Home » Laws & Taxes » Understanding Low-Cost Housing Initiative in Pakistan Part 1: What Exactly is Affordable Housing?

Let’s start this article with a harmless question, and then dig deeper. To the avid reader of this research piece, I ask, what does affordable housing mean to you?

Perhaps a decent living place of our own, that is not too heavy on the wallet? Sure, but let’s try to quantify this for policy purposes.

Suppose that you decide to buy a mortgage, or rent a house. Out of your current income, what percentage would you prefer to put aside for this expense? How much can you afford to before your housing cost becomes unbearable?

On a personal level, this might be an easy undertaking. On a policy level, it is far more complex, albeit a worthwhile endeavor.

Numerous government institutions around the world have attempted to undertake this exercise to understand housing dynamics. On one hand, it helps them understand the state of housing affordability, on the other it serves as a useful indicator for business entities, such as mortgage and insurance providers, who want to dip their toes in the real estate sector.

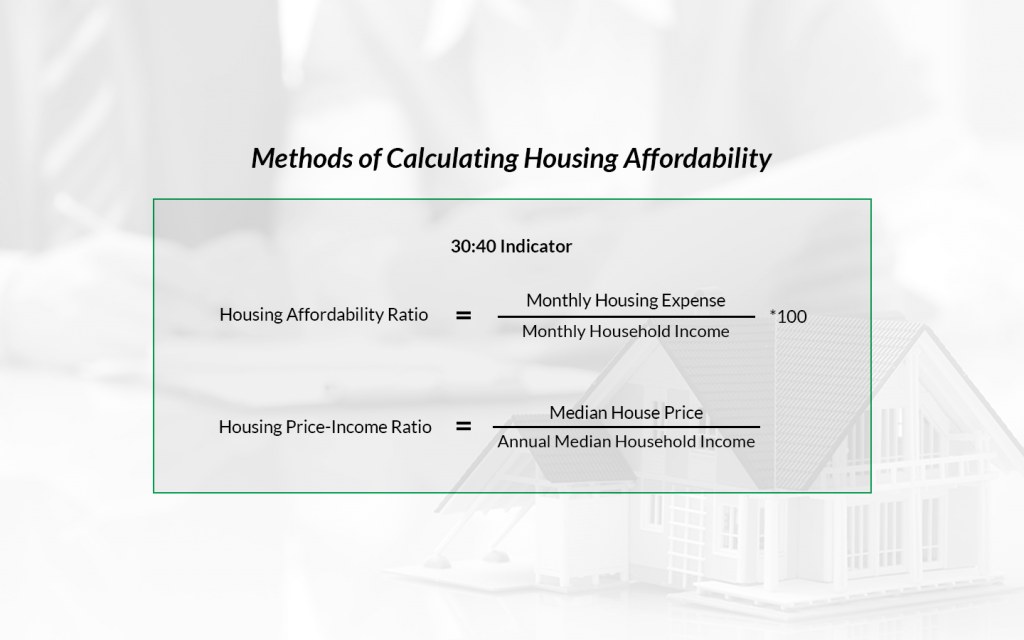

A common global estimate of housing affordability is the ratio of monthly housing expense, such as rental or mortgage payments, to the monthly income of a household. As a rule of thumb, housing is considered affordable if your expenses on it do not exceed more than 30% of your monthly income.

A similar indicator, considered by United Nations to convey the greatest amount of information on the overall performance of housing markets, is the house price-to-income ratio. It divides the median house price with the annual median household income of a specified region. If this ratio does not exceed 3, housing expense is considered affordable in that area.

Moreover, some countries have curated customized indices to determine whether real estate is affordable in their country based on the incomes of their populace.

For example, in Australia, respective agencies use the 30:40 indicator to identify households that are within the housing affordability stress. To put it simply, if you are in the bottom 40 percent of the Australian household income distribution, and your maximum percentage of housing cost exceeds 30 percent, you are considered to be under housing stress.

In India, Jones Lang LaSalle (JLL), a professional services firm specializing in real estate, introduced Housing Price Affordability Index (HPAI) to check whether a household earning an average annual income, at the city level, is eligible for a housing loan at prevailing market prices and home loan interest rate.

In the US, multiple stakeholders, such as National Association of Realtors, National Association of Home Builders, and banks such as Wells Fargo, publish housing affordability indices to understand the various facets of real estate sector.

Considering the context of Naya Pakistan Housing Plan (NPHP), in which the government aims to provide 5 million low cost housing units to deserving households, a pertinent question to ask is whether there is a strategy to understand housing affordability prior to providing them to the masses.

For now, no such measures (or indices) exist in Pakistan, but there are innovative ways to calculate it through existing data. For instance, using the income quintiles published by the Pakistan Bureau of Statistics, and the real estate valuations recorded by the Federal Board of Revenue (FBR), a house affordability index can be created.

Of course, this is easier said than done. These figures may not provide a foolproof picture, and issues, such as FBR house valuations being significantly lower than market value, may distort the overall outcome of this exercise.

However, for a government venturing out to provide affordable housing to 5 million people in the country, having no blue print, or no definition of what constitutes affordable housing, is alarming.

Therefore, more questions need to be asked to understand the income dynamics of people participating in NPHP.

For example, what income brackets is the government’s housing plan being specifically targeted to? Are the mortgage or installment plans being offered under this scheme affordable for these people? Can they afford to set aside the monthly amounts required to pay under this plan? And ultimately, what is the likelihood of these households defaulting on their home loans?

Some of us are lucky enough to have our own living place. But for a sizable majority, it is a luxury, a lifelong wish to have a roof of their own over their heads, a desire representative of nearly 9-12 million families in the country. For such a huge and noble undertaking, proper planning is required for implementation, which seems to be lacking currently.

In part 2 of this series, we will attempt to provide some statistics to shed more light on the issue of affordable housing, setting the stage for further analysis, and thus playing our part in helping the government succeed in its low-cost housing initiative.