Home » Laws & Taxes » Understanding Low-Cost Housing Initiative in Pakistan Part 2: An Attempt to Calculate Housing Affordability for Pakistan

In part 1 of this series, we presented numerous ways in which housing affordability is calculated across the globe, and argued that in Pakistan, there is a lack of analysis on what constitutes affordable housing. In this article, based on existing research, as well as publicly available data, we lay the foundation for examining affordable housing in Pakistan.

Any feedback, suggestions or concerns are welcome to facilitate this conversation in order to help relevant stakeholders understand the present housing scenario.

Mr. Tasneem Siddiqui, in a working paper titled ‘Pakistan’s Urbanization: Housing for the Low Income’, argues that there is a demand and supply mismatch in the housing sector. While this is a commonly known fact, a deeper analysis shows that in the middle to upper-middle income groups, there may, in fact, be an excess of supply for housing.

In his research, Mr. Siddiqui, using a 2012 survey of housing projects in Lahore, argued that 12 percent of the population in the high-income segment had access to 56 percent of the housing supply.

What is striking, however, is that a stark majority of 68 percent of the Pakistani population, in the lowest income segment, had access to only 1 percent of the total housing supply. Arguably, other city housing surveys would also show similar statistics, where there is a shortage of housing supply for people with low incomes.

Resultingly, cities in Pakistan are marred by large sprawls of informal settlements commonly known as kacchi abaadis that are built on open wastelands or occupied land owned publicly or privately by land mafias. At the time of this study, it was about 40 percent of the urban population, but since then this number has grown to nearly 50 percent.

Low Income Households – PKR 8000-30,000

Middle-Income Households – PKR 30,001 – 250,000

High Income Households – PKR 250,000 and above

Based on these stark statistics, one can understand the need for a government backed housing initiative, such as the Naya Pakistan Housing Plan. It is indeed the need of the hour, but what needs to be seen is whether this initiative can actually fill the housing gap for the lowest income group whose need for housing, as seen from the analysis above, is the direst.

Understanding Housing Affordability through Household Incomes in Pakistan

As mentioned in part 1 of this series, understanding income distribution of a country is a pre-requisite to analyzing affordable housing. India, too, categorizes its households by its income. Four predominant categories defined in the country are: economically weaker sections (EWS), lower income group (LIG), middle income group (MIG), and higher income group (HIG). Housing policy is designed based on these income categories.

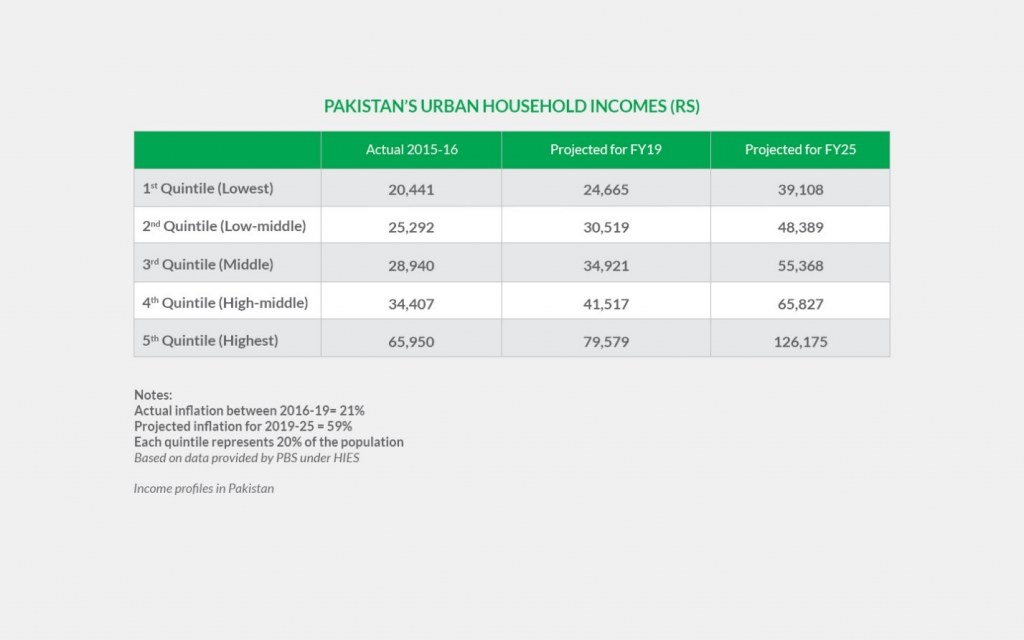

In Pakistan, Household Integrated Economic Survey (HIES), produced by Pakistan Bureau of Statistics, sheds light on the income distribution of the country. The categorization of household is done in 5 quintiles, with the 1st quintile being the lowest income group and the 5th being the highest. An excerpt of the urban household incomes is shown below

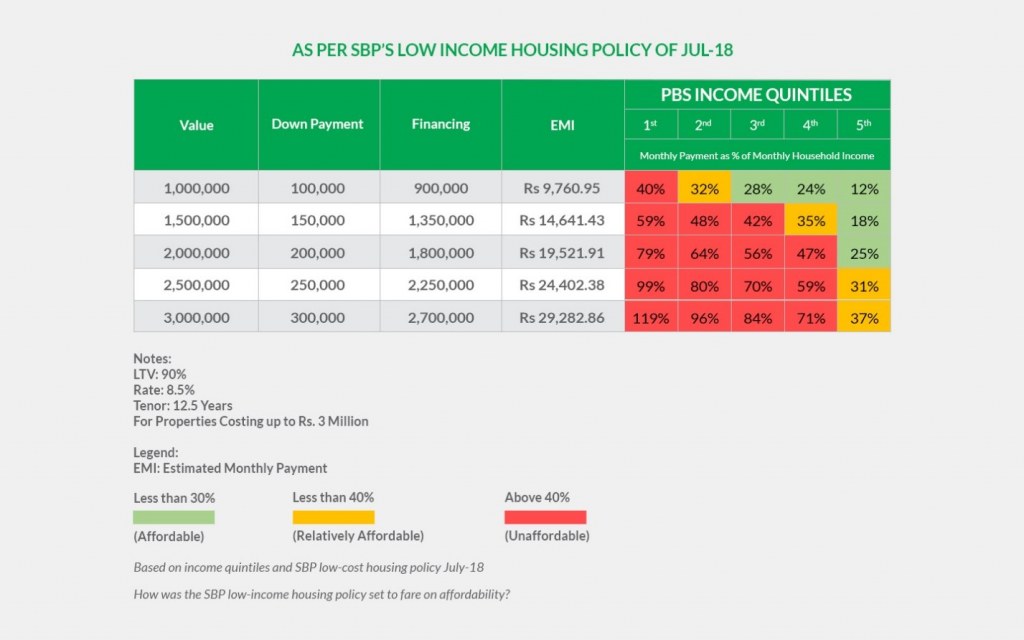

Under the State Bank of Pakistan’s (SBP) policy (if it had been implemented), given a blended interest rate of 8.5 percent, Loan to Value Ratio [1] of 90 percent, and a tenor of 12.5 years, only the fifth income quintile group (based on the income projected for FY19) could afford to buy a house that cost Rs1.5 million-Rs2 million, thus still remaining unaffordable for first four income quintiles (80% of the population).

Again, using the 30% rule, where housing is considered affordable if the costs associated with it are less than 30% of your total income, even at the prevailing income levels of the highest 20 percent of the population, affordability seems far-fetched for property value between Rs2.5-3 million. One must keep it in mind though that there is a lot of variation in incomes in the top income quintile which averages out the income levels.

It can be seen from both the supply of housing among

different income groups and their income levels that affordability is a daunting

concern in the housing sector. Despite the SBP’s low-cost housing push, the

income levels of the lower-income groups do not allow households to buy houses,

whereas those in the top quintile are largely the ones who can afford it.

Interestingly, this

is the same group that has a disproportionate share in the supply of housing.

Thus, there exists a huge demand and supply mismatch in the housing sector for

low income groups. The Naya Pakistan Housing Programme initiative should,

therefore, address the low income segments the most by strategically planning

to make housing affordable and accessible for the people belonging to this

category.

[1] The loan-to-value (LTV) ratio is a financial term used by lenders to express the ratio of a loan to the value of an asset purchased.