It must only be used to make online transactions.

- The electromagnetic strip at the back of your credit card is sensitive, so you should keep the card in a plastic cover or pouch to ensure it remains safe from any damage.

- Don’t carry too many cards in your wallet

- Check your bag/wallet to make sure you have the credit card after making any purchase.

- Cut up your expired cards before throwing them out. The numbers and the code at the bank should be decipherable at all.

- Do not lend your credit card to anyone.

- Always shop from trusted websites. It’s advised to read the vendor’s privacy policy before entering your credit card details online.

- If a shopping website asks you to enter your credit card details before allowing you to browse through the items, proceed with caution as they might charge you even when you don’t buy anything.

- While making online payments, ensure the website you are using has a small padlock symbol in the URL bar. This indicates your payment information will remain secure.

- Sign the back of your credit card as soon as you receive it.

- If you don’t receive your credit card from the bank within the given time, contact the issuer to confirm if it has been dispatched.

Fine Print, Receipts and Statements

- As recommended above, it’s extremely important for credit card users to thoroughly read all the terms and conditions. If you find the fine print confusing, immediately contact the bank for clarification.

- Never throw away your credit card receipts, as you would need them to make sure your monthly statement is accurate and does not list any transactions that you did not make.

- While setting up a payment due date, always select the date that’s a couple of days after you usually receive your paycheck. Banks offering credit cards in Pakistan usually offer a grace period, but this facility should not be abused.

- Always check the amount on your charge slip before signing it. If you think the card has been swiped twice, contact the bank immediately.

- Do not throw away old credit card statements and other important mail without blacking out important details. This is one of the most important tips to protect yourself from identity theft.

- If possible, opt for online billing to avoid the risk of someone intercepting your mail.

Paying Your Credit Card Bill

- It’s important to pay your credit card bill in full before the due date if you want to add a high rate of interest on the outstanding amount and future transactions.

- Compare your credit card bill with your transaction history to make sure there aren’t any discrepancies.

- If you pay your credit card bills online, make sure you don’t do it while using a public WiFi or an insecure connection.

- Always select ‘never’ when banking websites show you the ‘remember my password’ option.

- Once you’ve made the payment, log out of your account, clear your history and close the browser – particularly if you are using someone else’s laptop or are at work or in a restaurant.

Credit Card Cash Advances

The cash advance is a facility that most banks offering credit cards in Pakistan provide to their customers, allowing them to withdraw cash from ATM. This money is essentially a loan that is borrowed from the issuer. Even if you don’t plan on using this facility, here are a few things you should know about it.

- Banks usually charge a transactional fee every time a customer avails the cash advance facility.

- Usually, a fee is levied on every transaction until you repay the amount. However, this might vary with each bank.

- The interest rate charged on cash advances is usually high, so it’s better to know about it in advance.

- These rates and transaction charges are explained thoroughly in a bank’s ‘Schedule of Charges,’ so make sure to get familiar with it.

To conclude, credit cards aren’t good or bad, it all depends on how you use them.

As long you don’t dig yourself a hole by spending more than you can repay, there’s no harm in owning credit cards in Pakistan. Not to mention, they can be really helpful in case of emergencies.

You can also check out our detailed guide on different types of bank accounts in Pakistan to know which one might be the best fit for you. Moreover, if you are new to online banking, don’t forget to take a look at the benefits of paying bills online. For more information on banking, finance and taxes, stay connected to Zameen Blog – the best real estate blog in Pakistan. You can also send us an email at blog@zameen.com. Also, make sure to subscribe to our newsletter on the right to receive the latest updates about property trends, lifestyle and taxation in the country.